- Trading volume surges 121.34%, indicating heightened activity, yet market cap falls by 5.6% to $4.5 billion.

- Oversold RSI at 29.52 suggests potential for a price rebound; active Litecoin addresses increase by 45%.

Litecoin (LTC) has recently experienced a 5.64% decline over the past 24 hours, continuing a downward trend that has seen a 7.84% drop over the past week.

Currently, Litecoin is trading at $72.98, reflecting a substantial 121.34% increase in trading volume, reaching $558 million in the same period.

Despite these developments, Litecoin’s market capitalization has decreased by 5.6%, standing at $4.5 billion.

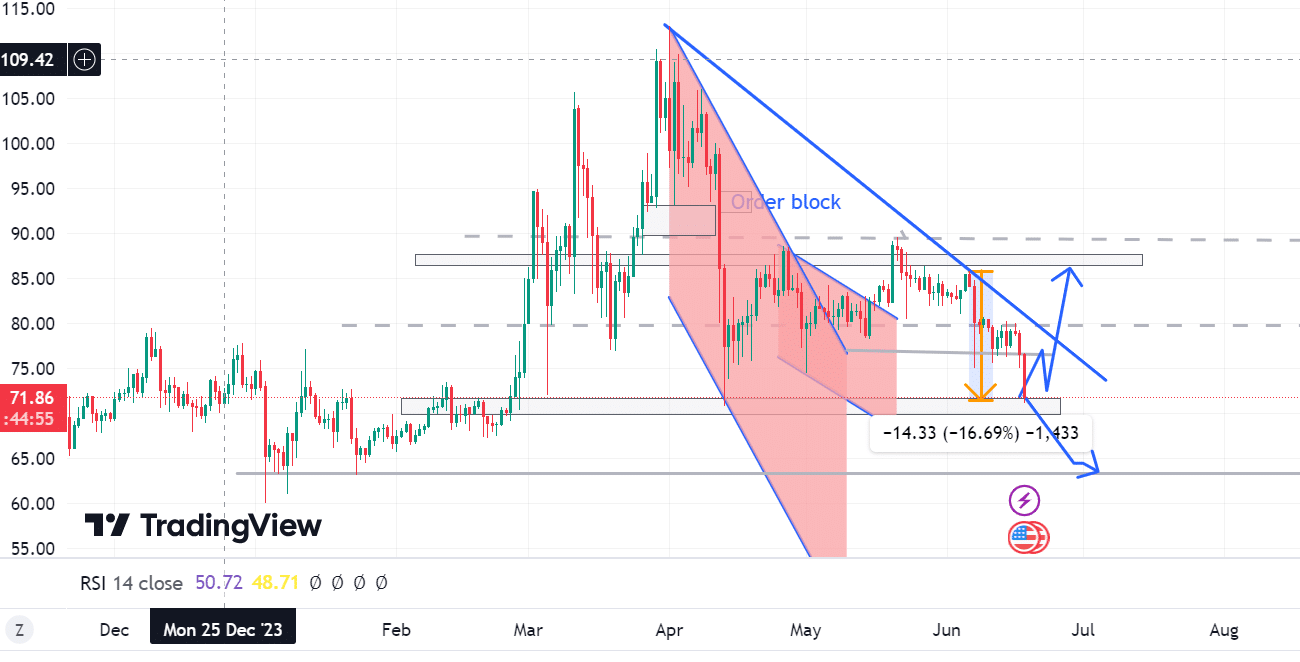

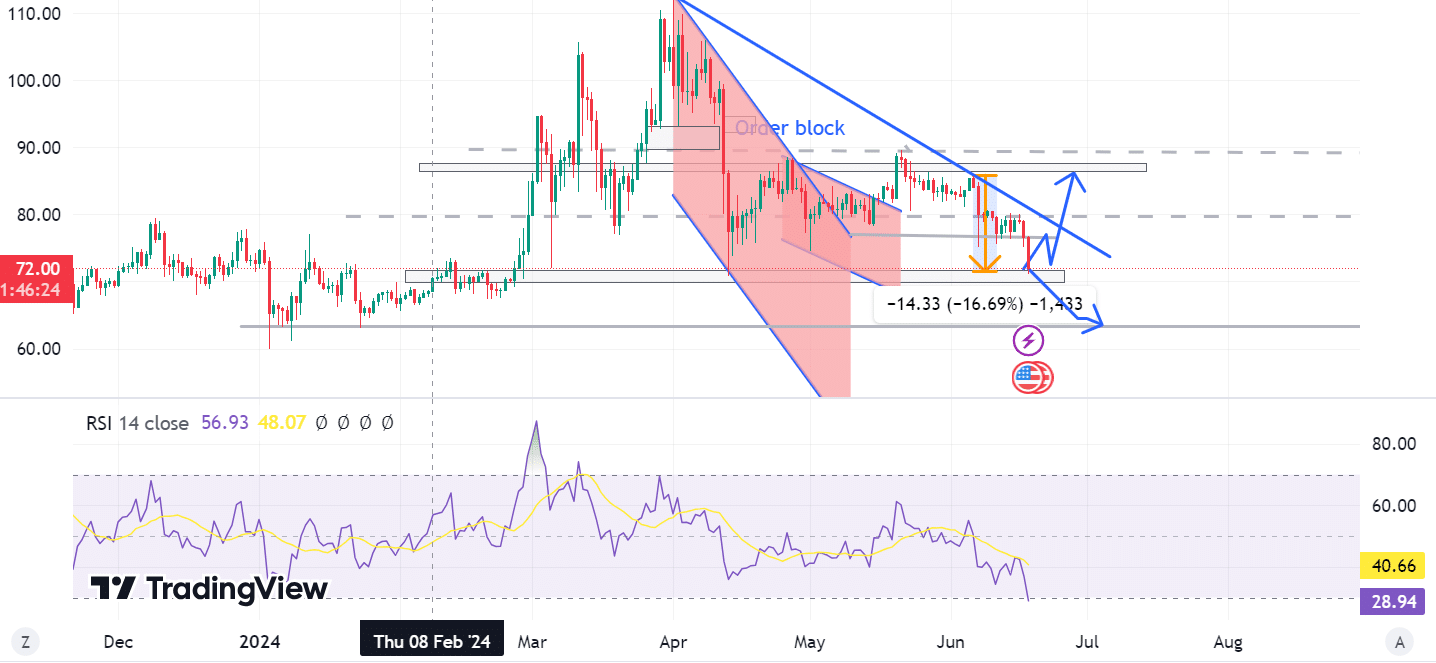

ETHNews Market analysts have observed that Litecoin is facing considerable selling pressure, with key support and resistance levels identified at $70.89 and $80.29, respectively. This ongoing pressure could potentially drive the price below the current support level. If this downward trend persists, a new support level may establish around $63.46.

However, the surge in trading volume suggests that market participants are actively engaging, possibly stabilizing the price through consolidation. The Relative Strength Index (RSI) stands at 29.52, indicating that Litecoin is currently in oversold territory.

Historically, such conditions are conducive to a price rebound as they offer attractive buying opportunities which may lead to price recovery.

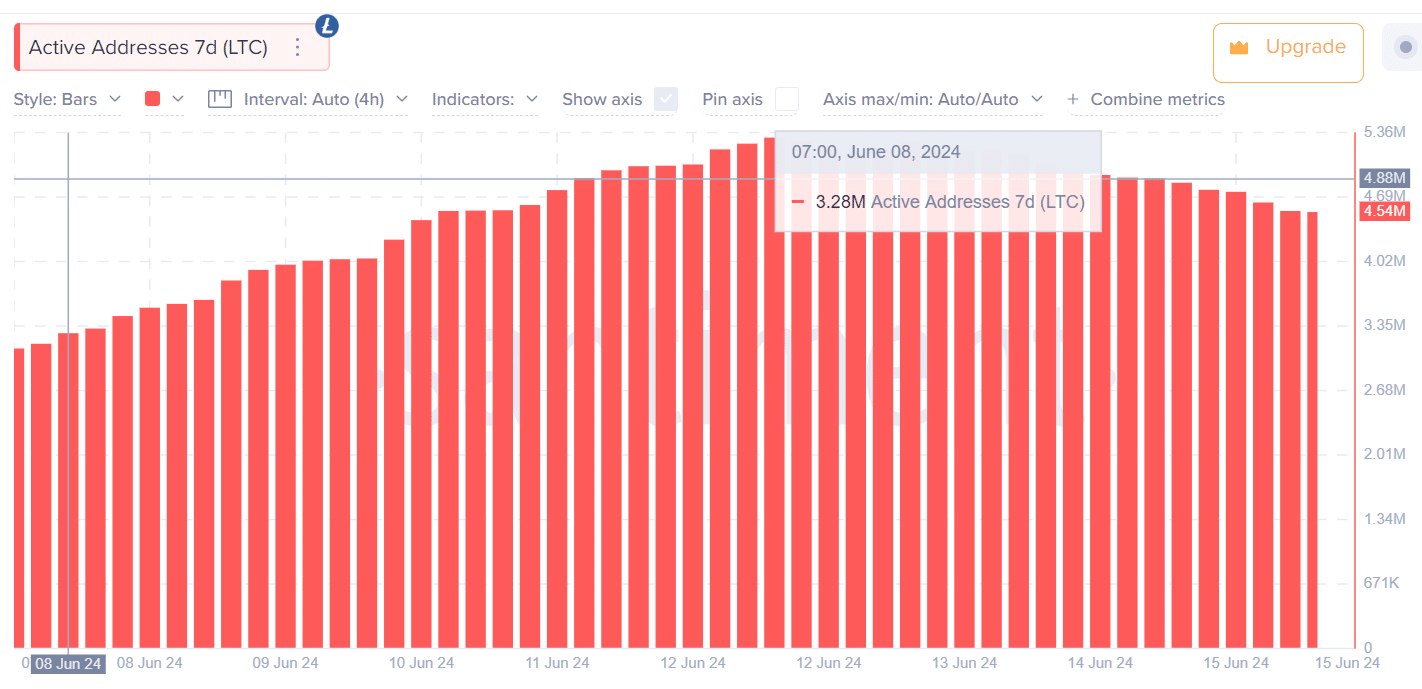

A key indicator of market sentiment towards Litecoin is the activity in its address base. According to data from Santiment, the number of active Litecoin addresses has increased by 45% from 3.13 million to 4.54 million between June 7th and June 15th. This increase in active addresses often correlates with a growing interest and confidence in the asset.

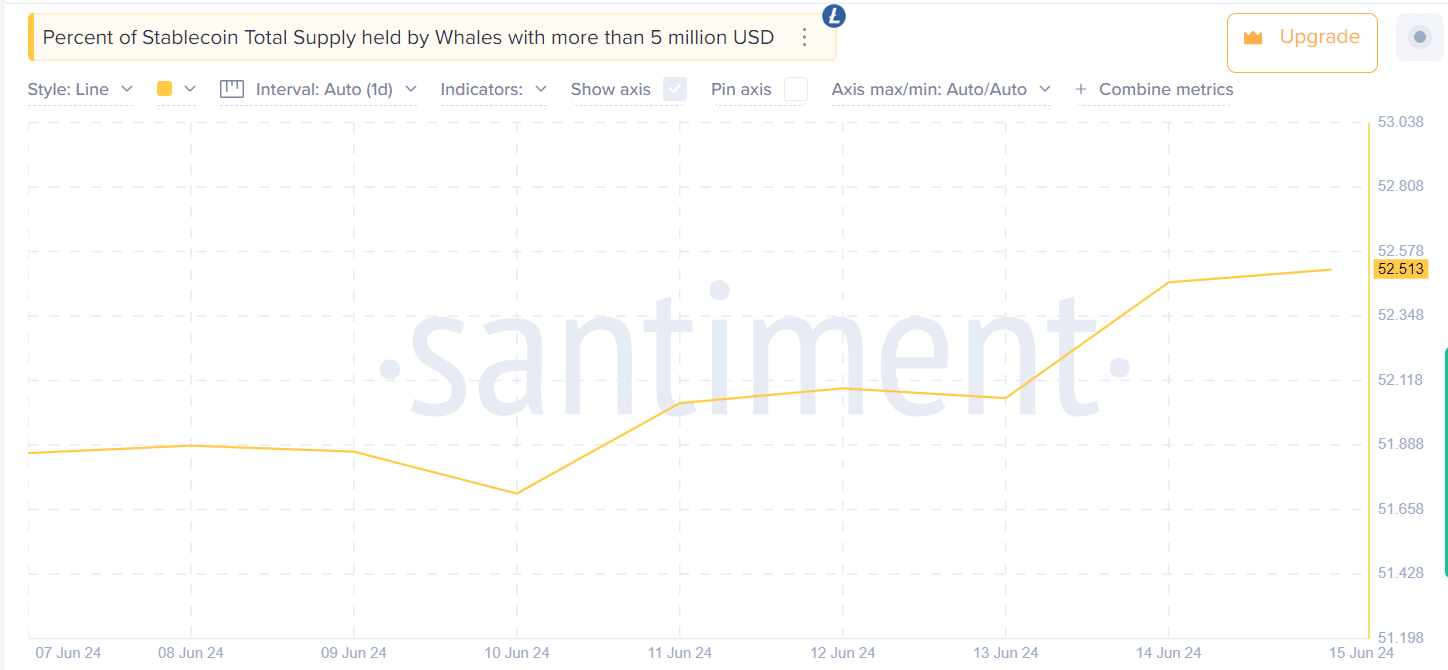

Further buoying this sentiment is the behavior of large-scale investors or ‘whales’. Data reveals that whales holding assets worth over $5 million now control 52.513% of Litecoin’s total supply, a slight increase from 52.06% noted earlier in the month. This accumulation by whales suggests a strengthening trust in Litecoin’s value, despite the broader market challenges.

Looking ahead, the trajectory of Litecoin’s price will largely depend on whether the positive indicators can outweigh the bearish trends observed recently. If the market sentiment continues to improve and is complemented by broader cryptocurrency market recovery, specifically Bitcoin, Litecoin could potentially reverse its course and aim for higher resistance levels around $85.96.

Conversely, if the current negative trend persists, Litecoin might face further declines, testing new lows around $63.58. This market scenario places Litecoin at a pivotal point, where its future movements will be closely watched by investors and market analysts alike.