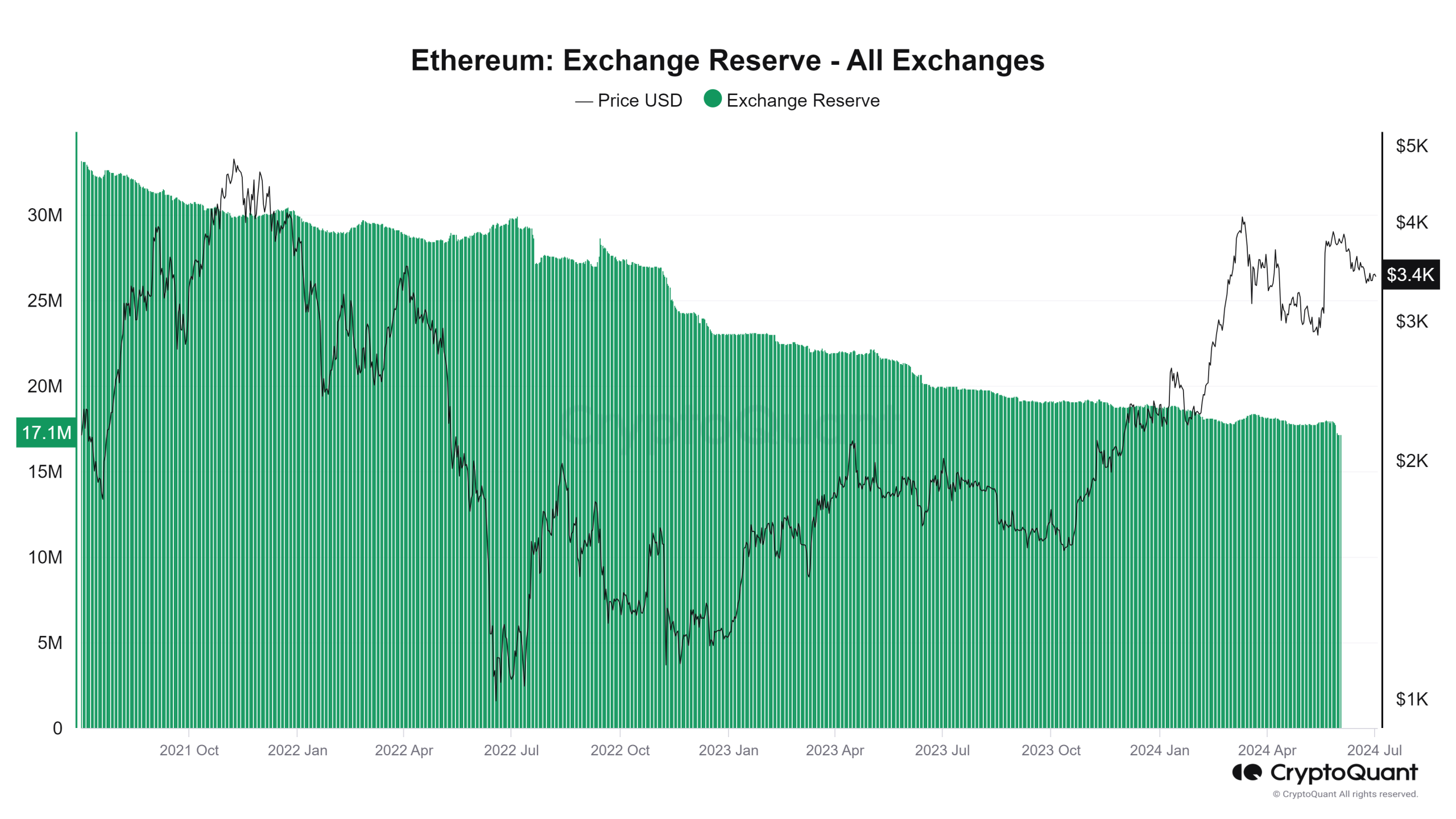

- Over 1 million ETH, valued at $3.8 billion, left exchange reserves in June, marking a notable decrease.

- Staking activity surges with over 1.5 million deposits and 33.2 million ETH staked, accounting for 28% of supply.

Ethereum (ETH) has witnessed a noticeable trend in recent weeks, with substantial withdrawals from cryptocurrency exchanges. This indicates a strategic shift among investors, who are increasingly opting to move their ETH holdings off trading platforms.

Instead of keeping their assets readily available for trading, many are securing them in staking contracts or long-term storage solutions.

Data analysis from ETHNews, highlights this phenomenon. In June alone, over 1 million ETH, valued at approximately $3.8 billion, departed from exchange reserves. This represents a significant 6.4% decrease in the ETH held on trading platforms.

At the start of the month, exchange reserves held over 17 million ETH, which dwindled to around 16 million ETH by month-end. Currently, this figure stands at approximately 16.6 million ETH.

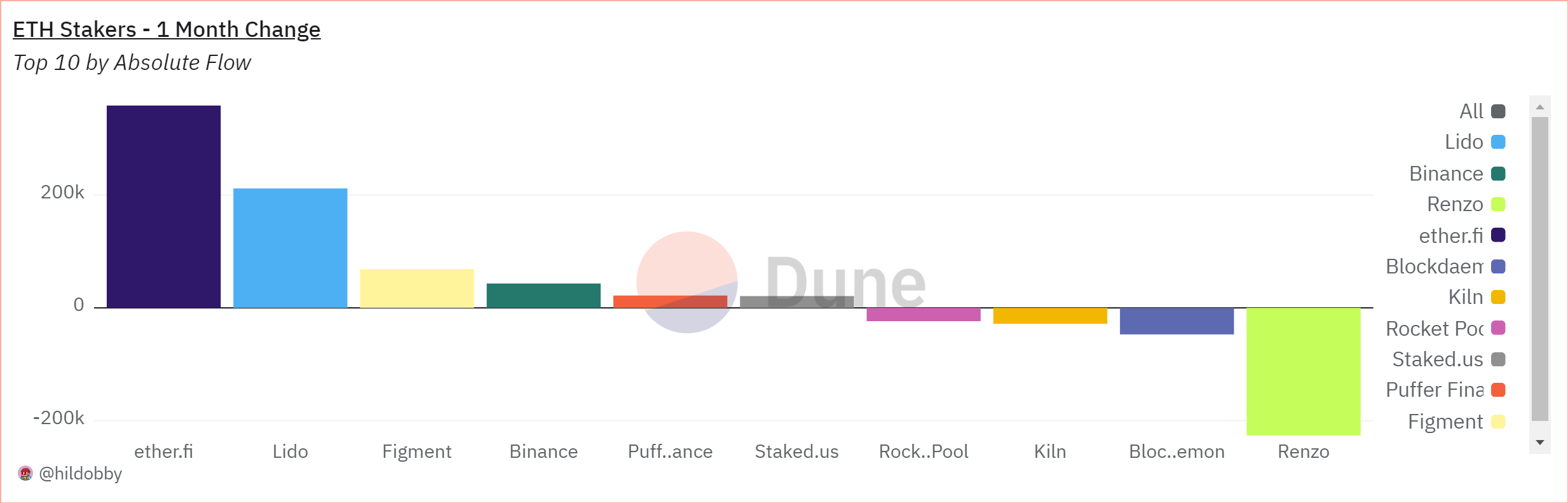

The decrease in exchange reserves typically suggests two main strategies among investors. Firstly, it indicates a growing trend towards long-term holding, where investors transfer ETH to secure wallets for extended periods. Secondly, it reflects an increased participation in Ethereum’s staking process, aligning with ongoing developments towards Ethereum 2.0.

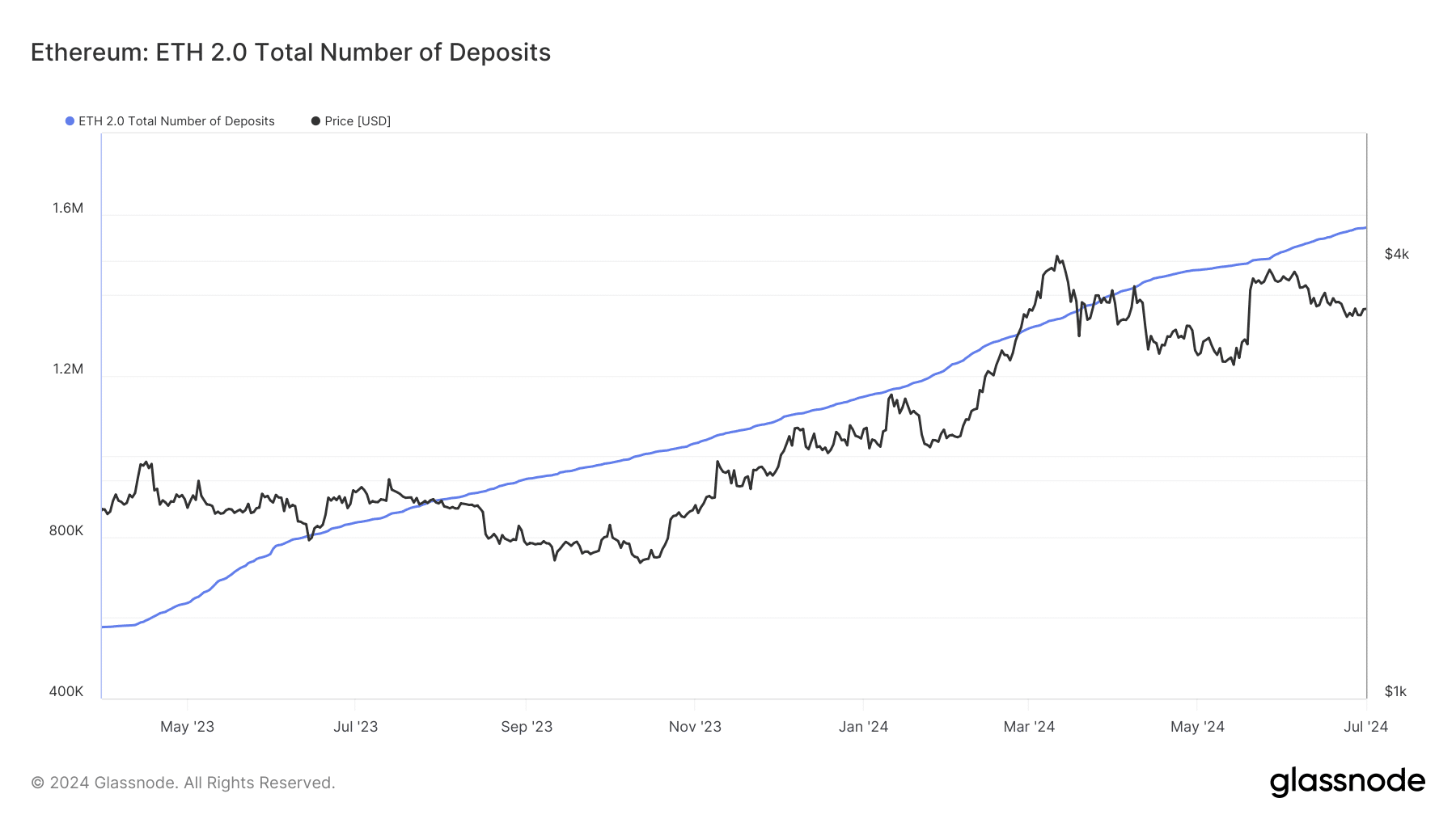

Staking activity has indeed surged, underscoring this strategic shift. Glassnode reports a consistent rise in the number of ETH deposits into staking contracts. As of now, over 1.5 million deposits have been recorded, with a total of 33.2 million ETH staked.

This substantial volume represents nearly 28% of Ethereum’s total supply, highlighting a strong inclination towards staking as a preferred method of engagement among holders.

Simultaneously, Ethereum has encountered resistance in its market movements. Recent data from ETHNews, reveals a decline in ETH’s price, which has fallen below its short moving average.

This average, previously a support level, has now flipped to act as a resistance barrier. Such technical patterns often indicate shifts in market sentiment, where previous support levels may impede further upward price movements.

At present, Ethereum is trading around $3,430, experiencing minor fluctuations with a slight decrease of less than 1%. The immediate resistance, marked by the short moving average, lies within the $3,500 to $3,600 range.

The combination of decreased exchange reserves, increased staking activities, and market resistance underscores a strategic pivot among Ethereum investors. This trend towards securing assets and engaging in long-term staking reflects a bullish sentiment, emphasizing a shift towards sustained investment strategies amidst evolving market crypto.