- Two major transactions by whales on Binance and Coinbase involve over $60 million of Ethereum offloaded.

- Crypto analyst Peter Brandt highlights patterns suggesting possible Ethereum price drop to $1,651 in the near term.

Today, Ethereum experienced a modest price increase, yet concerns loom due to substantial sales by influential whales, who have recently sold about $60 million worth of Ethereum across platforms like Binance and Coinbase.

This large-scale offloading has raised questions about the potential impact on Ethereum’s market stability and price trajectory.

🚨 🚨 10,000 #ETH (26,107,205 USD) transferred from unknown wallet to #Binancehttps://t.co/b6QT8WVULE

— Whale Alert (@whale_alert) August 17, 2024

Specifically, transactions included one whale transferring 10,000 ETH, valued at $26.1 million, to Binance, and another moving 12,675 ETH, worth approximately $33.10 million, to Coinbase.

According to Arkham, the Gnosis Safe Proxy address marked as the Metalpha transferred 10,000 ETH to Binance about two hours ago, worth about 26.02 million US dollars. Yesterday, the asset management company Metalpha applied to Lido to redeem 10,000 ETH. Metalpha is an affiliated…

— Wu Blockchain (@WuBlockchain) August 17, 2024

These moves have led to heightened speculation about the possibility of a downturn in the Ethereum market.

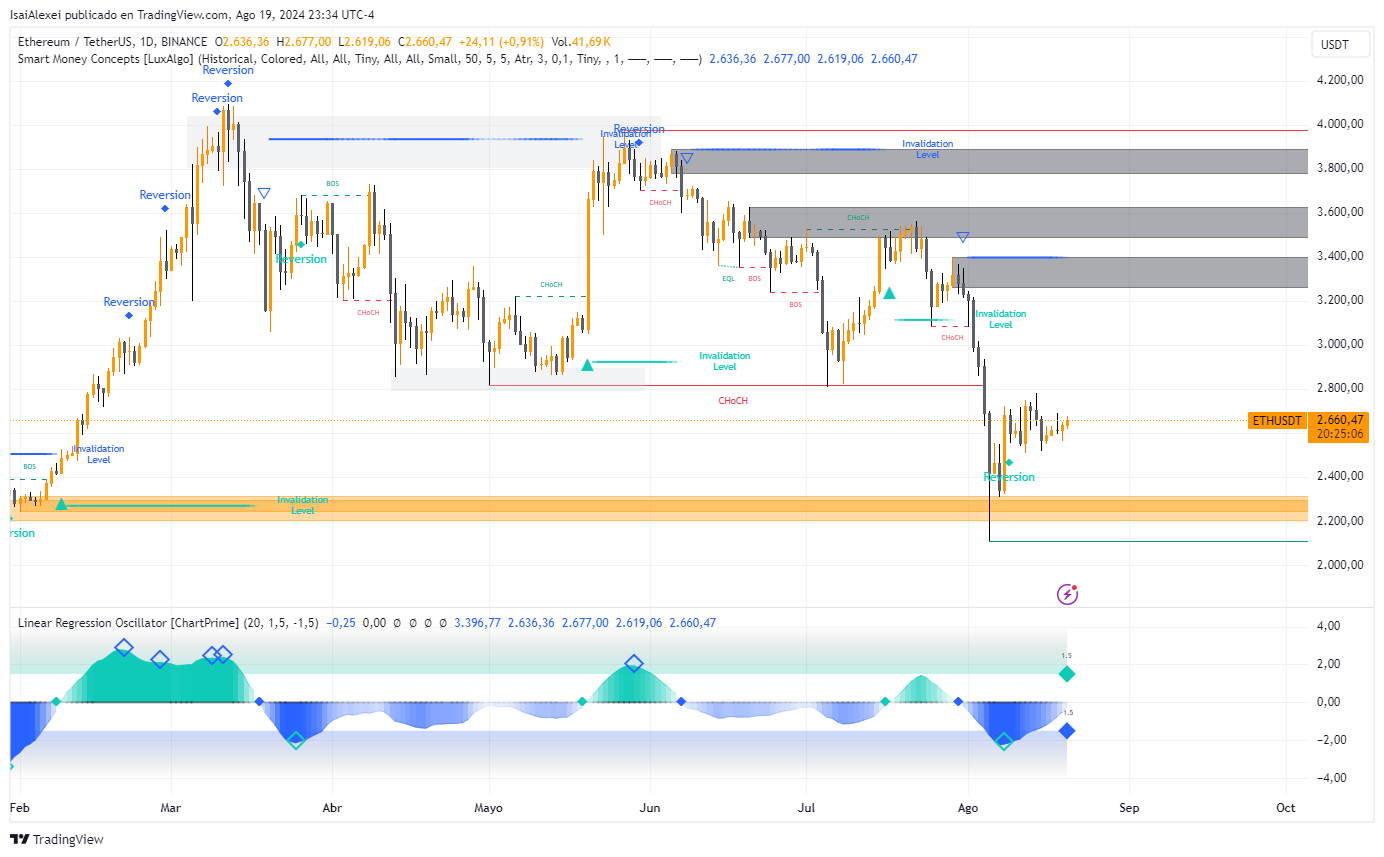

Amidst these developments, Ethereum’s immediate financial outlook is being scrutinized. Crypto analyst Peter Brandt pointed out specific technical patterns on the Ethereum chart, including a completed rectangle pattern and an ascending wedge, which traditionally suggest a possible decline.

Ether $ETH

I am posting this not as a slam on ETH, even though I'm not a fan, but to describe how I trade – so ETHernuts, dont take offense. I am as quick to go long on a good pattern as short on a good pattern

1. 5-mo rectangle (my fav pattern) completed Aug 4

2. Retest of BO… pic.twitter.com/h89EAzP7cb— Peter Brandt (@PeterLBrandt) August 14, 2024

Brandt speculates that these patterns might predict a drop in Ethereum’s price to $1,651, though he admits these indicators are historically unreliable more than half of the time.

Furthermore, Ethereum’s trading volume has notably decreased by 41% in the past 24 hours, settling at $9.28 billion. This reduction in trading activity, alongside the significant sales by whales, is stirring ongoing debates concerning Ethereum’s future market direction.

Moreover, there’s a surge of optimism about the future of Ethereum’s financial instruments, notably the potential introduction of an Ethereum ETF. Industry experts, like Vance Spencer of Framework Ventures, believe that an Ethereum ETF could significantly attract investments, potentially mirroring or even exceeding the influx seen with Bitcoin ETFs.

Ethereum Financial Analysis

[mcrypto id=”12523″]Ethereum is currently trading at $2,658.7 USD, marking a 0.78% uptick in the latest trading session. With a market capitalization of $319.70 billion and a daily trading volume of $12.15 billion, ETH demonstrates robust liquidity and sustained investor interest.

Technical Analysis

- Recent Trend: Over the past month, ETH has experienced a bearish trend, dropping 24.51%, and is down 10.45% over the last six months. However, it has posted a 16.46% gain year-to-date and a significant 57.70% increase over the past year, indicating strong long-term momentum despite recent volatility.

- Support and Resistance Levels: Technically, if Ethereum breaks below the key support level of $2,595, it could retrace further to the $2,490 region. Conversely, a break above the $2,685 resistance could trigger a bullish run toward the $2,800 mark.

- Technical Indicators: The current consolidation phase suggests market indecision, often a precursor to a significant price movement. Analysts are divided, with some forecasting a bearish reversal while others anticipate a potential breakout to the upside, contingent on how ETH navigates its critical support and resistance levels.

Investors and analysts are watching closely, aware that Ethereum’s path could be influenced by numerous factors, including regulatory developments and broader market trends.

Investors and analysts are watching closely, aware that Ethereum’s path could be influenced by numerous factors, including regulatory developments and broader market trends.