- Analysis shows a decrease in large UNI addresses, indicating a reduction in whale activity and potential market shifts.

- UNI’s price shows bearish trends with a triple bottom pattern; recovery requires consistent testing of the $9.310 level.

Uniswap (UNI), a leading decentralized exchange, is currently experiencing notable shifts in investor behavior, as significant holders, known as whales, have started selling their holdings. This trend is stirring concerns among smaller investors about the potential impact on the token’s value.

Details of the Whale Transactions

Recent data from Lookonchain indicates a substantial transaction where a prominent Uniswap investor moved 561,782 UNI tokens, valued at approximately $4.38 million, to the exchange Binance.

This marked the investor’s first sale in over a year after a period of accumulation, suggesting a change in strategy. Despite this sale, the investor still holds around 2 million UNI tokens, valued at $15.48 million.

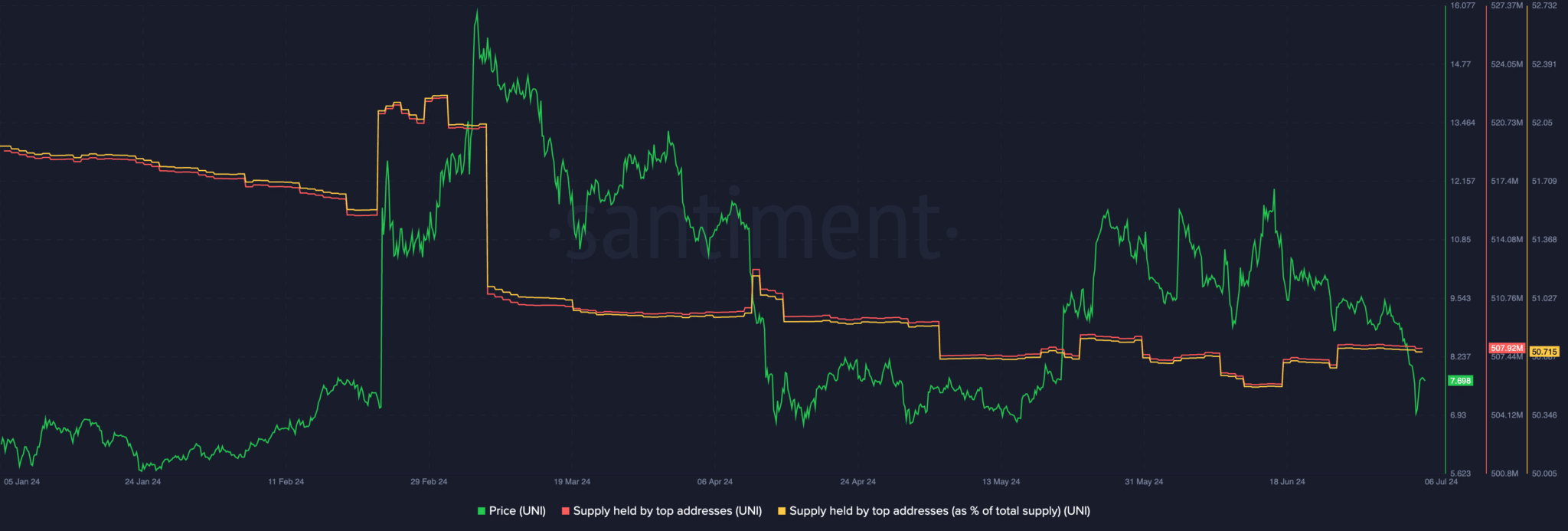

Analysis from ETHNews, using data from Santiment, shows a decrease in the number of large UNI addresses. This trend suggests a diminishing interest from whales, potentially signaling a broader market shift.

Technical Analysis and Market Trends

The UNI price chart from late May to mid-June displayed a triple bottom pattern, an indicator often associated with a bearish outlook. Following this pattern, UNI’s price continued to drop, confirming a bearish trend. For recovery, the token needs to test and possibly breach the $9.310 level consistently.

The Relative Strength Index (RSI) for UNI has fallen to 37.94, reflecting a weakened bullish momentum. Additionally, the Chaikin Money Flow (CMF) indicator shows a downturn, indicating a decrease in money flowing into UNI.

Network and On-chain Performance

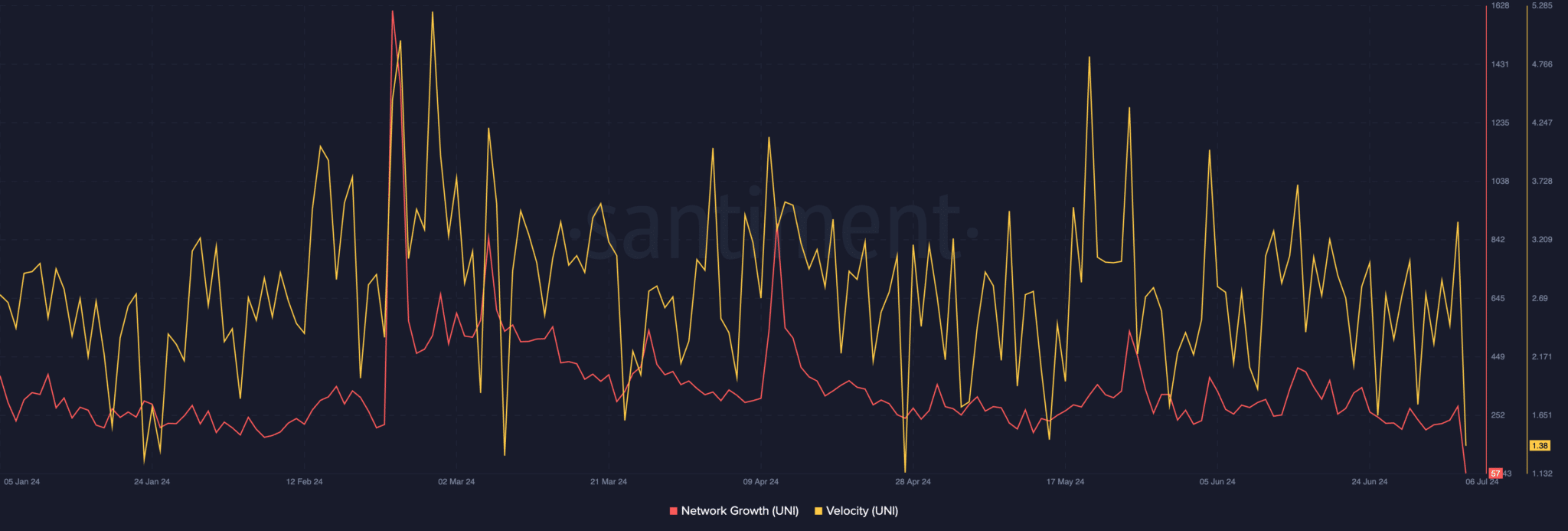

On-chain metrics highlight a decline in new network growth for UNI, suggesting decreased interest from potential new holders. The token’s velocity has also decreased, pointing to reduced trading activity.

Outlook Amid Uniswap v4 Update

Despite current challenges, the recent Uniswap v4 update could provide a turning point. The update introduces “hooks,” code snippets that activate at specific times during a pool’s lifecycle, which could enhance functionality and attract new liquidity providers.

This new feature aims to invigorate the platform by improving the mechanisms for managing liquidity and executing trades, potentially stabilizing UNI’s market.