- Market analyst Michael van de Poppe predicts Ethereum could climb above $3,000 in September, exceeding 80% likelihood.

- Historical data shows Ethereum typically recovers to higher levels within three weeks after finding support at $2,500.

Ethereum (ETH) is positioned to potentially rise above $3,000 in the coming month, according to market analyst Michael van de Poppe.

This prediction follows a period of declines, aligning with historical patterns that suggest a potential rebound.

Van de Poppe highlights that Ethereum has not seen a consecutive three-month decline since before the 2018 bear market. With current market indicators suggesting a bullish phase, he estimates over an 80% chance that Ethereum could reach or exceed $3,000 by September.

There's only one occasion where $ETH has been making more than three monthly candles in red.

It was the start of the bear market in 2018.

I think that the chance of $ETH being above $3,000 in September is larger than 80%. pic.twitter.com/deUgSGfqkR

— Michaël van de Poppe (@CryptoMichNL) August 17, 2024

Examining the weekly charts, Ethereum’s recent price drop found support near $2,500. Historically, Ethereum has taken about three weeks to climb to $3,500, with similar trends observed in early 2022 and early 2024.

Moreover, the Stochastic RSI, a measure of price momentum, indicates that Ethereum is currently oversold, suggesting an impending price reversal.

For Ethereum’s price to continue its recovery, it must surpass the $3,000 resistance level and maintain higher lows, which would indicate a reversal of the current downtrend. Despite a decline in demand as evidenced by a dropping weekly RSI, the U.S. market shows strong investor interest.

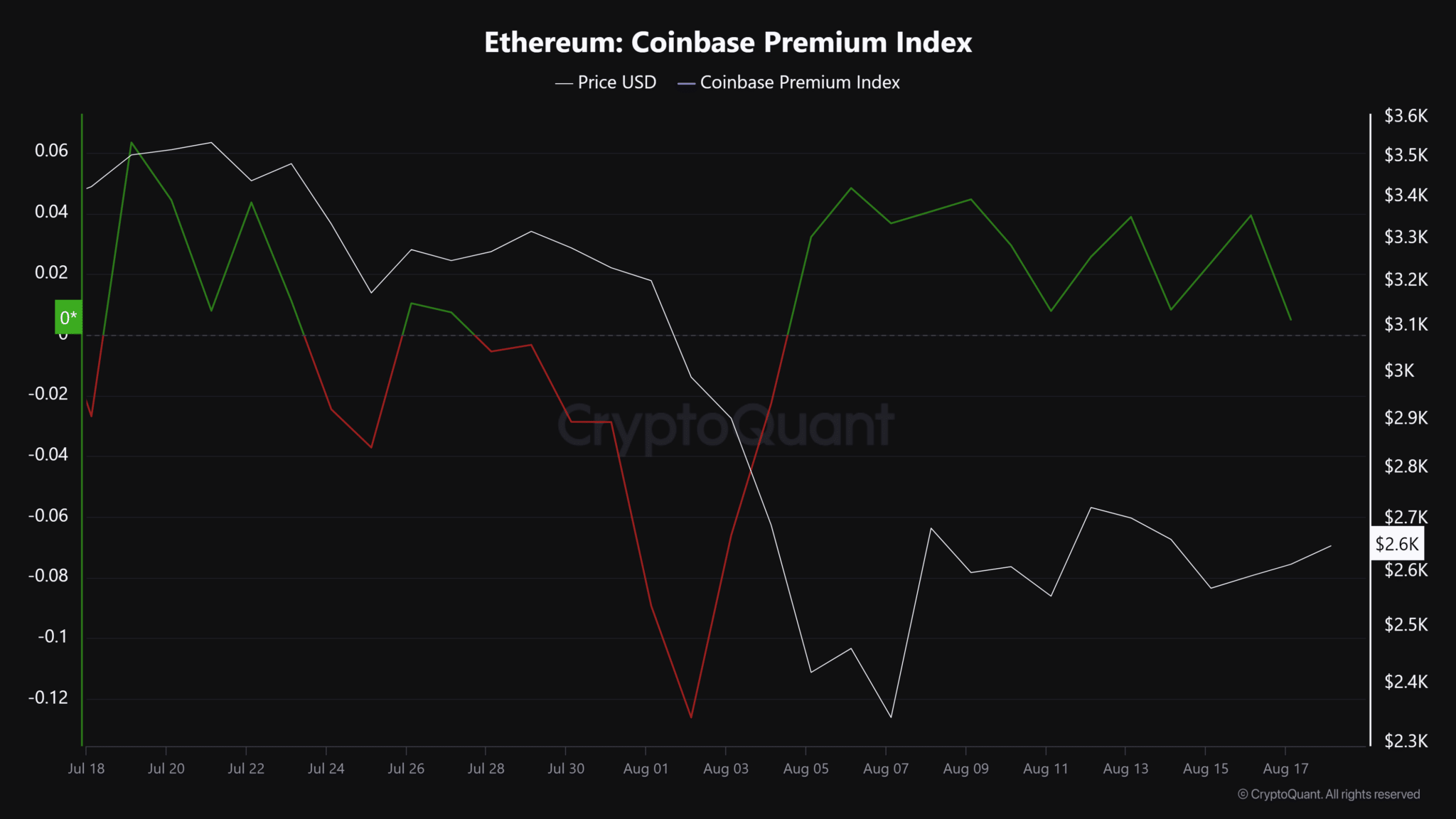

The positive Coinbase Premium Index reflects increased demand for Ethereum among U.S. investors. Additionally, the recent U.S. spot ETH ETFs have seen positive inflows, with BlackRock’s ETHA nearing the $1 billion mark. Historically, such demand from U.S. investors has been associated with periods of recovery or rallies in Ethereum’s price.

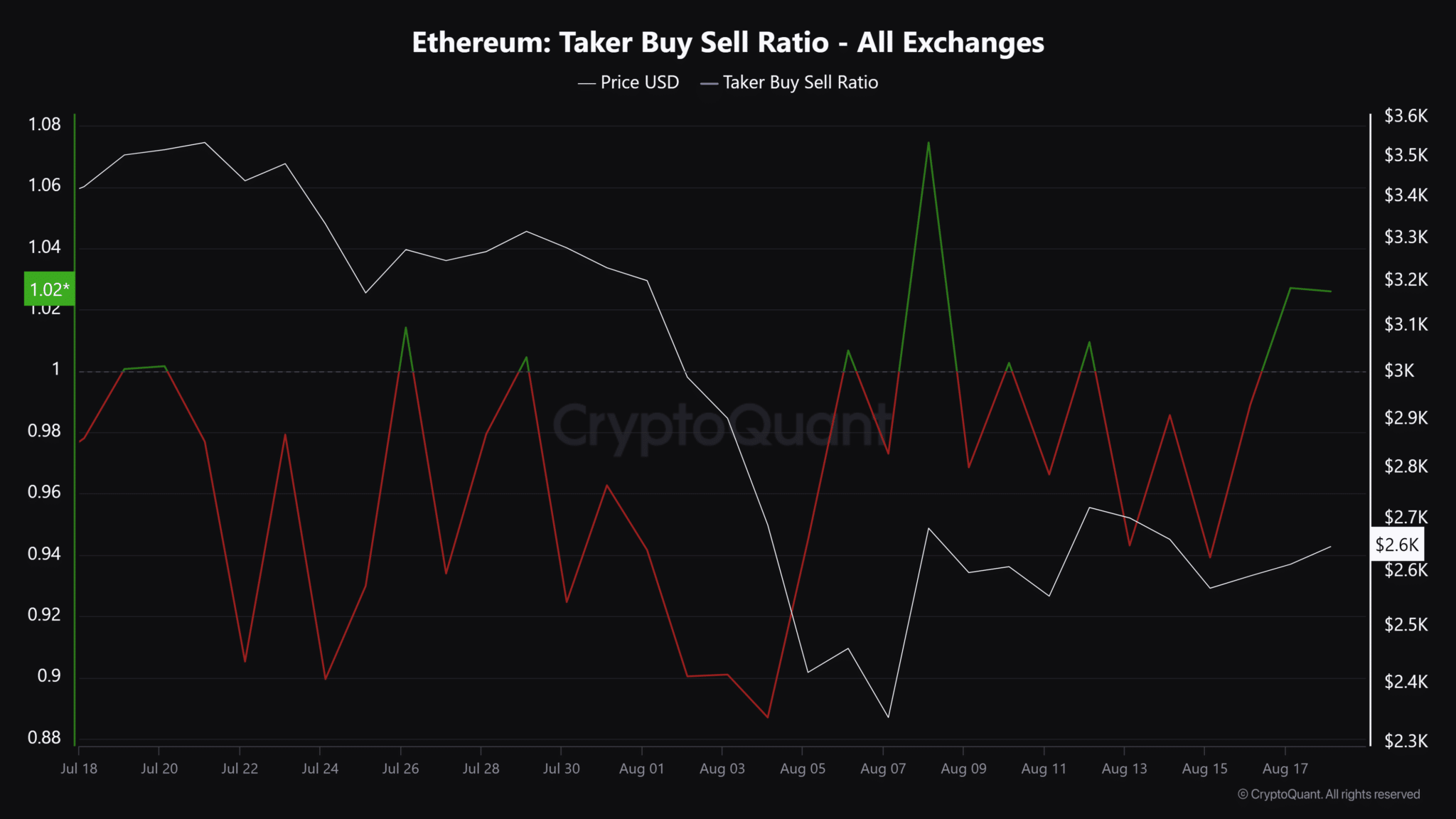

Futures market data also reflects a bullish sentiment, with the Taker Buyer Sell Ratio showing more buying than selling volume, suggesting that bullish sentiment predominates.

Despite these positive signs, Ethereum faces challenges

The record low gas fees indicate reduced network activity, which could undermine the strength of a potential recovery.

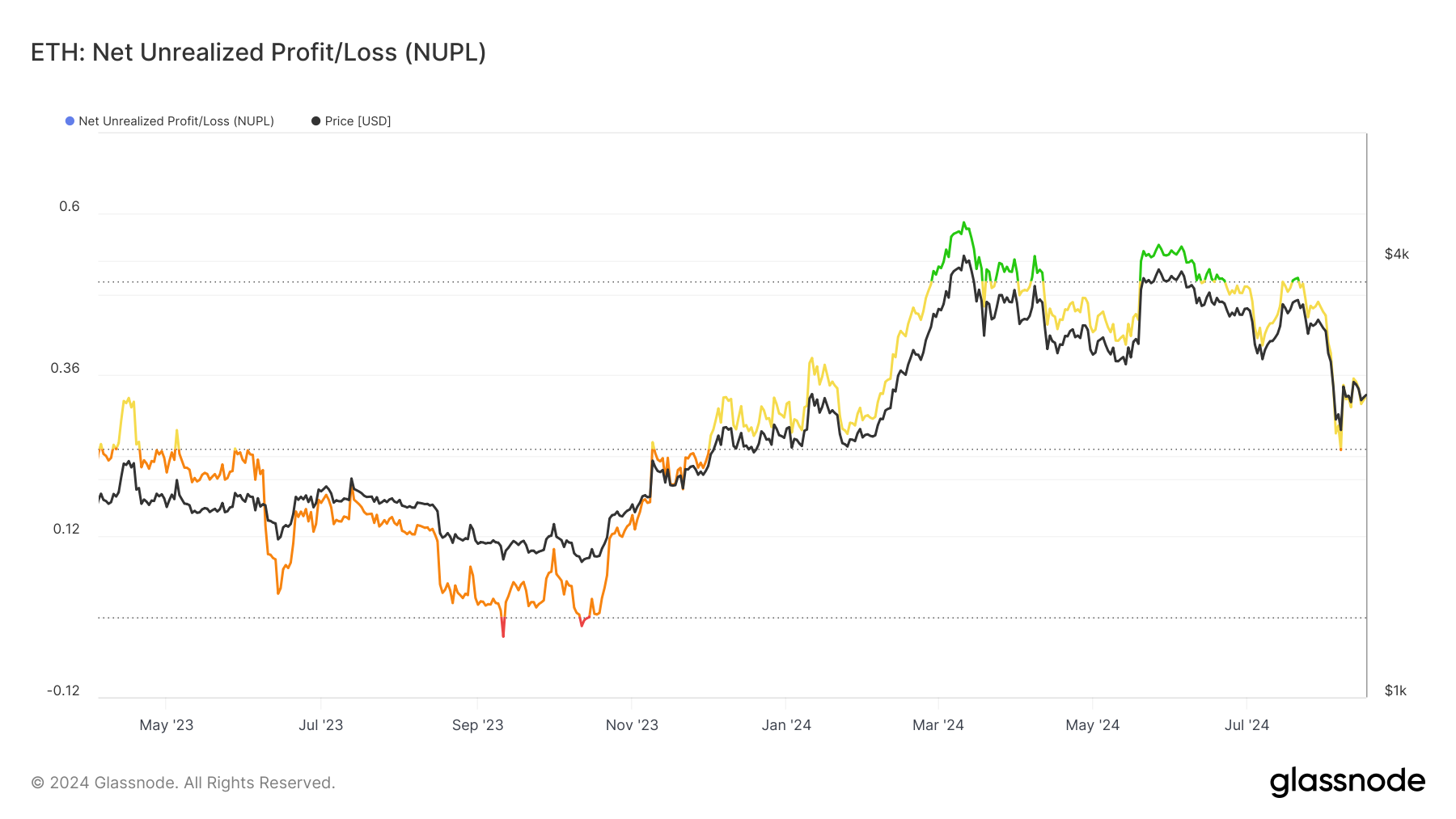

Furthermore, the Net Unrealized Profit/Loss (NUPL) indicator is nearing the fear zone, signaling increasing caution among investors and a potential price reversal.

[mcrypto id=”12523″]

As Ethereum trades around $2,651, just below the $2,681 resistance level, its ability to sustain a breakout above this threshold remains uncertain.

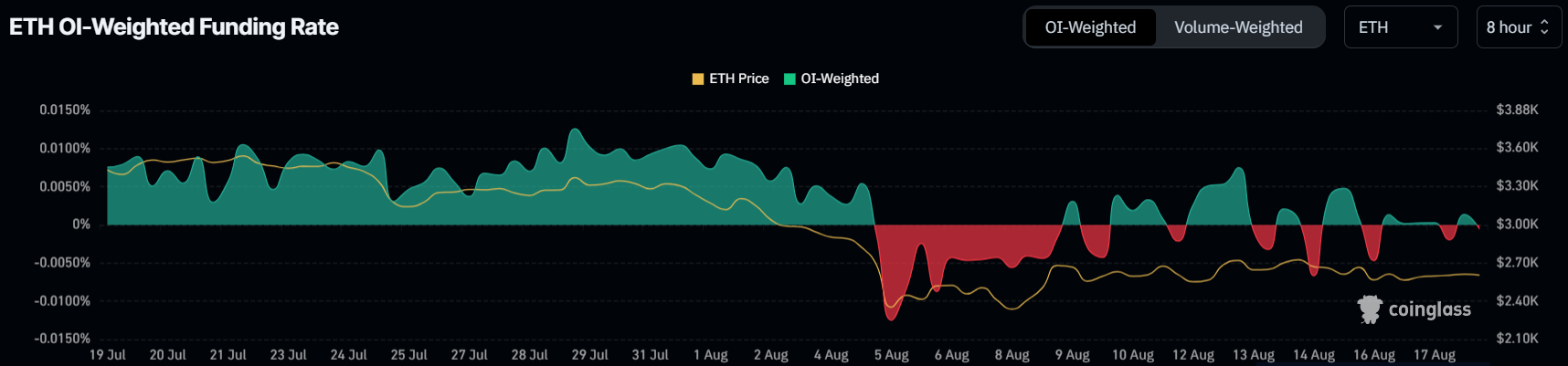

The combination of reduced funding rates and the NUPL indicator nearing the fear zone underscores the market’s unease, which could stifle a significant price recovery.

Overall, while there is a robust case for Ethereum’s potential rise to $3,000 and beyond, it must first overcome several technical and sentiment-driven hurdles.

Ethereum’s path will likely be influenced by both its on-chain activity and broader investor sentiment.