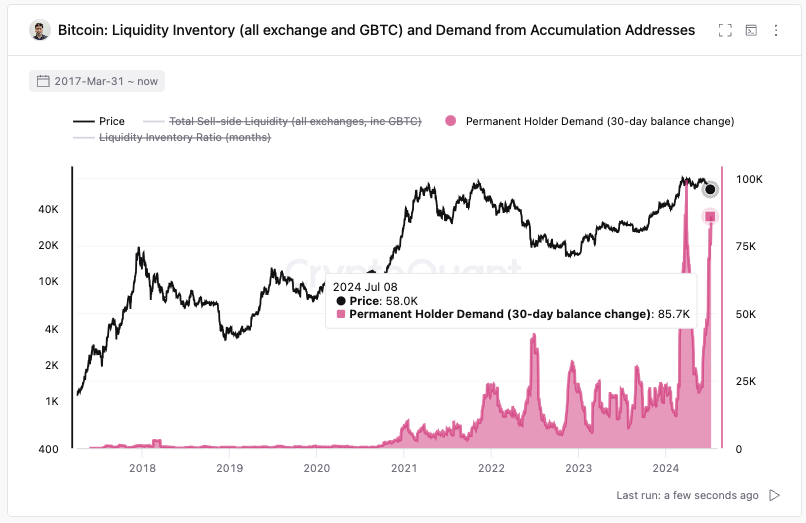

- Custodial wallets accumulate 85K Bitcoin in 30 days, contrasting with 16K BTC outflow from ETF holdings.

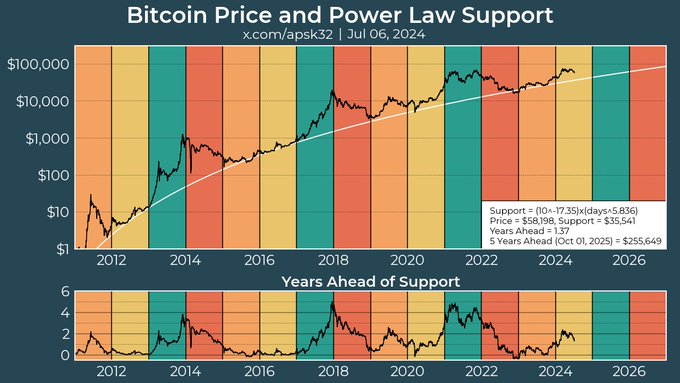

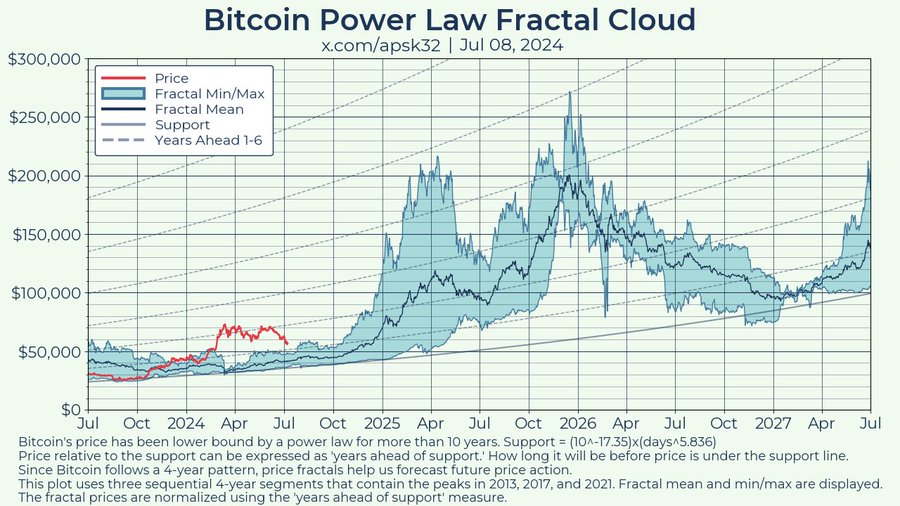

- Fractal analysis predicts Bitcoin price trends, using historical cycles and ‘years ahead of support’ metric for scaling.

Bitcoin continues to captivate market watchers with its recent performance and the unique investment patterns around it. Over the last 30 days, specific custodial wallets known for holding their assets permanently have accumulated an additional 85,000 Bitcoins.

These are not associated with ETFs, exchanges, or miners, highlighting a distinct trend of steady accumulation despite the market’s ups and downs.

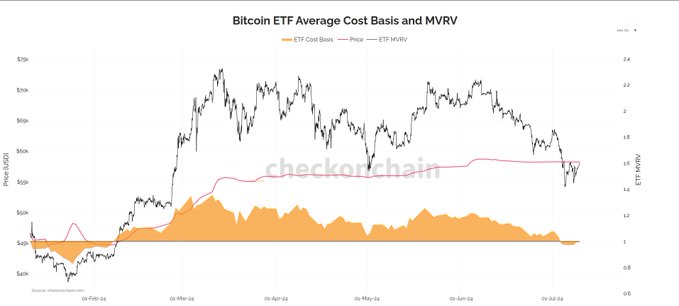

As we have been writing in ETHNews, during the same period, Bitcoin ETF holdings experienced a net outflow of 16,000 BTC, contrasting with the buying behavior of these permanent holders. This a complex picture of the current Bitcoin ecosystem, where different investor classes react diversely to market conditions.

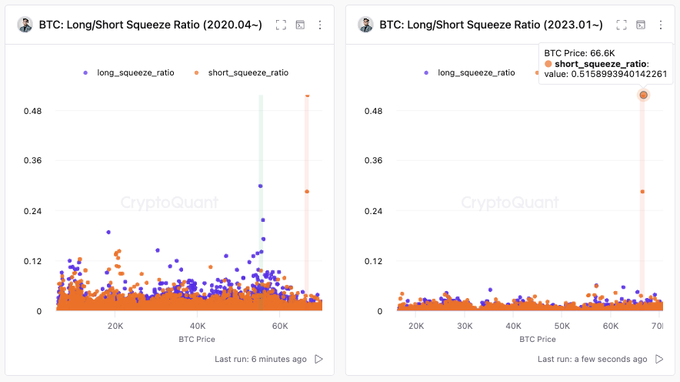

Interestingly, the market has not yet experienced a long squeeze in this cycle, a scenario where long position holders are forced to sell their holdings, potentially triggering further price drops.

However, historical data suggests two short squeezes occurred when Bitcoin reached $66,000 earlier this year, and four long squeezes were observed at $55,000 in the previous cycle.

ETHNews analysts are divided on whether the support level of $55,000, tested four times in the last cycle, remains a reliable floor, or if the absence of a long squeeze signals that Bitcoin has not yet reached its bottom.

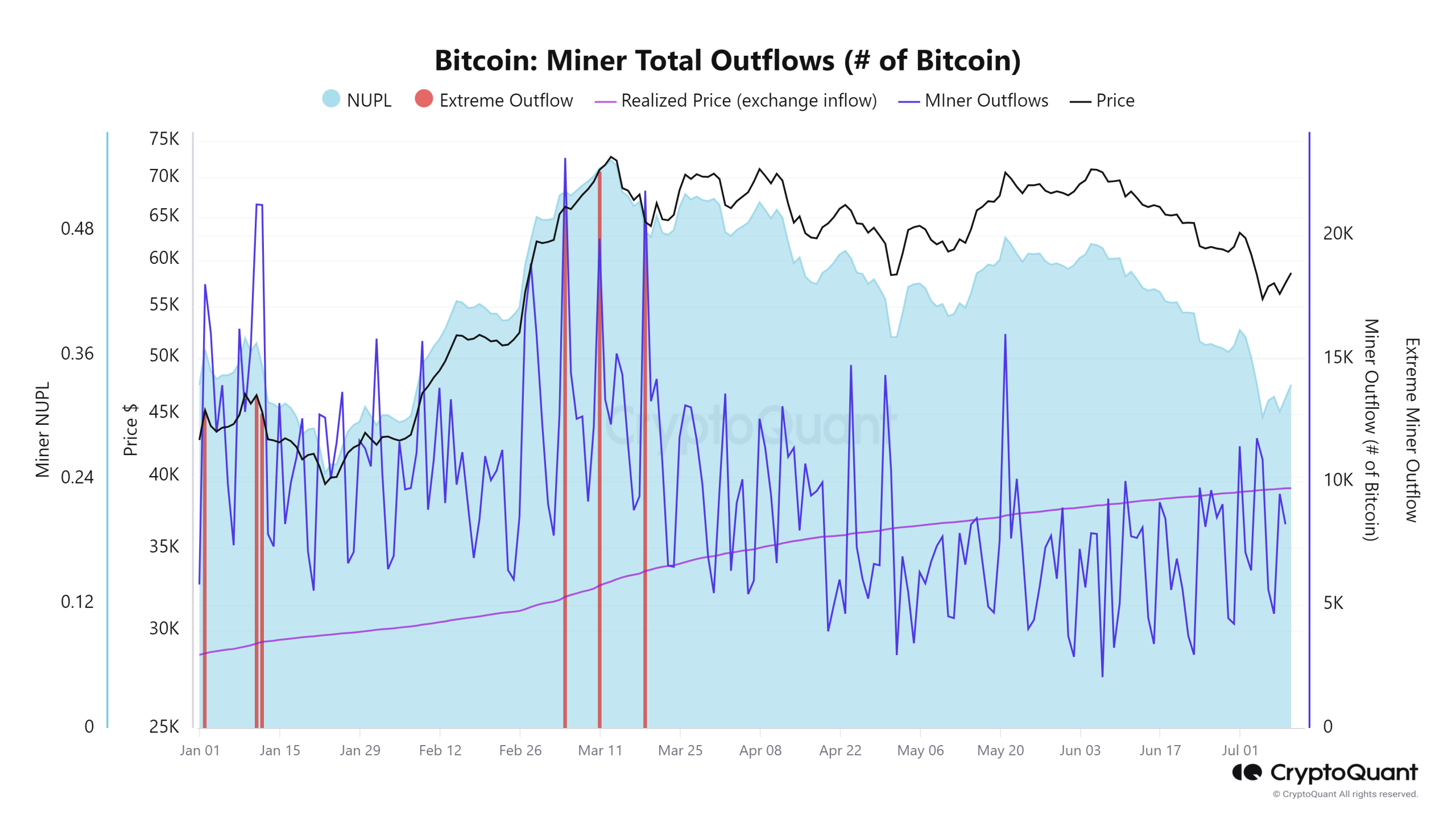

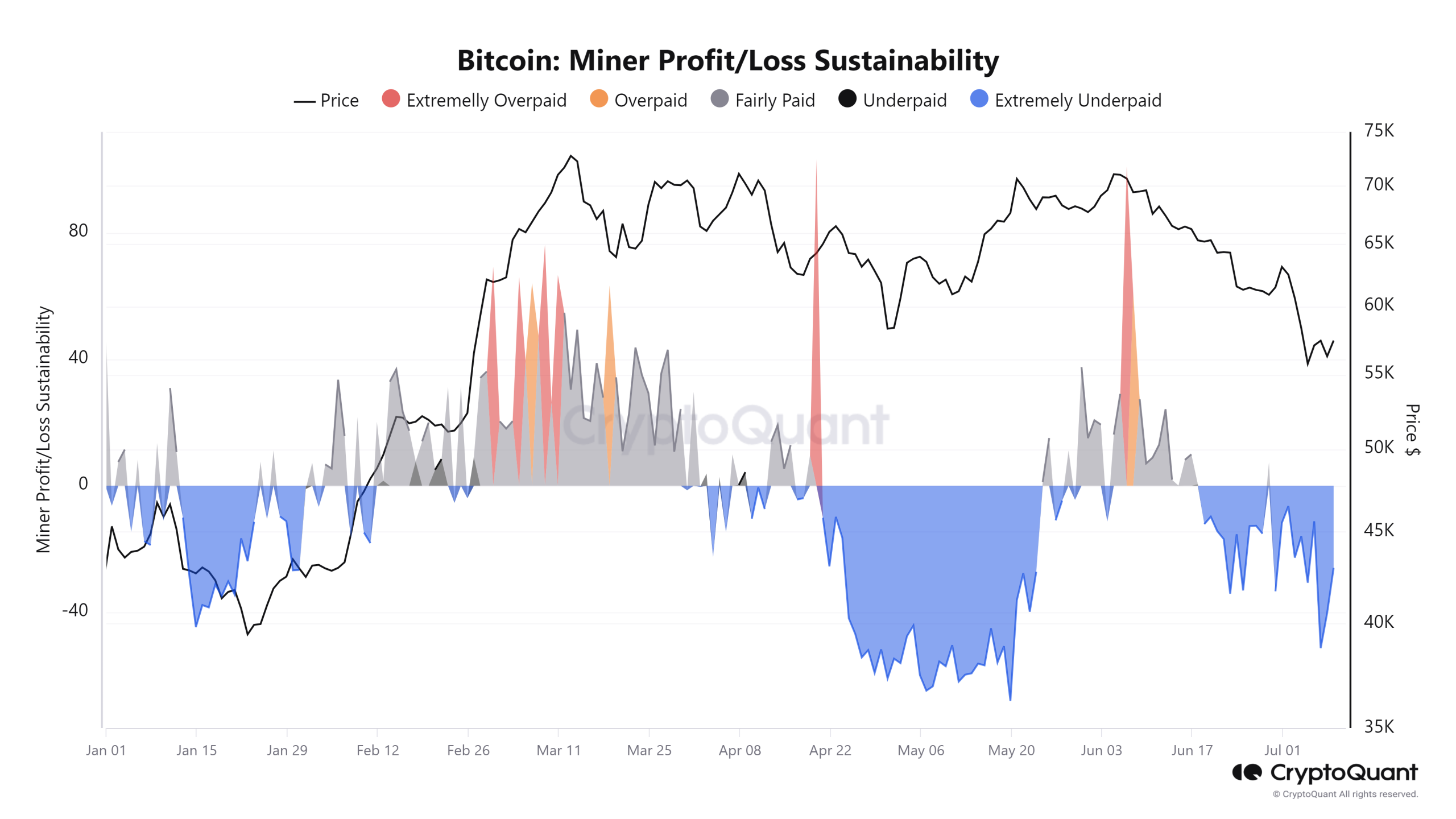

Adding to the complexity, Bitcoin miner capitulation continues, with daily mined value significantly above levels traditionally indicating the end of such phases.

The current market sentiment suggests a subdued outlook for the coming months, with recommendations to maintain a long-term bullish stance but avoid excessive risks.

The cryptocurrency’s price is expected to stabilize, with potential for significant growth projected towards the end of 2025, potentially seeing prices multiply.

Beyond simple market speculation, Bitcoin’s behavior is increasingly analyzed through fractals—patterns that use historical data to predict future performance.

These analyses consider factors like the number of days since the last halving and overall market cycles, often showing that psychological patterns, as much as technical ones, drive crypto market.

This approach involves scaling past price data to present conditions, using methods like the ‘years ahead of support’ metric. This metric calculates how many years it might take for Bitcoin’s price to align with its historical support trend, a consideration that can temper investment decisions.

As we move forward, Bitcoin’s alignment with these fractal predictions will provide crucial insights.

The current reversion to earlier patterns, after deviations caused by factors like ETF-driven price spikes, underscores the cyclical and somewhat predictable nature of cryptocurrency markets. Yet, as always in the world of Bitcoin, the only certainty is the asset’s inherent unpredictability.