- Stochastic RSI suggests Ethereum is in the oversold zone, indicating potential for upcoming bullish trend.

- Despite market liquidations, Ethereum’s strong whale support showcases confidence in its long-term value.

Ethereum, a leading cryptocurrency, is on a trajectory toward a $3,700 resistance level, following a significant recovery in its market price. Over the past week, Ethereum has seen a 6% rise from a low of $3,381, with current trading figures pointing to an average price of $3,527. This uptick accompanies a notable 14% increase over the last 30 days.

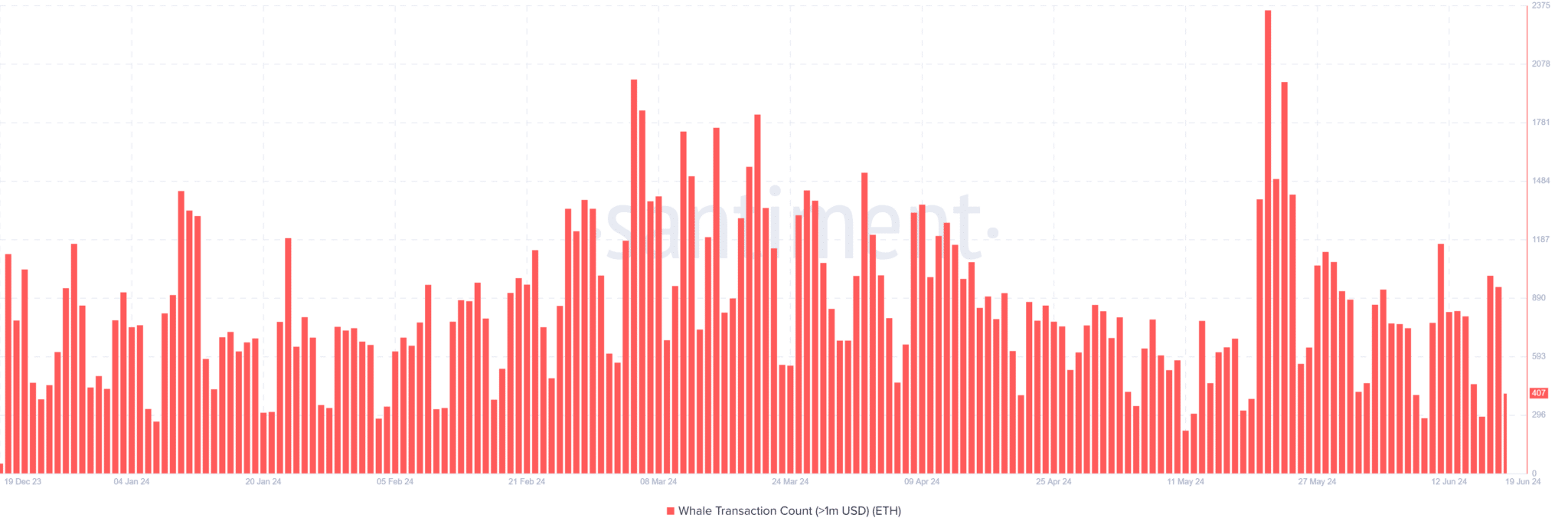

Market analysts attribute this positive movement to increased activity from large-scale investors, commonly known as whales. Data from Santiment reveals a substantial spike in whale transactions on June 18th, with over 1,400 transactions recorded. This surge aligns with Ethereum’s price increases, indicating robust accumulation by these investors during the recent price dip.

Ethereum’s market resilience is further underscored by its substantial trading volume and market cap, which currently stands at $19.5 billion and $433 billion, respectively. Additionally, the stochastic RSI—a momentum indicator—signals that Ethereum is in the oversold zone, suggesting a potential shift toward a bullish market trend.

Despite broader market liquidations, Ethereum maintains strong investor commitment, particularly from whales who have sustained significant long positions worth $43.57 million in the last 24 hours. Such sustained interest from large investors suggests a continued belief in Ethereum’s long-term value and stability.

The balance Between Long and Short Positions also Reflects Market Optimism

While there was a period of stagnation, recent spikes in long position data from Coinglass’s liquidation heatmap indicate that investors holding long positions are currently dominating the market.

Looking ahead, the robust activity of whale investors coupled with strong market hints that Ethereum’s bullish momentum might persist. If these trends continue, the anticipated resistance level of $3,700 could soon be tested.

However, as with all cryptocurrency markets, volatility remains a factor, and a bearish turn is still within the realm of possibilities.

Investors and market watchers will continue to monitor these developments closely, as Ethereum’s performance in the coming days could set the tone for its trajectory in the near term.