- Investors remain optimistic as ETH approaches potential breakout from a bullish falling wedge pattern.

- Analysis suggests ETH may reach new highs of $3,895 if bullish trends continue; bearish scenario could see $2,877.

Ethereum appears poised for a potential bullish breakout in the near future, sparking enthusiasm among investors tracking its recent price movements. Over the past week, Ethereum experienced notable selling pressure, yet market indicators have remained bullish.

As of the latest data by ETHNews, Ethereum’s price has risen by more than 2% in the last seven days, with a notable surge of over 3% in the past 24 hours, bringing its current trading value to $3,488.88 and a market capitalization exceeding $419 billion.

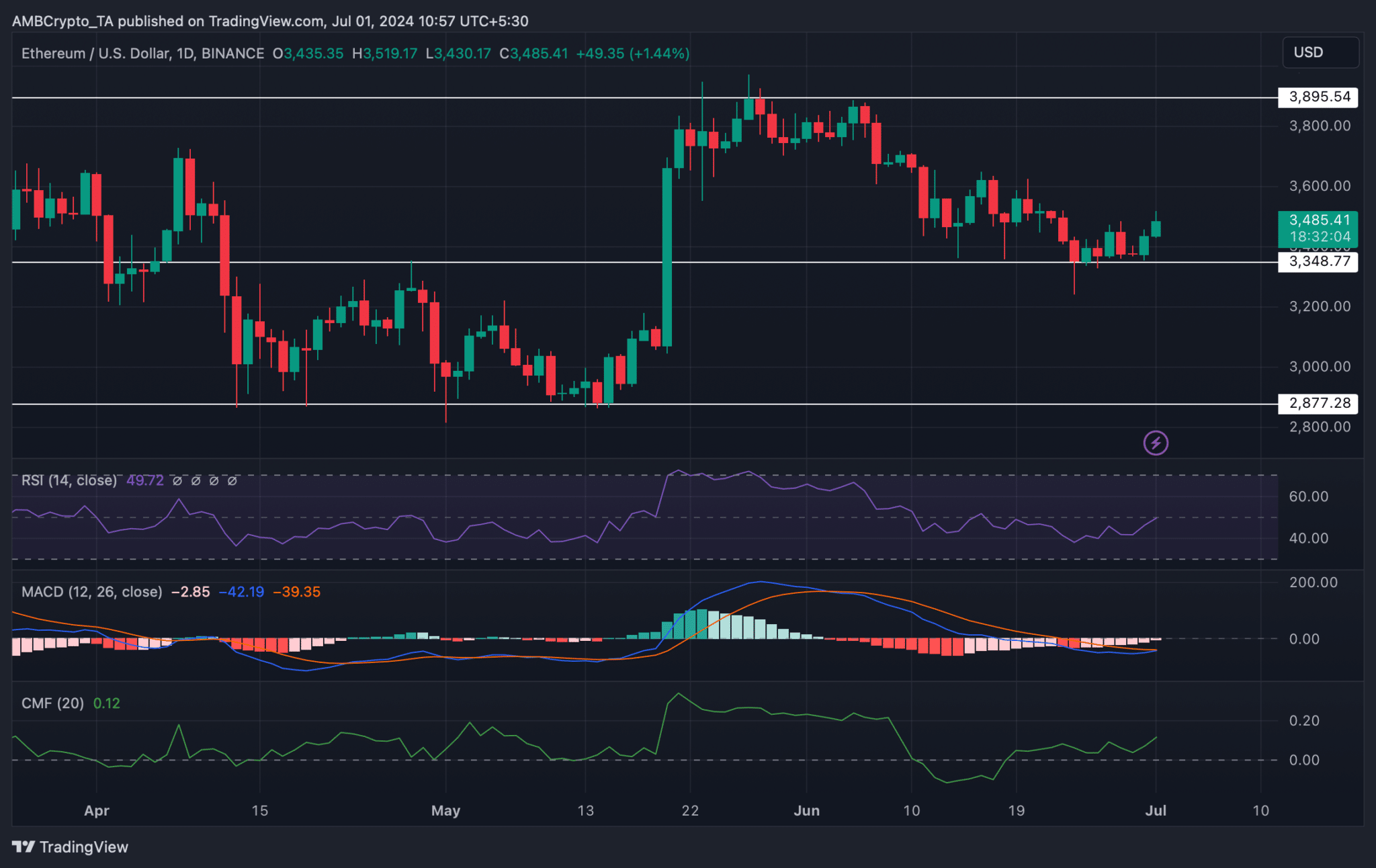

Analysts by ETHNews and CoinMarketCap, have observed a bullish falling wedge pattern forming in Ethereum’s price chart. This pattern, highlighted by X crypto analysts, suggests a potential breakout soon.

Despite previous rejections from the upper limits of this pattern, there are optimistic signals indicating a possible upward movement in Ethereum’s price trajectory.

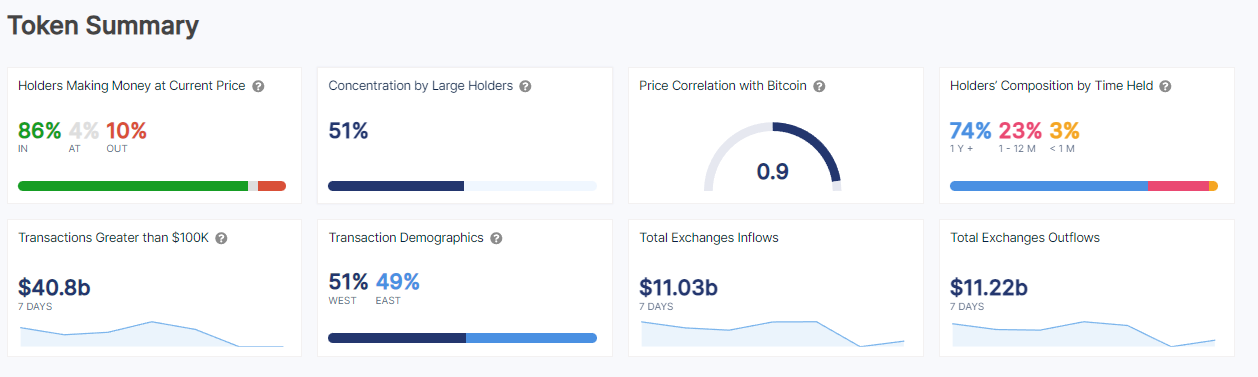

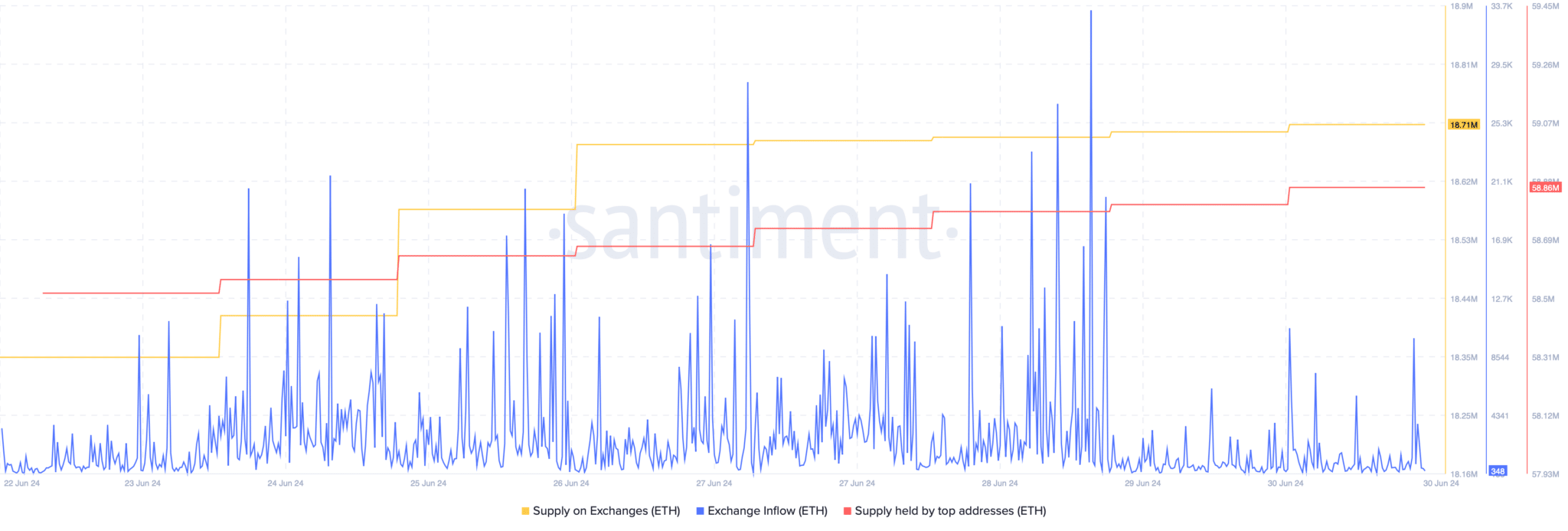

Short-term metrics for Ethereum also show mixed signals. According to ETHNews’ analysis of Santiment’s data, there has been a significant increase in Ethereum’s Exchange Inflow and Supply on Exchanges, indicating heightened selling activity among investors.

However, large holders of Ethereum, known as whales, have maintained their confidence as the supply held by top addresses has increased.

Technical indicators such as the Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), and Chaikin Money Flow (CMF) are showing positive signs.

The MACD suggests a potential bullish crossover, while the RSI has seen an uptick towards a neutral stance, and the CMF indicates increasing money flow into Ethereum.

Looking ahead, if the current bullish momentum persists, Ethereum could potentially reach new highs, with ETHNews analysts speculating a price target of around $3,895 in the coming days. However, in a bearish scenario, Ethereum’s price might retreat to around $2,877.

Overall, while Ethereum faces short-term uncertainties due to increased selling pressure, the broader market sentiment remains cautiously optimistic about its potential for a breakout and sustained upward movement towards new price highs by the end of this year.

Investors and analysts alike continue to monitor Ethereum’s price movements closely for further insights into its future trajectory.