- Ethereum price declines by 2.7%, trading at $3,442 after a $19.3 million transfer to Kraken.

- Whale from Ethereum’s ICO moves 5,500 ETH, hinting at potential large-scale sell-off activities.

Ethereum, a major player in the cryptocurrency market, has seen a decrease in price by 2.7%, now trading at $3,442.

This downturn is attributed to the actions of an initial coin offering (ICO) participant, often referred to as a ‘whale’, who moved $19.3 million worth of Ethereum to the Kraken exchange. This transfer involved approximately 5,500 ETH and appears to signal a potential sell-off by long-standing holders of the currency.

Just before the $ETH further plummeted 3hrs ago, an #Ethereum ICO participant deposited 5.5K $ETH ($19.3M) to #Kraken.

Notably, the whale:

• received 150K $ETH in 2015 at an ICO price of $0.31 ($46.6K),

• deposited a total of 10K $ETH ($35.4M) to Kraken in the past 2 days,… pic.twitter.com/fzswTXi3yx

— Spot On Chain (@spotonchain) June 18, 2024

Historically, this individual acquired 150,000 ETH during the ICO phase at $0.31 per token. Their recent activity includes the transfer of 10,000 ETH, valued at about $35.4 million, to the same exchange. Despite these transactions, they still possess approximately 139,000 ETH across three wallets, with a current estimated value of $469 million.

Such substantial movements in the cryptocurrency typically indicate that the holder might be preparing to sell, which can increase the supply in the market and subsequently push prices down. The linkage between this whale’s activities and the dip in Ethereum’s price is a subject of keen interest in market analysis.

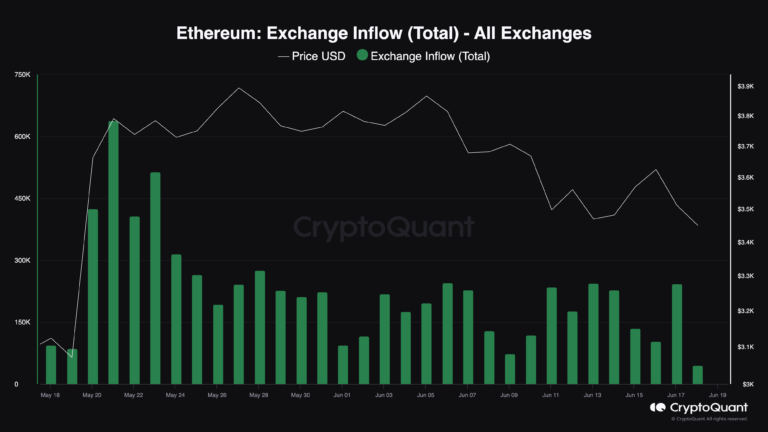

Conversely, broader market data from CryptoQuant shows a decline in the overall movement of ETH to exchanges, reducing from over 600,000 ETH in March to less than 50,000 ETH.

This suggests that the general sentiment in the Ethereum market might be shifting towards holding rather than selling, which could mitigate some downward pressures on the price.

Additionally, recent data indicates a high volume of liquidations in the Ethereum market, totaling $92.8 million in the past 24 hours. This contributes to market volatility and can intensify price decreases.

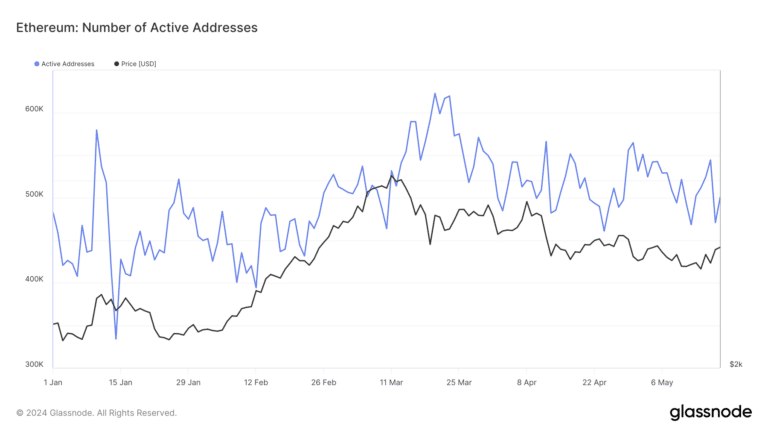

However, an increase in new Ethereum addresses, as reported by Glassnode, introduces fresh interest in the market, potentially providing support for the cryptocurrency’s value.