- Over $1 billion in Bitcoin transferred to exchanges last week, potentially indicating upcoming sales by large holders.

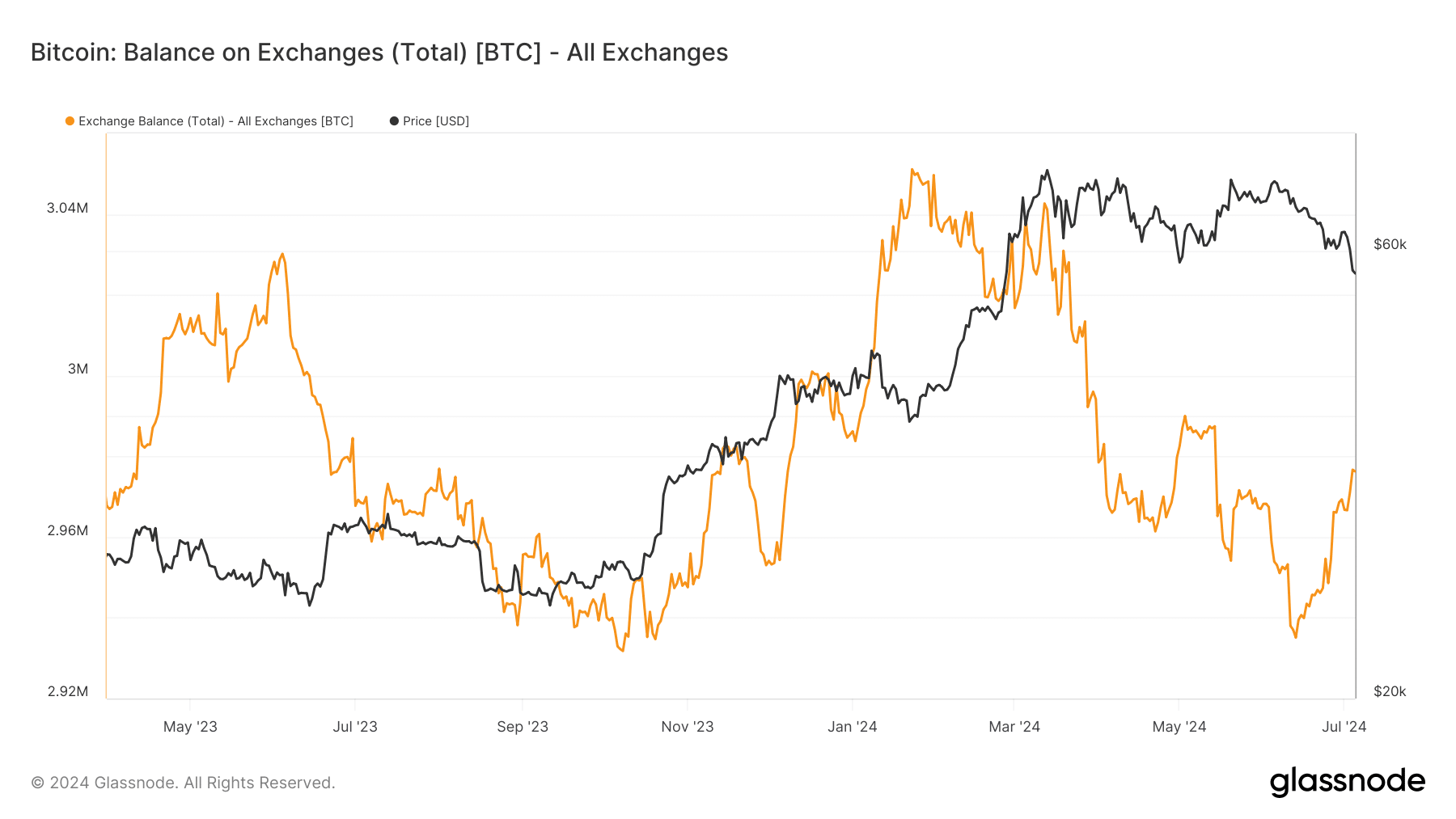

- Analysis from Glassnode shows over 21,000 BTC moved to exchanges, hinting at increased selling pressure on prices.

Over the past week, Bitcoin exchanges witnessed an influx of more than $1 billion worth of the cryptocurrency, signaling a potential shift in crypto market. This movement corresponds with a period of decline for Bitcoin, which recently saw the cryptocurrency breaking critical support levels.

Large-Scale Bitcoin Movements

Data from Glassnode reveals a sharp increase in Bitcoin being transferred to exchanges. Detailed analysis of these transactions shows that from July 1 to 5, exchanges received over 9,500 BTC, valued at roughly $540 million.

Expanding this view to the entire last week, the total reaches beyond 21,000 BTC, translating into more than $1 billion. This trend could suggest that investors, possibly including large-scale holders or “whales,” are preparing to sell, which could exert downward pressure on Bitcoin prices in the near term.

Activity from Dormant Accounts

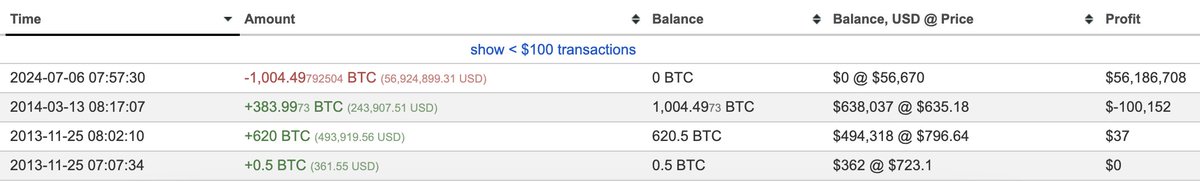

Further stirring the market are activities from long-dormant Bitcoin accounts. Lookonchain reported that a wallet inactive for over ten years transferred all its holdings—1,004.5 BTC. These coins, acquired in 2014 for an average price of $735 each, were worth approximately $738,000 at the time of purchase.

A wallet that has been dormant for 10.3 years transferred all 1,004.5 $BTC($56.9M) out 2 hours ago.

The wallet received 1,004.5 $BTC($738K at that time) at an average price of $735 on Nov 25, 2013 and Mar 13, 2014.

Address:

1B1o9yxkweyh7zbjC5EpGNPLDWHsD33NpM pic.twitter.com/HkwSb6AF30— Lookonchain (@lookonchain) July 6, 2024

Now, they are valued around $57 million, underscoring Bitcoin’s substantial appreciation over the years. Such movements from aged wallets could significantly influence cryptomarket, particularly if these coins enter the selling side of the market.

Implications of Historical Bitcoin Transactions

This week also noted other significant Bitcoin transactions influencing the market. For instance, Mt. Gox, a defunct exchange, conducted a test transaction of over 1,000 BTC as part of its preparations for creditor payouts.

Moreover, it moved more than 42,000 BTC, worth over $2 billion, from wallets inactive for a decade. Similarly, the German government transferred over 4,000 BTC to exchanges, adding to the market’s liquidity.

Market Outlook and Technical Analysis

Despite these movements, Bitcoin is struggling to find its footing. A technical analysis on the daily timeframe indicates continued challenges. The Relative Strength Index (RSI) and moving averages suggest that the market is still grappling with the recent downturns.

The influx of large amounts of Bitcoin into exchanges, combined with transactions from dormant accounts and governmental actions, creates a complex environment for Bitcoin’s potential recovery.