- Ethereum whales bought over 700,000 ETH, totaling $2.45 billion, impacting market dynamics.

- High volatility caused $215 million in liquidations, with ETH contracts accounting for $50.61 million.

With over 700,000 ETH purchased in the last three weeks, Ethereum whales have been incredibly active, spending almost $2.45 billion, according to popular on-chain analyst Ali Martinez.

#Ethereum whales have bought over 700,000 $ETH in the past three weeks, totaling approximately $2.45 billion! pic.twitter.com/sfmXnkqD49

— Ali (@ali_charts) June 15, 2024

Along with it, recent significant volatility in the cryptocurrency market led to $215 million in liquidations, of which Ether (ETH) contracts accounted for $50.61 million, according to Coinglass data.

When a trader’s margin balance is too low to maintain a position open, forcible closures take place in order to prevent more losses.

Stormy Season for Ethereum

For Ethereum, the large liquidations were associated with swings in the price of the cryptocurrency. The price of ETH fell to $3,368 on June 14th, then rose to $3,512 and, at press time, settled above $3,500.

Meanwhile, CoinMarketCap data shows that the price of ETH is now over $3,565.08, up 2.31% in the last day despite a bearish trend of 2.96% during the previous week.

These price movements impacted both long and short positions. Traders who wager on price rises are known as longs; those who wager on price falls are known as shorts.

Before the options expired on Friday, the Put/Call ratio made clear that a price decline was expected. According to the derivatives exchange Deribit, the put/call ratio for Ethereum was 0.37, which suggests low expectations because the ratio was less than 0.50.

Market Expectations and Realized Profits

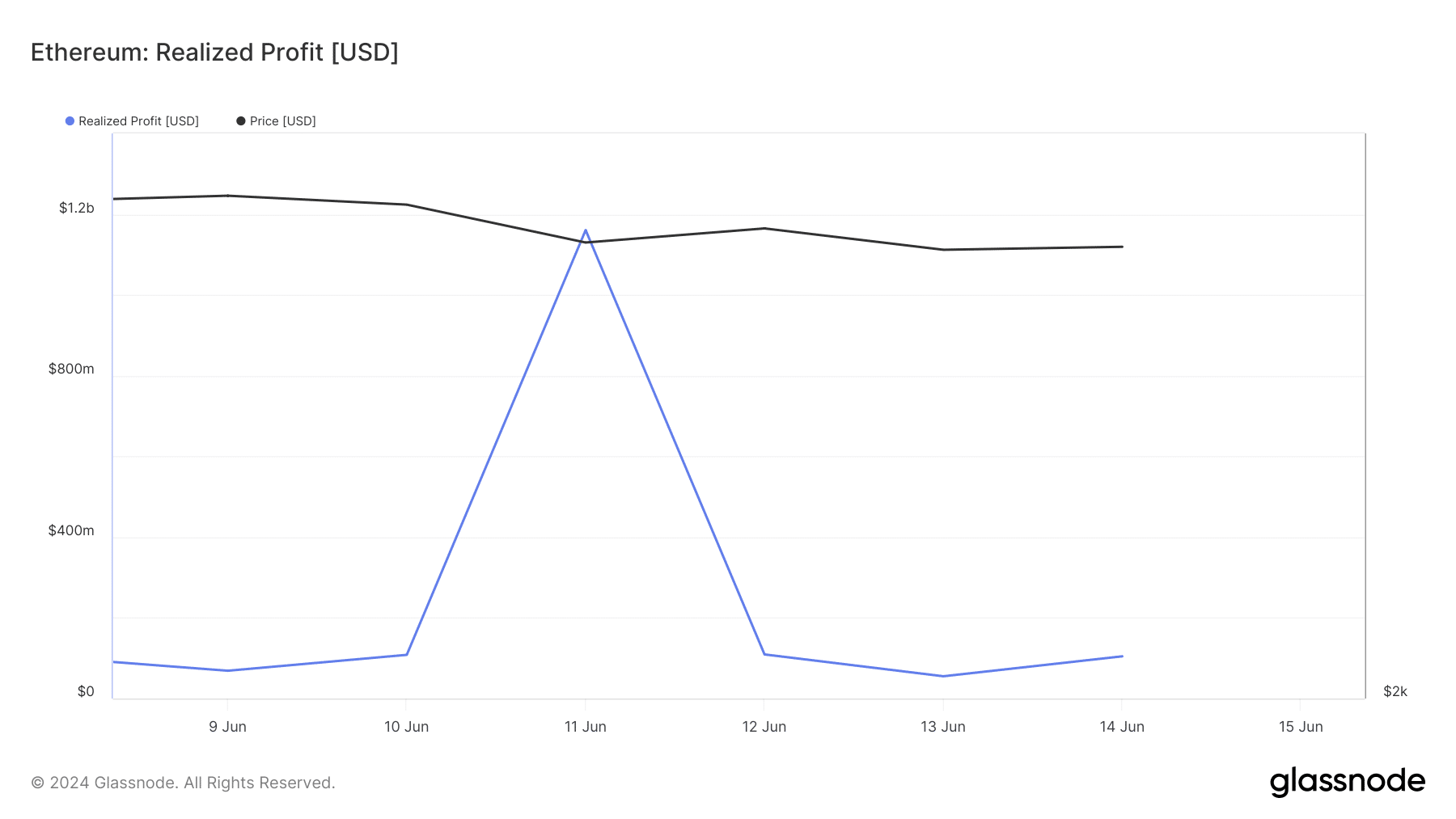

Though there was a pessimistic mood, the degree of volatility was unanticipated. Analysts looked at ETH’s realized profit, which is the sum of all coins moved whose final price was less than their current value.

The realized profit for ETH was $55.18 million on June 12 and increased to $104.58 million on June 14. If holders are booking profits, as this rise implies, the price may drop.

Selling strain might ease, though, if the Realized Profit indicator stabilises. The realized profit for Ethereum seems to have stabilized at the indicated amount, indicating that in the next few days, it may trade between $3,400 and $3,600.

ETHNews also reported on the update of Bloomberg analyst Eric Balchunas’s planned debut date for the much awaited spot Ethereum ETF to July 2.