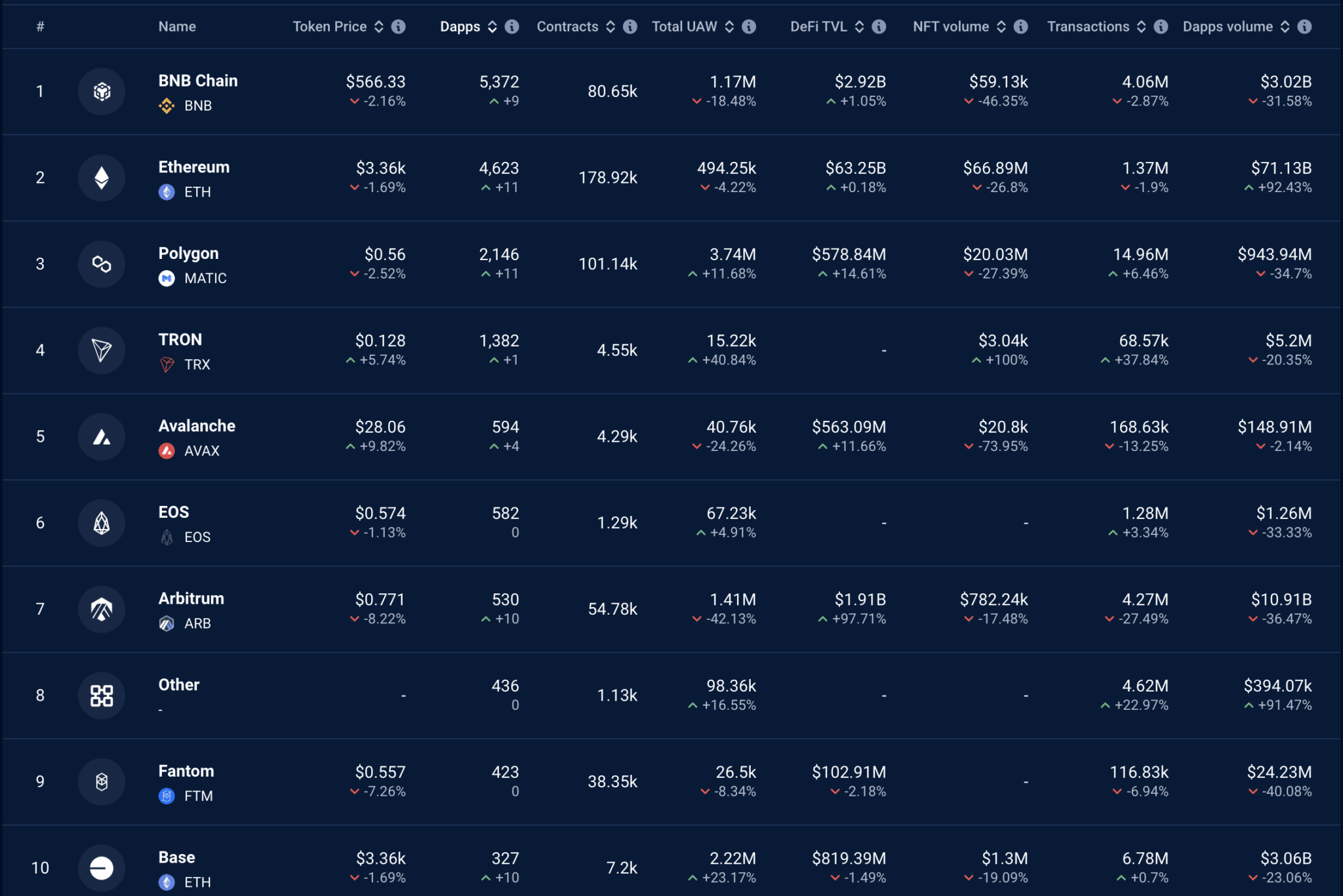

- Ethereum’s dApp volume surged 92.43% to $71.13 billion, outperforming BNB Chain, Polygon, and Tron recently.

- NFT trading and staking activities drove the spike, benefiting platforms like Blur, EigenLayer, and Uniswap NFT Aggregator.

Ethereum’s decentralized application (dApp) volume has surged by 92.43% over the past week, reaching $71.13 billion, surpassing competitors like BNB Chain, Polygon (MATIC), and Tron (TRX).

This increase is primarily driven by activities in NFT trading and staking, which have seen upticks in platforms like Blur, EigenLayer, and the Uniswap NFT Aggregator.

However, not all dApps on the Ethereum blockchain experienced growth; notable declines were observed in dApps like Uniswap V2 and V3.

This disparity underscores the uneven nature of Ethereum’s recent performance in the dApp sector, influenced heavily by specific segments rather than across the board, as we have described in ETHNews.

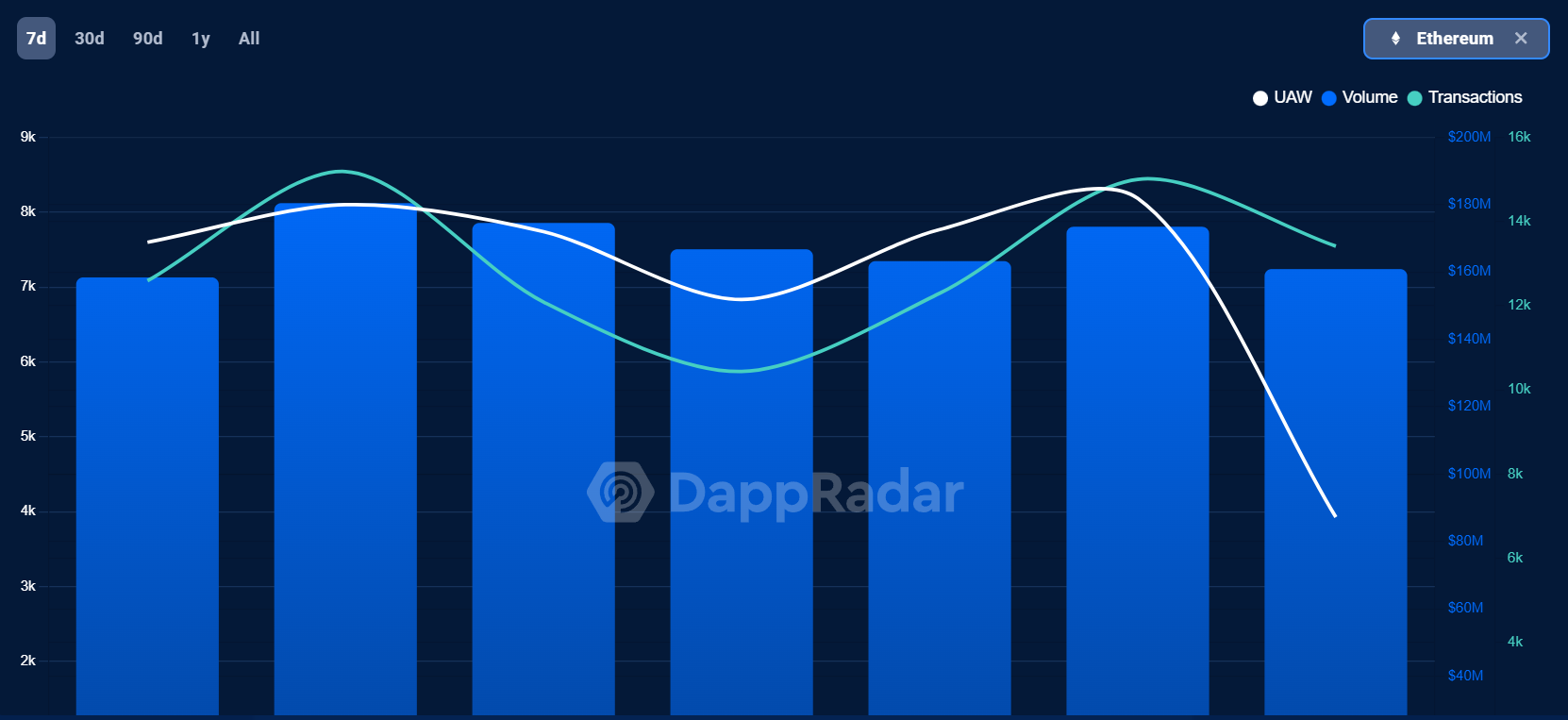

Despite the spike in dApp activity, Ethereum’s network showed a decrease in Unique Active Wallets (UAW), indicating reduced engagement in active transactions. Concurrently, Ethereum’s price dipped by 2.32% in the last 24 hours, trading at $3,365. This price movement suggests cautious trading sentiment, despite expectations for a potential recovery later in the month.

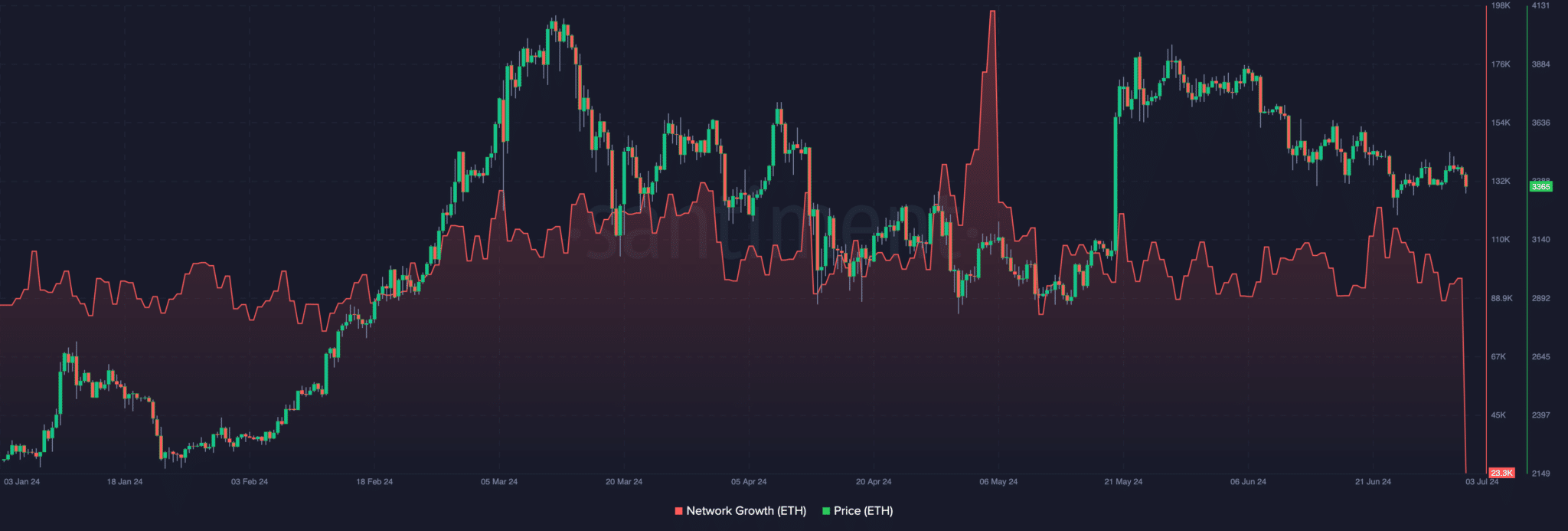

Looking ahead, Ethereum faces a mixed outlook; while short-term prospects remain subdued due to lower network growth metrics and decreased active wallets, long-term forecasts remain optimistic.

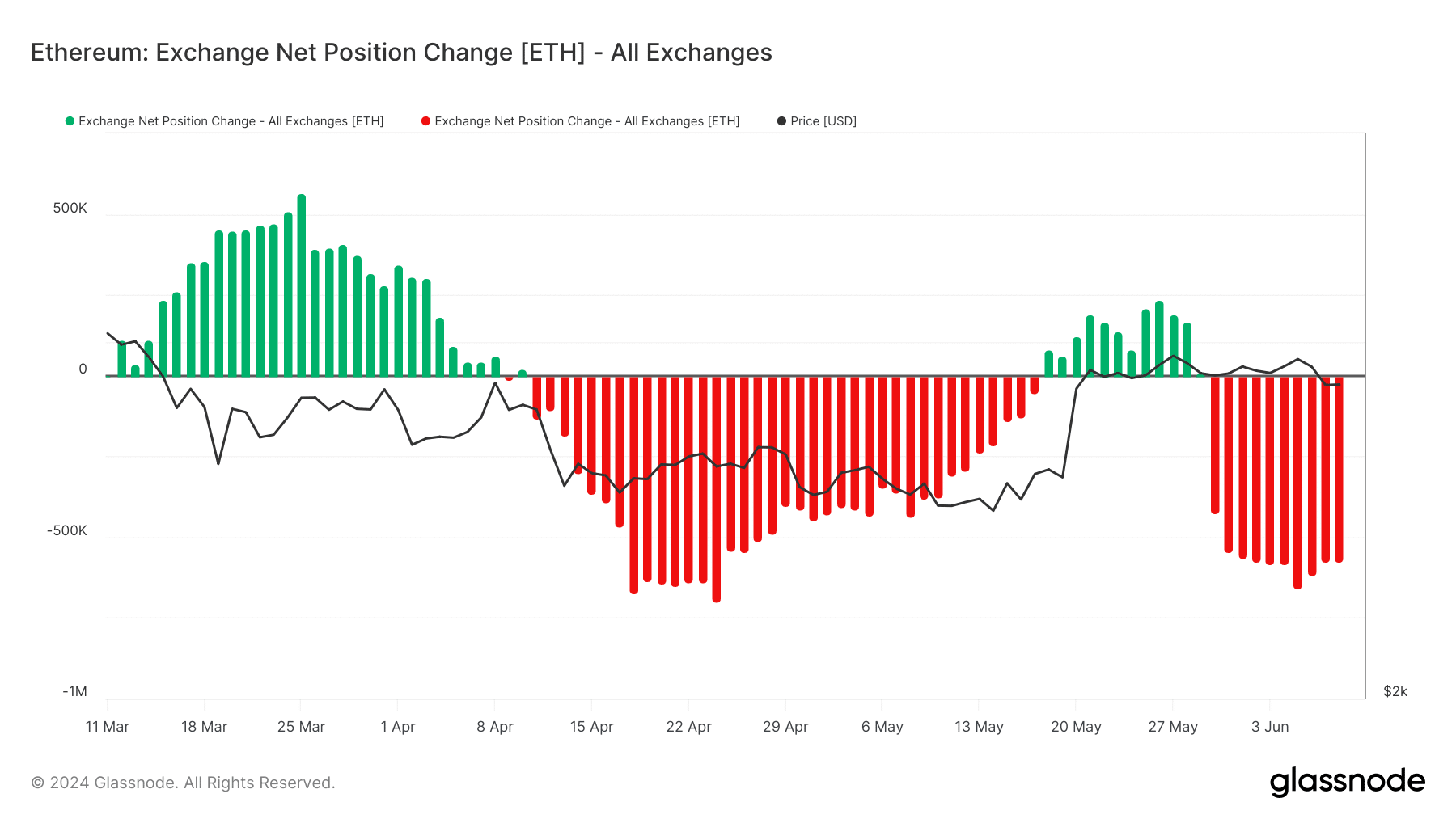

The Exchange Net Position Change, tracking cryptocurrencies held in exchange wallets, indicates a trend of withdrawals rather than deposits, potentially stabilizing ETH’s price.

ETHNews Analysts predict that if current withdrawal trends continue, Ethereum could target reaching $4,000 this quarter or even surpassing its previous all-time high. This scenario hinges on sustained market confidence and continued adoption of Ethereum’s network by new users.