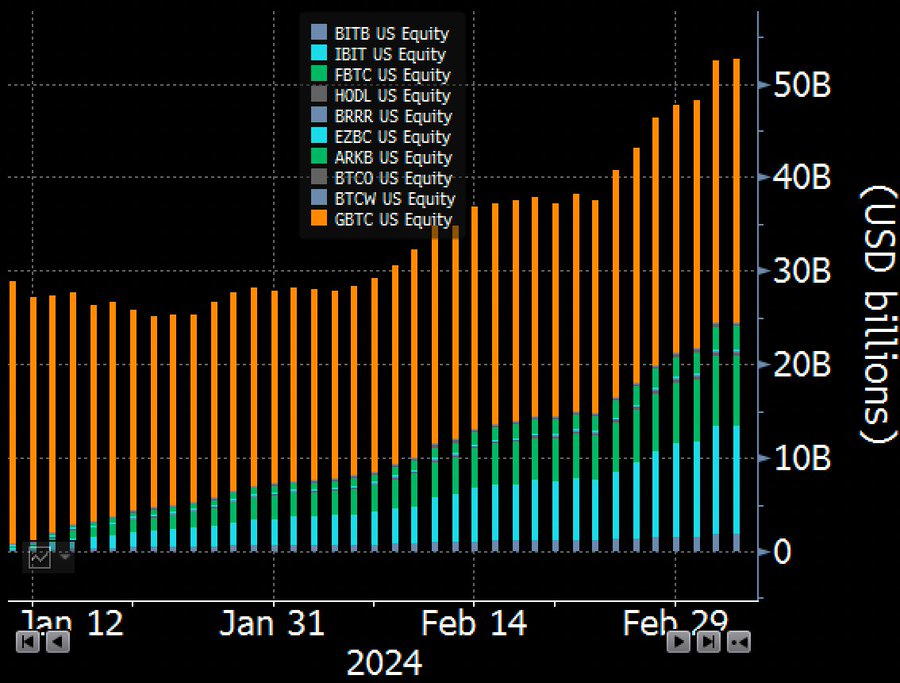

- Bitcoin ETFs beat expectations, racking up $8.5 billion in inflows in less than two months.

- MicroStrategy, with 193,000 BTC, reflects confidence in Bitcoin, planning to buy more with $700 million from a note sale.

Have you heard about the rage Bitcoin ETFs are causing? Well, Michael Saylor, the renowned CEO of MicroStrategy, recently shared some words that have caused a stir in the cryptocurrency world.

During the Madeira Bitcoin conference, Saylor revealed that Bitcoin ETFs, especially those launched by financial giants like BlackRock and Fidelity, are outperforming all expectations. But what does this mean for the financial market and for you as an investor? Let’s break it down.

Bitcoin’s Race Against Gold

As Saylor rightly pointed out, what initially appeared to be a head-to-head competition with gold has quickly turned into an accelerating race to the top, where Bitcoin is not only challenging the precious metals but also starting to rub shoulders with the big boys of the S&P 500 index .

incredible, don’t you think? According to data collected by BitMEX, Bitcoin ETFs have managed to accumulate an impressive $8.5 billion in net inflows in less than two months since their launch. And if that doesn’t sound like enough, they have even managed to surpass corporate titans like Microsoft in trading volume.

Bitcoin ETF Flow – 5 March 2024

All data in. $648m total net inflow for the day. Largest inflows since day 1. Blackrock with a record +$788.3 million day. pic.twitter.com/zOJ5Y5XsEx

— BitMEX Research (@BitMEXResearch) March 6, 2024

This new investment avenue not only simplifies transactions between different funds thanks to what Saylor describes as a “universal API,” but also democratizes access to Bitcoin, opening up a range of financial possibilities for the average investor.

Previously, using Bitcoin as collateral for loans was a cumbersome and costly process. Now, thanks to ETFs, this becomes a smoother and more accessible operation.

A World of Opportunities for Conventional Investors

The implementation of these ETFs has opened up a whole new world of opportunities. We are not only talking about easier access to loans and credit, but also more active participation in the global financial market.

As Saylor points out, these financial instruments represent a revolution for 99% of conventional investors, providing an essential tool in the modern financial arsenal.

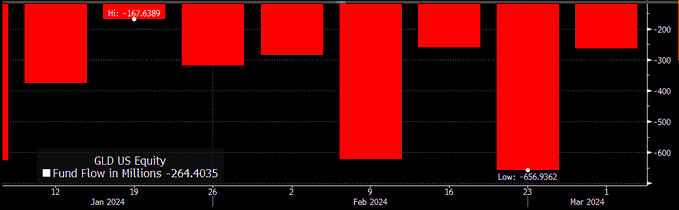

Furthermore, MicroStrategy’s holding of 193,000 BTC reflects not only a vote of confidence in Bitcoin but also a long-term commitment to the cryptocurrency as a sound investment. And while the crypto market has seen its ups and downs, investor greed and interest in Bitcoin ETFs has only grown, setting a record of nearly $1 billion in net inflows recently, even amid market corrections.