- Investments in Bitcoin ETFs exceed mining production by more than ten times, reflecting an increase in demand.

- BlackRock and Fidelity lead investments in Bitcoin, evidencing institutional interest in this cryptocurrency as an investment asset.

Recent activity in the Bitcoin ETF market highlights an increase in institutional investment in this sector, with a notable inflow of capital far exceeding the capacity of miners to produce new bitcoins.

In the last two trading days, inflows into Bitcoin ETFs were recorded as exceeding more than ten times what the miners were able to produce.

BlackRock iShares Bitcoin Trust led with inflows of $374.7 million, followed by Fidelity’s Wise Origin Bitcoin Fund with $151.9 million, and the Ark 21Shares Bitcoin ETF with $40 million. Although there were outflows from Grayscale and Invesco Galaxy ETF funds, the net balance showed inflows of close to half a billion dollars.

As #Bitcoin's fourth halving nears, a supply shock meets a demand surge. Experts predict soaring prices, potentially pushing BTC to $100,000. With #BlackRock and other ETFs buying 10x more than miners produce daily, Bitcoin's long-term rise seems inevitable. 🚀📈 #BitcoinHalving pic.twitter.com/Vdcgbpw9d9

— Marcel Knobloch aka Collin Brown (@CollinBrownXRP) April 3, 2024

Meanwhile, Bitcoin miners produced approximately 1,059 BTC, which equates to about $51 million, just 10% of the total absorbed by Bitcoin ETFs in the same period.

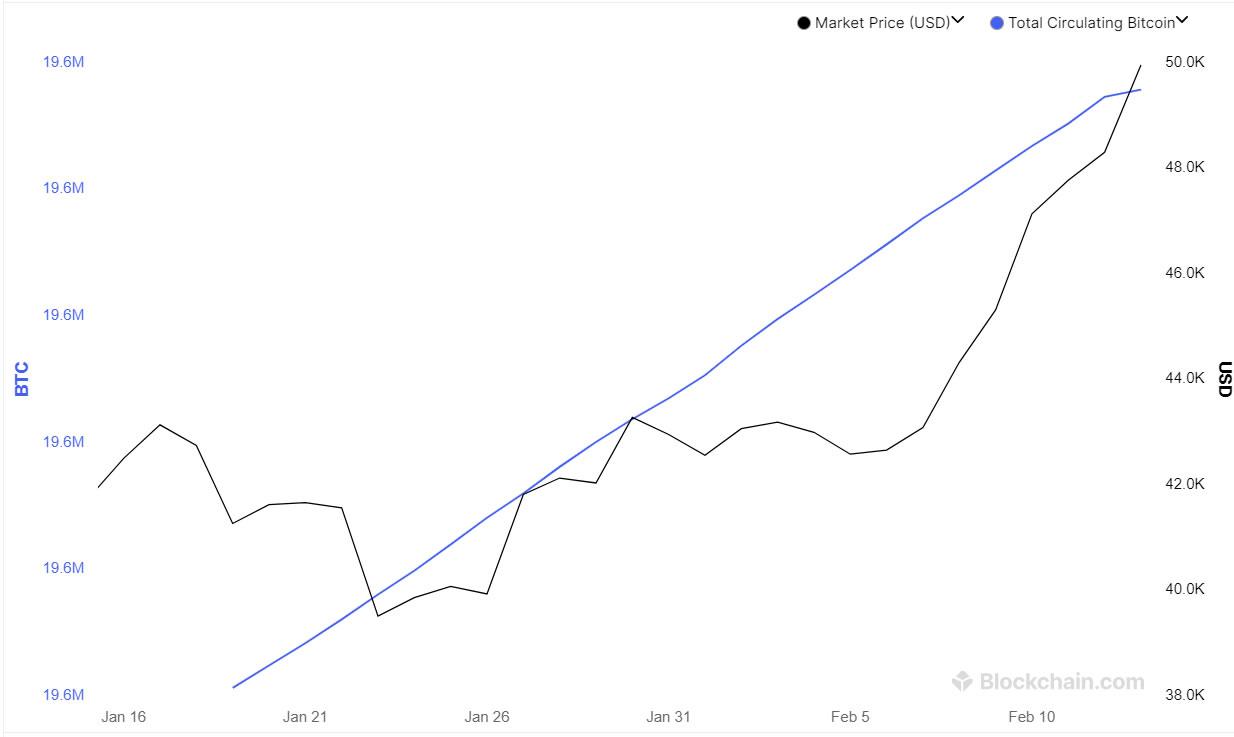

Bitcoin Production vs. ETF Demand

The contrast between daily Bitcoin production, approximately 1,059 BTC which equates to about $51 million, and the amount absorbed by ETFs highlights the growing gap between the limited supply of Bitcoin and an expanding demand.

This suggests upward pressure on the Bitcoin price as discussed in our portal video, as the ability to increase production in response to increased demand is limited.

Pompliano’s Outlook

The observations of Anthony Pompliano, a well-known Bitcoin supporter, offer a valuable perspective on this situation. Pompliano highlights Wall Street’s enormous appetite for Bitcoin, with demand exceeding daily production by 12.5 times .

Bank of America is predicting the US government will pay $1.6 trillion in annual interest payments by December if the Fed doesn’t cut interest rates. pic.twitter.com/taT1zjG9hd

— Pomp 🌪 (@APompliano) April 1, 2024

This not only underscores the growing institutional interest but also the potential for Bitcoin shortages, considering that 80% of the total supply has not moved in the last six months.

Bitcoin provides hope & protection for anyone.

The US dollar has lost 25% of its purchasing power in 4 years, while bitcoin has gained over 800%.

We are watching a global store of value be adopted.

Here is my full segment on @SquawkCNBC this morning. pic.twitter.com/XvO0B4yE0o

— Pomp 🌪 (@APompliano) April 1, 2024

According to Pompliano, this implies that ETFs have absorbed about 5% of Bitcoin’s marketable supply in just 30 days, a figure that highlights the intense concentration of demand and its potential effects on Bitcoin’s price.