- Ethereum staking sees significant increase, with 33.9% of total supply now locked in ETH2 Beacon Deposit Contract.

- Enhanced staking activity suggests growing confidence in Ethereum 2.0, potentially stabilizing prices by reducing available supply.

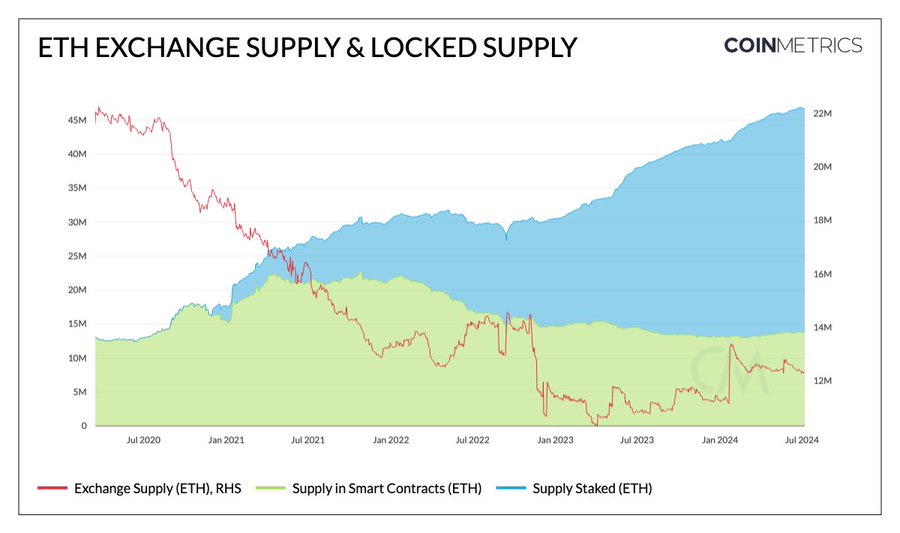

In recent days, Ethereum has experienced a sharp increase in staking activity, with a significant portion of its total supply now committed to the ETH2 Beacon Deposit Contract. As of the latest figures, approximately 33.9% of all Ethereum, totaling 47.36 million ETH, is locked in staking contracts.

This marks a considerable rise from just two years ago, when only 10.9% of Ethereum was staked, highlighting a growing confidence in the forthcoming Ethereum 2.0 and its promised enhancements.

The rise in staked Ethereum reduces the circulating supply, potentially pushing prices upward due to the basic economic principle of supply and demand. Additionally, the nature of staking means this Ethereum is not readily available for sale, providing a buffer against price drops during market dips, contributing to a stabilization of value.

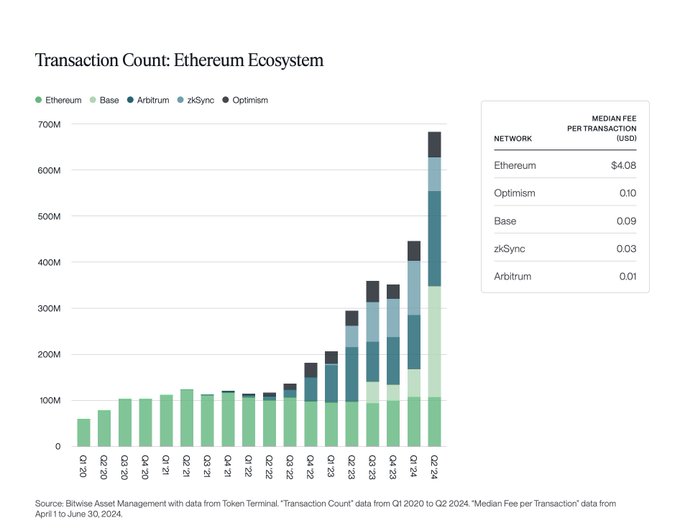

Despite these positive indicators in staking, the Ethereum network itself shows signs of decreased activity. Data analysis from Santiment, as reported by ETHNews, indicates a notable decline in active Ethereum addresses over the last month.

The decline aligns with a drop in the number of NFT transactions processed on the network, suggesting a reduction in usage across various Ethereum-based applications.

This downturn in network engagement might stem from several factors, including high transaction fees, a dearth of compelling new applications, or overall bearish sentiment within the broader cryptocurrency market.

- Supply Lock-up: Approximately 40% of Ethereum’s total supply is currently inaccessible for regular trading. This significant portion includes 28% that is staked—meaning it’s committed in the Ethereum 2.0 deposit contract, where it helps secure the network in exchange for rewards. Additionally, 12% is utilized in various smart contracts and bridges, which are essential components for decentralized applications and cross-chain interactions.

- Decreasing Exchange Supply: The amount of Ethereum available on trading platforms is diminishing. This reduction in exchange supply can lead to a scarcity effect, making it harder to buy large amounts of Ethereum without affecting its price, which is beneficial for price appreciation.

- Potential for Price Rally: Combining the locked-up supply, increased institutional interest, and shrinking exchange reserves suggests a setting that is primed for a potential price rally. The reduced available supply, coupled with potentially increased demand from new institutional entries, could drive up Ethereum’s price.

Overall, these elements indicate a tightening of Ethereum’s market supply at a time when demand could be set to increase, possibly leading to upward price movements.

Furthermore, Ethereum’s network growth has slowed, suggesting diminishing interest among new users, and the velocity of Ethereum transactions has decreased, indicating less frequent exchanges of ETH. These metrics underscore a cautious or wait-and-see approach among investors and users.

As of the latest market ETHNews data, Ethereum’s price stood at $3,087.00, reflecting a 1.91% increase since July 10th.

However, despite recent price gains, the long-term outlook appears tentative, with prevailing market conditions keeping bullish momentum in check.

This scenario paints a mixed picture: while staking activity flourishes, broader network engagement and growth lag, presenting a nuanced view of Ethereum’s current market status.