- Bitcoin sentiment hits yearly low on social media, hinting at potential price recovery contrary to public fear.

- Despite bearish social sentiment, Bitcoin ETFs experience $295 million in inflows, signaling strong institutional investor confidence.

Bitcoin sentiment on social media platforms has seen a notable decline recently, suggesting broader apprehensions about the cryptocurrency’s future. However, this bearish sentiment could paradoxically signal an upcoming positive shift for Bitcoin prices.

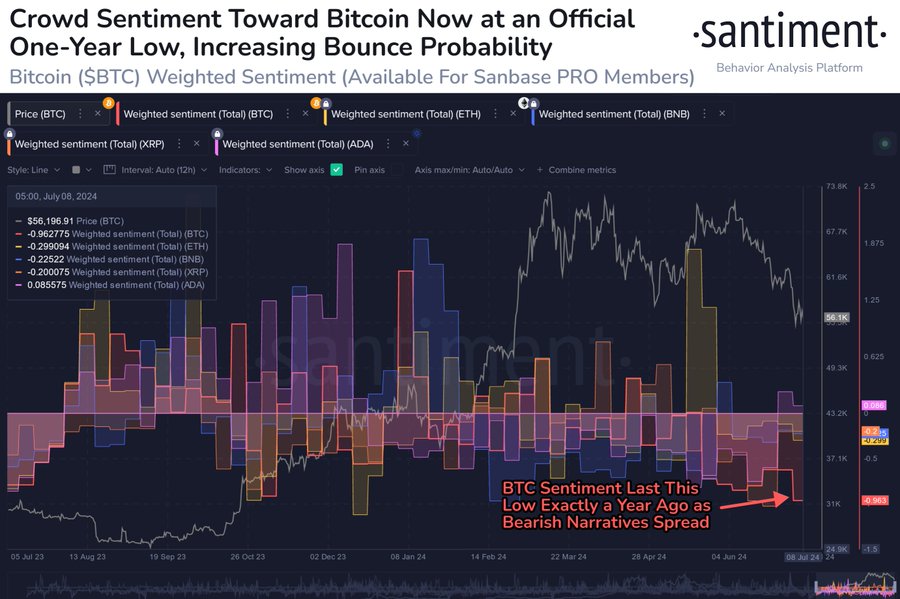

Data from Santiment reveals that sentiment related to Bitcoin has reached its lowest point in a year across platforms like X, Reddit, Telegram, 4Chan, and BitcoinTalk. The prevailing mood is one of extreme caution, characterized by widespread fear, uncertainty, and doubt.

😒 Bitcoin sentiment among traders on X, Reddit, Telegram, 4Chan, and BitcoinTalk are showing the most bearish narratives this week in a year. When the crowd shows FUD at this level, the chances of a rebound to catch the majority off guard is at its peak. pic.twitter.com/JLOhNB77n7

— Santiment (@santimentfeed) July 9, 2024

Historically, such levels of pessimism have often preceded sudden market rebounds, catching many by surprise. This pattern suggests that the current negativity might be an indicator of a forthcoming price increase.

Despite the gloomy sentiment, Bitcoin spot ETFs have seen a surge in inflows, indicating a disconnect between general sentiment and investor actions. On July 8th, Bitcoin ETFs recorded a daily net inflow of $295 million, the highest in over three weeks.

Noteworthy contributions to this influx included $25.08 million to Grayscale’s GBTC, $187 million to BlackRock’s IBIT, and $61.54 million to Fidelity’s FBTC. This robust inflow, amid a backdrop of declining prices and negative sentiment, points to continued confidence from institutional investors.

Furthermore, this influx of capital into Bitcoin ETFs suggests that despite the social media backlash, financial institutions and individual investors are optimistic about Bitcoin’s potential. This optimistic investment behavior contrasts sharply with the broader negative sentiment and indicates a strong belief in Bitcoin’s value proposition over the long term.

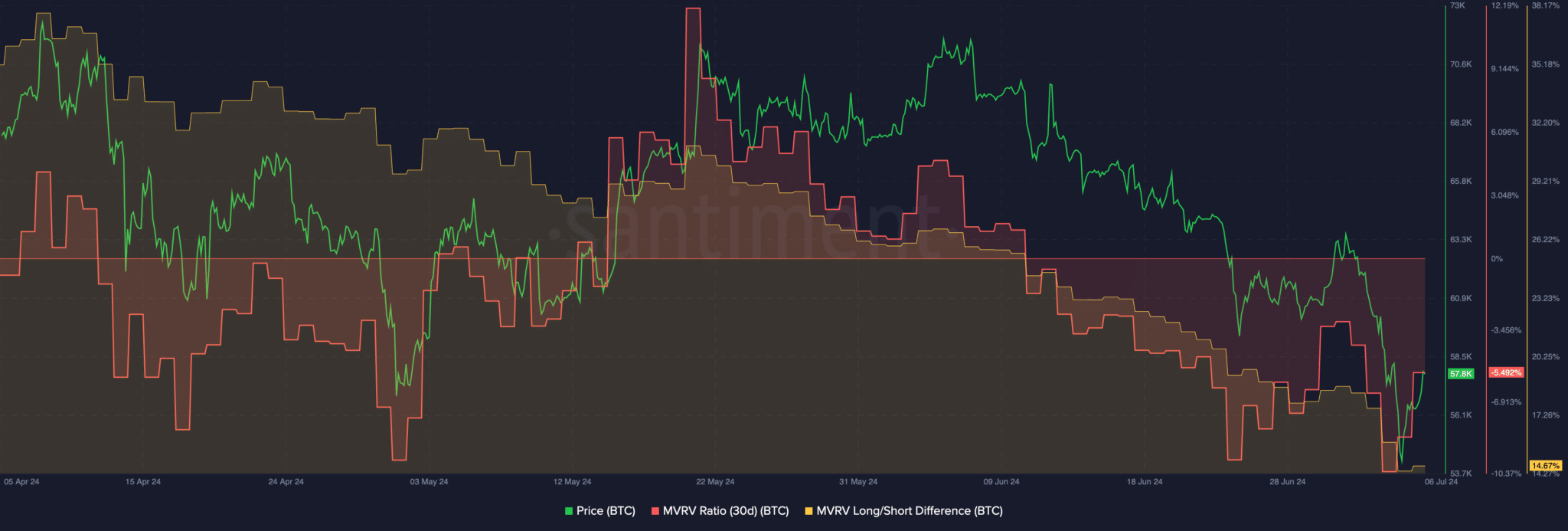

At the time of this writing, Bitcoin is trading at $57,404.26, marking a 3.87% increase over the last 24 hours. However, the MVRV ratio, a measure of the profit and loss of Bitcoin holders, has decreased.

This reduction in profitability means that many holders would not gain by selling their Bitcoin at the current price, potentially decreasing selling pressure on the cryptocurrency.