- The SEC’s delay in approving a spot ETH ETF has added to uncertainties surrounding Ethereum’s future.

- Despite regulatory challenges, Ethereum’s price surged today, reflecting broader cryptocurrency market movements.

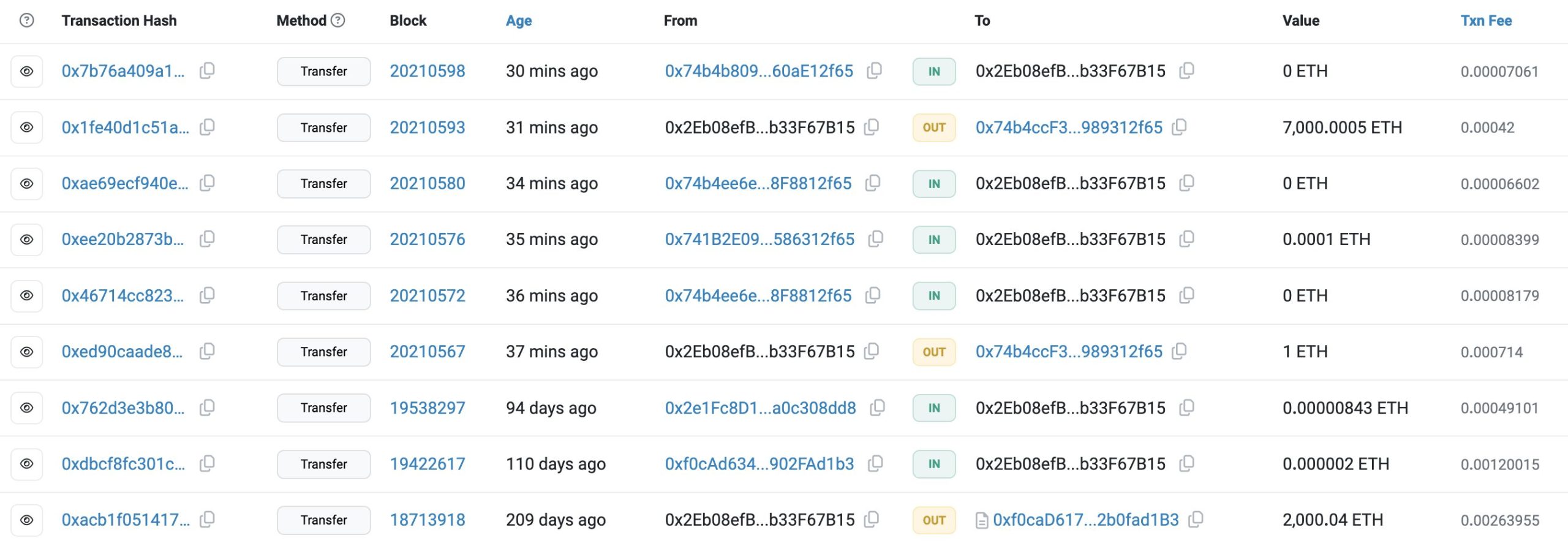

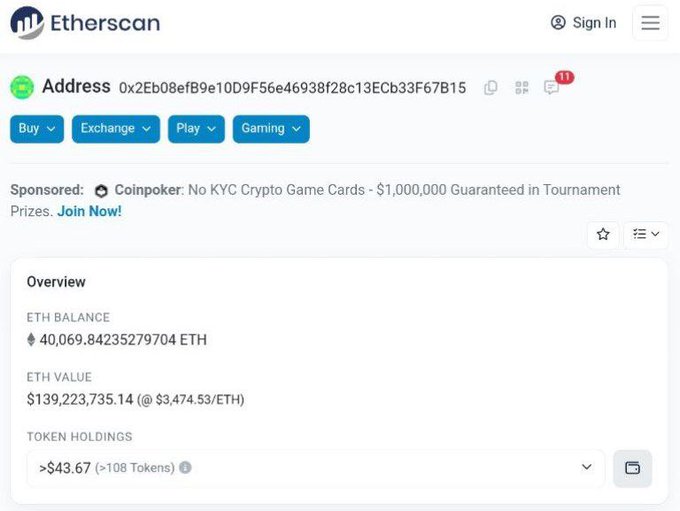

Today, Ethereum faced significant activity from a major investor, as an ICO whale moved 7,000 ETH to Kraken exchange.

This action, valued at $24.28 million, comes amid ongoing concerns over Ethereum’s market dynamics. The whale, known as 0x2Eb08, had held over 40,000 ETH, totaling $138.76 million.

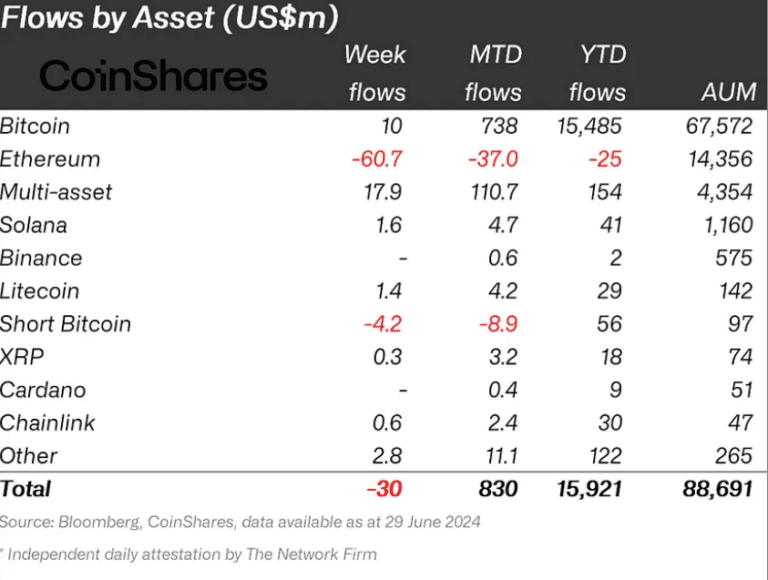

This move coincides with a period of substantial outflows from Ethereum, totaling $60.7 million weekly, according to CoinShares data. The asset has seen its largest outflows since August 2022, compounding worries among investors about its short-term prospects despite being the second-largest cryptocurrency by market cap, currently valued at $415.98 billion.

As we have reported in ETHNew, the SEC’s recent decision to delay the launch of a spot ETH ETF has further fueled uncertainty about Ethereum’s future performance. This regulatory setback has prompted a reevaluation of market expectations and added to the cautious sentiment among traders and stakeholders.

Nevertheless, Ethereum’s price surged notably today, aligning with broader movements in the cryptocurrency market. This uptick in price, amidst the backdrop of significant outflows and regulatory developments, underscores the volatile nature of digital assets and their susceptibility to market shifts, as we have analyzed in ETHNews.

Investors are closely monitoring Ethereum’s next moves, particularly its ability to sustain momentum amid regulatory challenges and investor sentiment. The recent whale activity and regulatory news highlight the intricate balance between institutional actions and market reactions within the cryptocurrency ecosystem.