- Recent bullish sentiment and high social volume suggest increasing investor confidence in Dogecoin (DOGE).

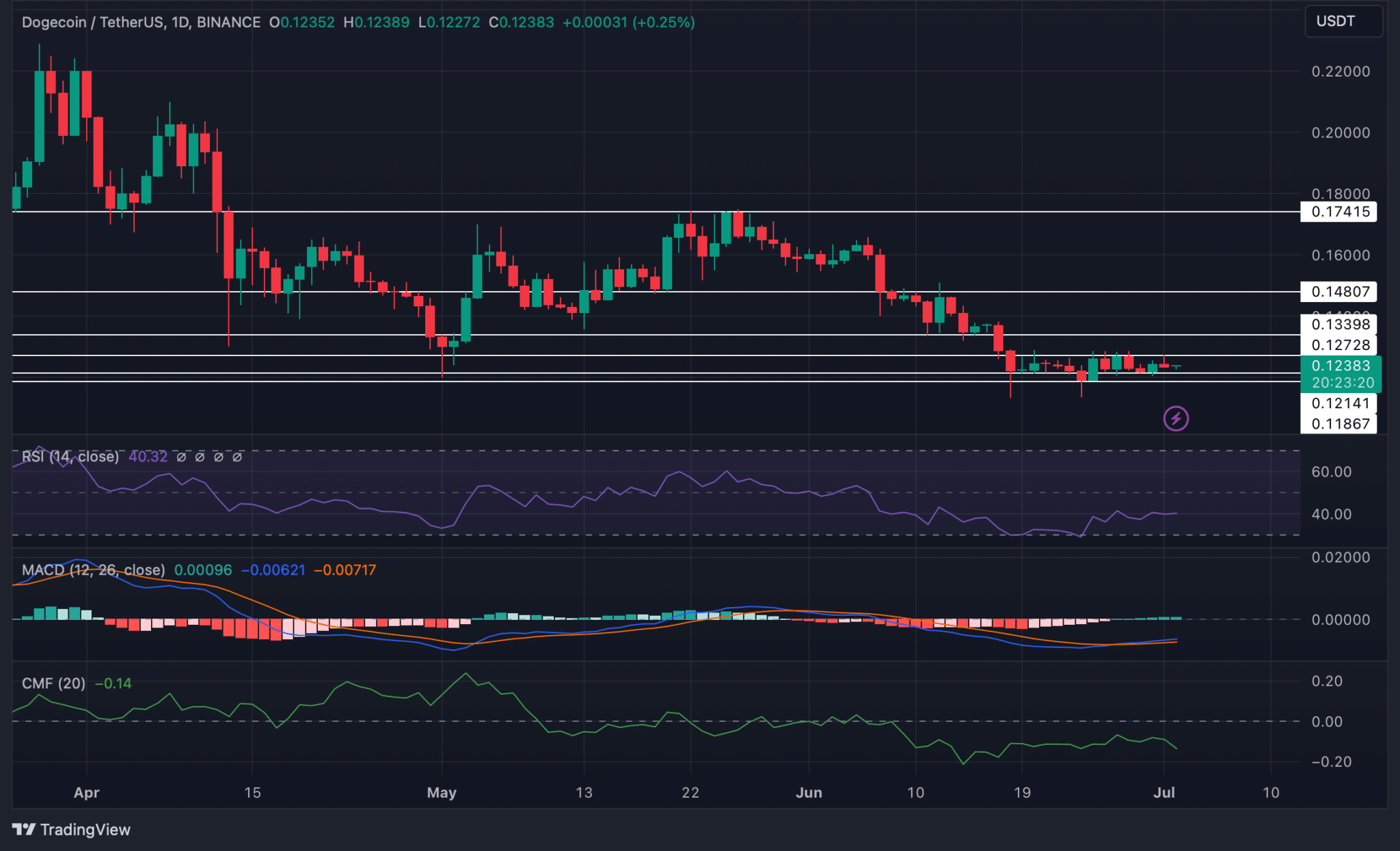

- A TD sequential buy signal indicates potential price growth for Dogecoin (DOGE) in the near term.

Dogecoin (DOGE) has shown promising signs of a potential price rally, supported by recent market indicators.

Over the past week, DOGE experienced a notable 6% surge in its price, with a 2% increase recorded in just the last 24 hours.

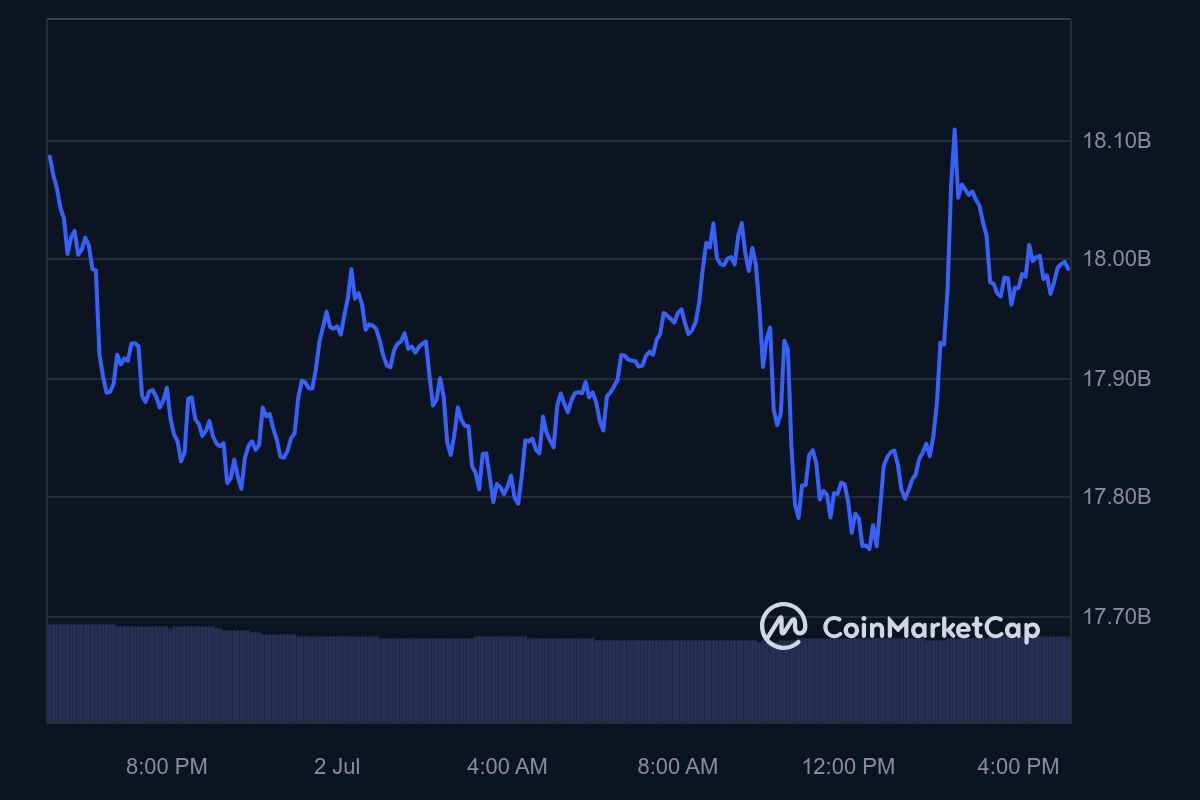

Currently trading at $0.1252, Dogecoin commands a market capitalization exceeding $18 billion, solidifying its position as the 9th largest cryptocurrency globally.

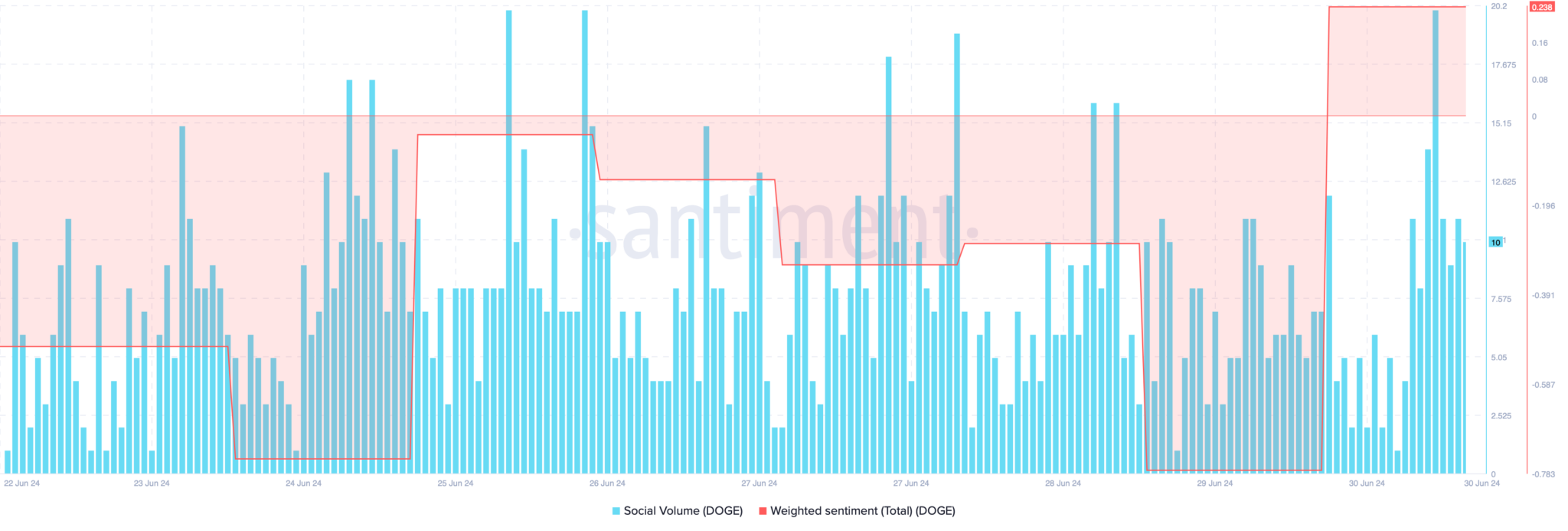

Market sentiment surrounding DOGE has turned bullish, as reflected by its increased social volume and positive weighted sentiment indicators. This uptrend suggests a prevailing optimism among investors, contributing to DOGE’s recent price gains.

A significant development adding fuel to DOGE’s bullish outlook is the buy signal triggered by Dogecoin’s TD sequential indicator. This signal, highlighted by crypto analyst Ali, implies a potential uptick in DOGE’s price in the near future.

The TD Sequential presents a buy signal on the #Dogecoin 3-day chart, predicting a rebound of one to four candlesticks for $DOGE! pic.twitter.com/elT1hc21vq

— Ali (@ali_charts) June 30, 2024

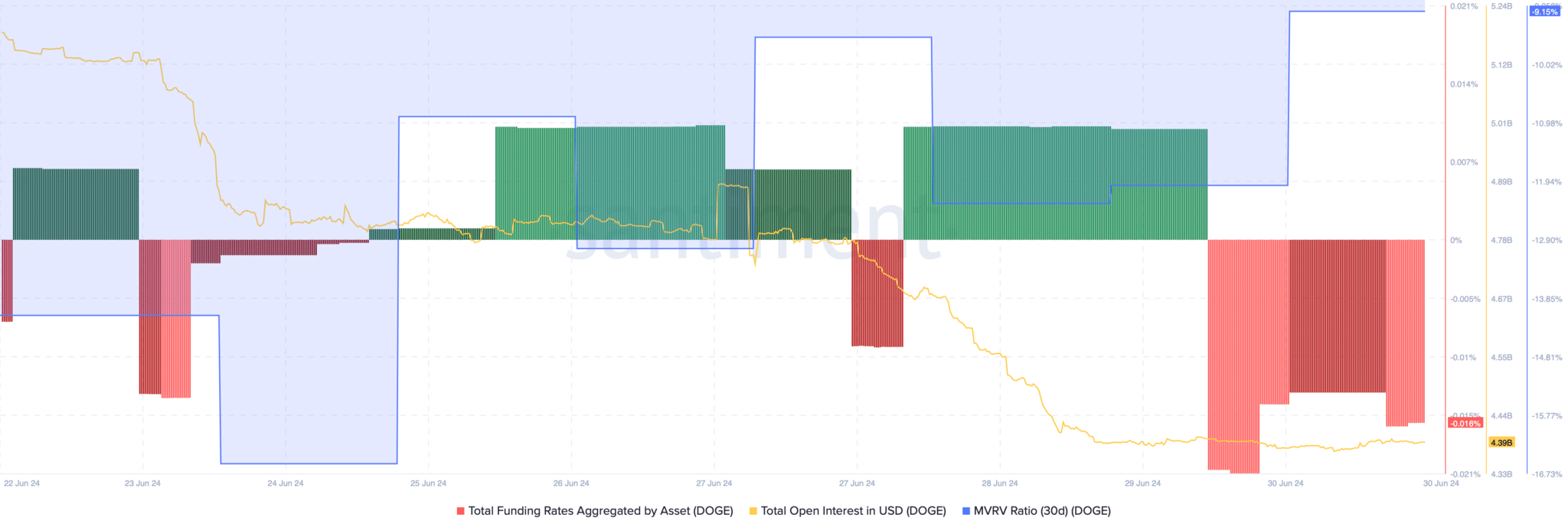

However, while indicators point towards a bullish scenario, there are factors indicating caution. DOGE’s on-chain metrics, analyzed through Santiment’s data, reveal improvements in its MVRV ratio, typically a positive sign for price movements.

Conversely, the funding rate for DOGE has turned negative, which historically suggests a potential price increase.

Yet, there are concerns regarding DOGE’s open interest, which has decreased despite its price uptick. This discrepancy raises the possibility of a price correction in the short term.

Technical analyses using TradingView also show mixed signals: while the MACD hints at a bullish crossover, the RSI indicates a slight downtrend, and the CMF reflects a declining trend in cash flow.

While Dogecoin shows promising signs of a price rally supported by bullish indicators and investor sentiment, caution is advised due to potential short-term corrections indicated by certain metrics.