- Ethereum sees price recovery, trading at $3,113.58 with significant 24-hour volume amid fluctuating market conditions.

- Ethereum whales actively accumulating, with major withdrawals from Binance and Kraken signaling renewed market confidence.

Ethereum’s market is showing signs of vitality as anticipation builds over the potential approval of a spot Ethereum ETF in the United States.

This potential regulatory nod is driving both retail and institutional investors towards Ethereum, marked notably by buying activity from large-scale holders, commonly referred to as whales.

Over the past week, amidst fluctuating market conditions, Ethereum has witnessed a notable rebound in its price.

As reported by ETHNews, Ethereum was trading at $3,113.58 with a substantial 24-hour trading volume of $14,340,649,075.

Despite a weekly drop of 7.46%, the last 24 hours saw a 1.07% increase in its price. This resurgence in value has correspondingly ignited a flurry of activity among Ethereum whales, who are again accumulating substantial amounts of ETH.

On-chain data analysis By ETHNews reveals that a notable Ethereum whale withdrew 16,449 ETH (worth approximately $50.3 million) from the cryptocurrency exchange Binance.

🚨 🚨 9,966 #ETH (30,571,932 USD) transferred from #Kraken to unknown wallethttps://t.co/QktmYNEiz2

— Whale Alert (@whale_alert) July 9, 2024

This transaction marked a re-entry into the market by a whale, as the funds were moved to a new wallet where they currently reside. In another major transaction, Whale Alert noted the transfer of 9,966 ETH (about $30.6 million) from Kraken to an undisclosed wallet.

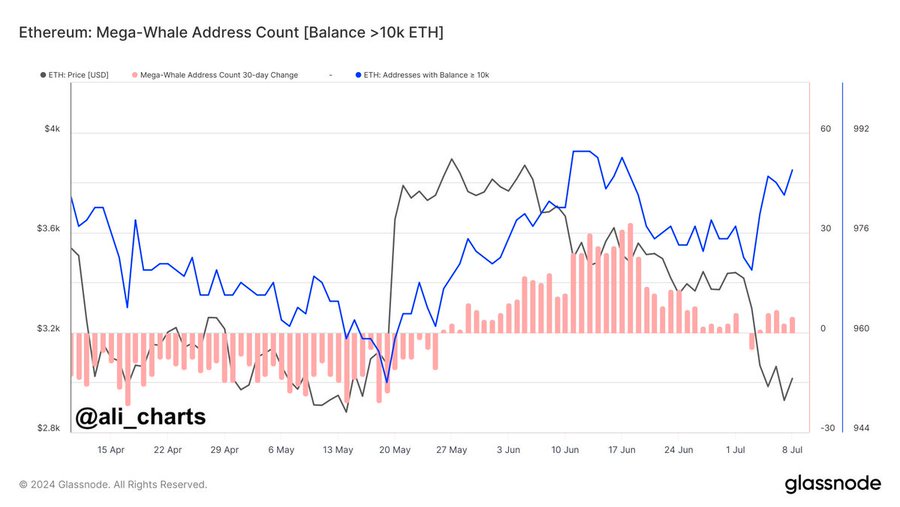

This pattern of accumulation is not isolated but part of a broader trend where Ethereum whales, after a period of distribution, are increasing their stakes again. This is underscored by the fact that the number of addresses holding over 10,000 ETH, which had decreased since mid-April, began to climb in early July.

These movements are strategically timed with the market’s heightened expectations for the imminent launch of an Ethereum ETF.

Bitwise Chief Compliance Officer Katherine Dowling discusses her firm's Ether ETF application and the potential for new products tied to crypto https://t.co/07GfltOyHY pic.twitter.com/yUgi4H4aai

— Bloomberg TV (@BloombergTV) July 9, 2024

Katherine Dowling, Bitwise’s Chief Compliance Officer, hinted that the approval of the ETF is drawing close, with expected finalizations around July 18th. This has led to a surge in institutional inflows into Ethereum-related investment products, with last week alone witnessing inflows totaling $10.2 million.

Long-Term Bullish Outlook for Ethereum

The discussion highlights Ethereum’s ($ETH) potential for significant appreciation after being relatively overlooked throughout the current market cycle. Unlike previous cycles, early focus shifted to meme and speculative assets like Solana ($SOL), which drew speculative capital away from Ethereum.

Furthermore, the launch of the Bitcoin ($BTC) ETF absorbed much of the demand typically seen early in the cycle, which also detracted from Ethereum’s appeal. Now, with the introduction of an Ethereum ETF that did not see a significant price increase upon announcement, it’s clear that market expectations did not previously account for this development.

Moreover, discussions in traditional finance (tradfi) about tokenization are increasingly centered around Ethereum, suggesting its use in real-world applications and potential for further integration into financial systems.

Short-Term Setup and Regulatory Potential

The optimism extends to potential regulatory changes that could particularly benefit Ethereum, especially if a new administration conducive to favorable cryptocurrency regulation comes into play. This could significantly impact Ethereum, particularly in terms of securitization.

Additionally, the emerging Layer 2 (L2) infrastructure is beginning to show promising signs of maturity, which supports Ethereum’s scalability and transaction efficiency. These technological and regulatory developments collectively bolster the long-term bullish case for Ethereum in the current cycle.

In the short term, the market setup also appears favorable, provided that the recent low price levels hold, setting the stage for potential gains.