- Bitwise CIO predicts a $15 billion influx into Ethereum ETFs within 18 months of their anticipated launch.

- Regulatory filings for Ethereum ETFs are underway, with potential final approvals and launch slated for mid-July 2024.

As the financial world anticipates the introduction of Ethereum ETFs, the buzz is growing about the potential these funds have to reshape Ethereum’s market presence. Matt Hougan, Chief Investment Officer (CIO) at Bitwise, has projected that Ethereum ETFs could see an influx of $15 billion within the first 18 months of their launch.

1/ Ethereum ETPs will attract $15 billion in net flows in their first 18 months on the market.

A thread on how I get to this estimate.

— Matt Hougan (@Matt_Hougan) June 26, 2024

This forecast aligns with recent regulatory movements suggesting a mid-July debut for these ETFs. According to reports by Bloomberg, multiple entities are expected to have submitted their amended S-1 forms by July 8th.

Nate Geraci, President of The ETF Store, hinted that final approvals might be secured by July 12th, potentially paving the way for a launch in the week of July 15th.

Wen spot eth ETF?

BBG sticking w/ mid-July.

Amended S-1s due July 8th.

Potential final S-1s by July 12th.

Would theoretically mean launch week of July 15th.

via @emily_graffeo @olgakharif pic.twitter.com/NG8xhtCP21

— Nate Geraci (@NateGeraci) July 3, 2024

The potential for Ethereum ETFs extends beyond simple market dynamics. Hougan expressed a strong belief in the appeal of Ethereum to institutional investors during a discussion with analyst Scott Melker.

He referenced consistent substantial investments in Ethereum from European and Canadian markets, which bolster his optimism about its potential success in the U.S. market as well.

Further enriching this perspective, Hougan shared insights from a strategic conversation with a major financial advisory firm managing over $100 billion in assets. The dialogue revealed a readiness to diversify into Ethereum following the ETF launch, signaling growing acceptance of cryptocurrency as a valid asset class within the broader financial community.

However, the broader cryptocurrency market, including Ethereum, has faced a downturn, with Ethereum’s price dropping to $3,139, a decrease of approximately 6.2% in the last 24 hours.

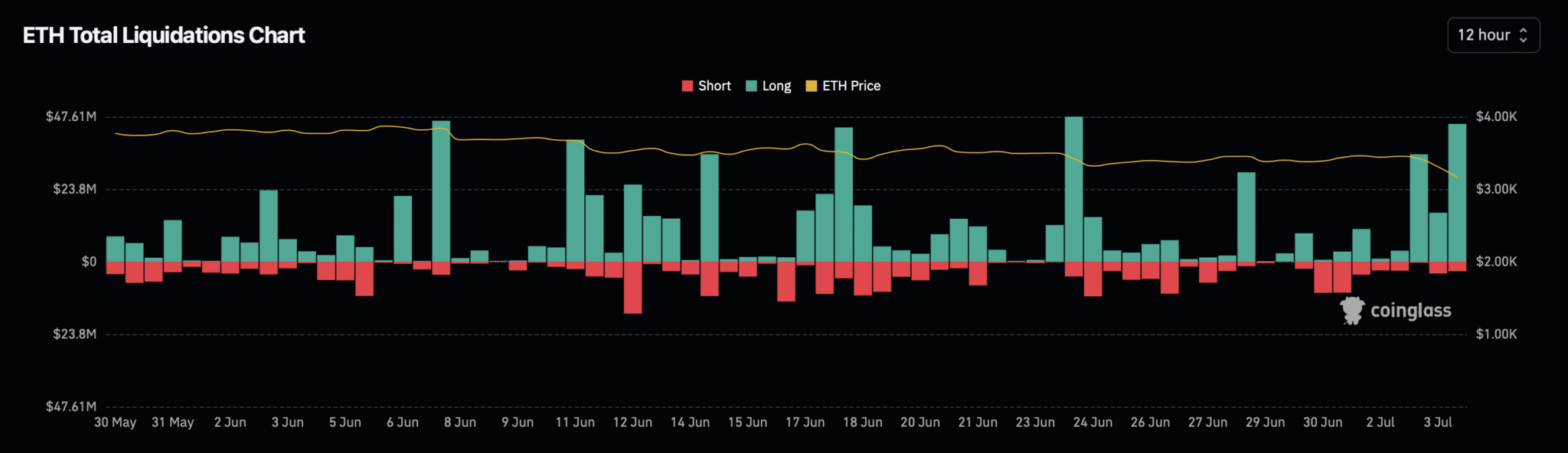

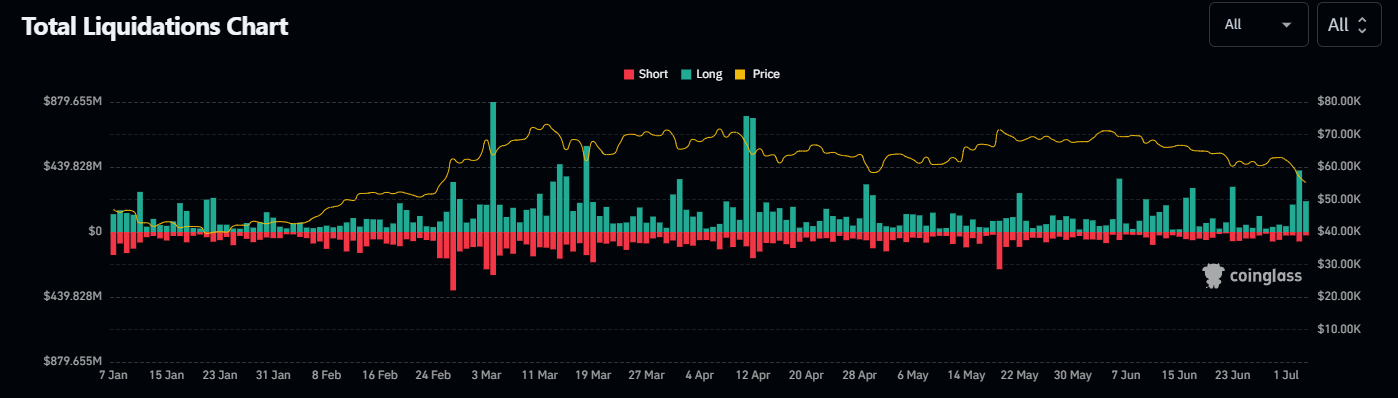

This decline has resulted in trading losses, with Coinglass reporting liquidations totaling $317.34 million in the past day, of which Ethereum-related liquidations constituted about $76.51 million. These figures predominantly reflect losses from long positions.

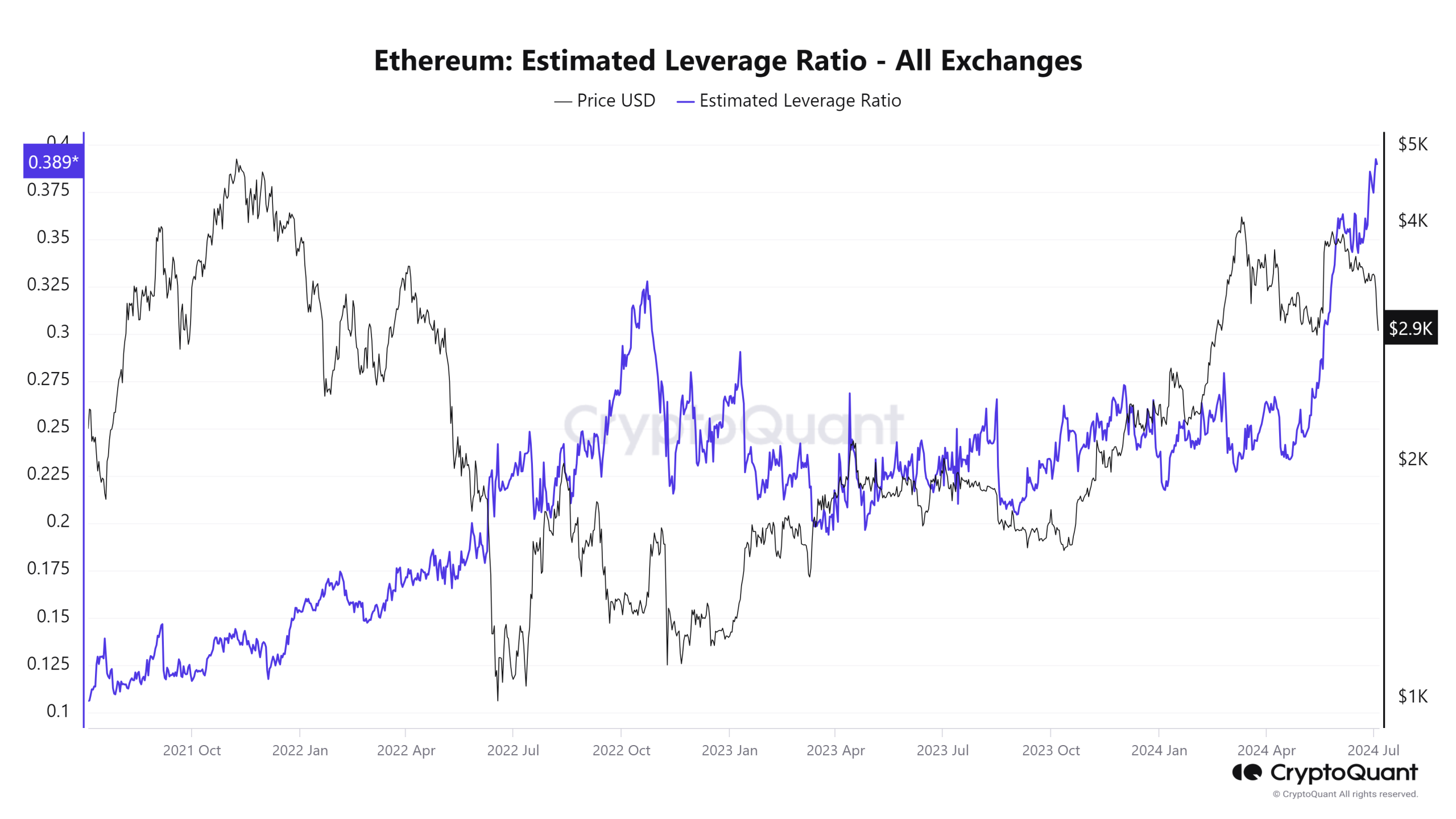

Moreover, data from CryptoQuant shows an increase in Ethereum’s Estimated Leverage Ratio across exchanges, reaching 0.392. This metric suggests a rise in leveraged positions relative to the market cap of Ethereum, indicating a potential for increased volatility or further liquidations in the near future.

The integration of Ethereum ETFs into the market is seen not only as a vehicle for substantial financial inflow but also as a potential stabilizer for Ethereum’s price by providing a structured, regulated way for institutional investors to engage with the cryptocurrency.