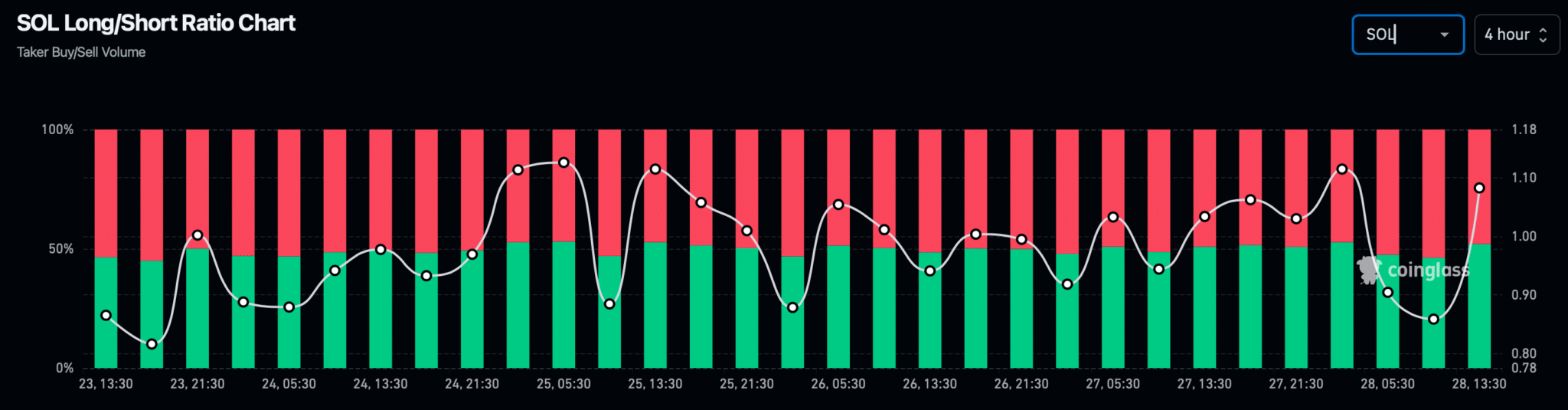

- On-chain data shows increased long/short ratio for Solana, indicating strong bullish sentiment among traders.

- Technical indicators suggest possible future price movements; a correction could see Solana’s price fall to around $141.

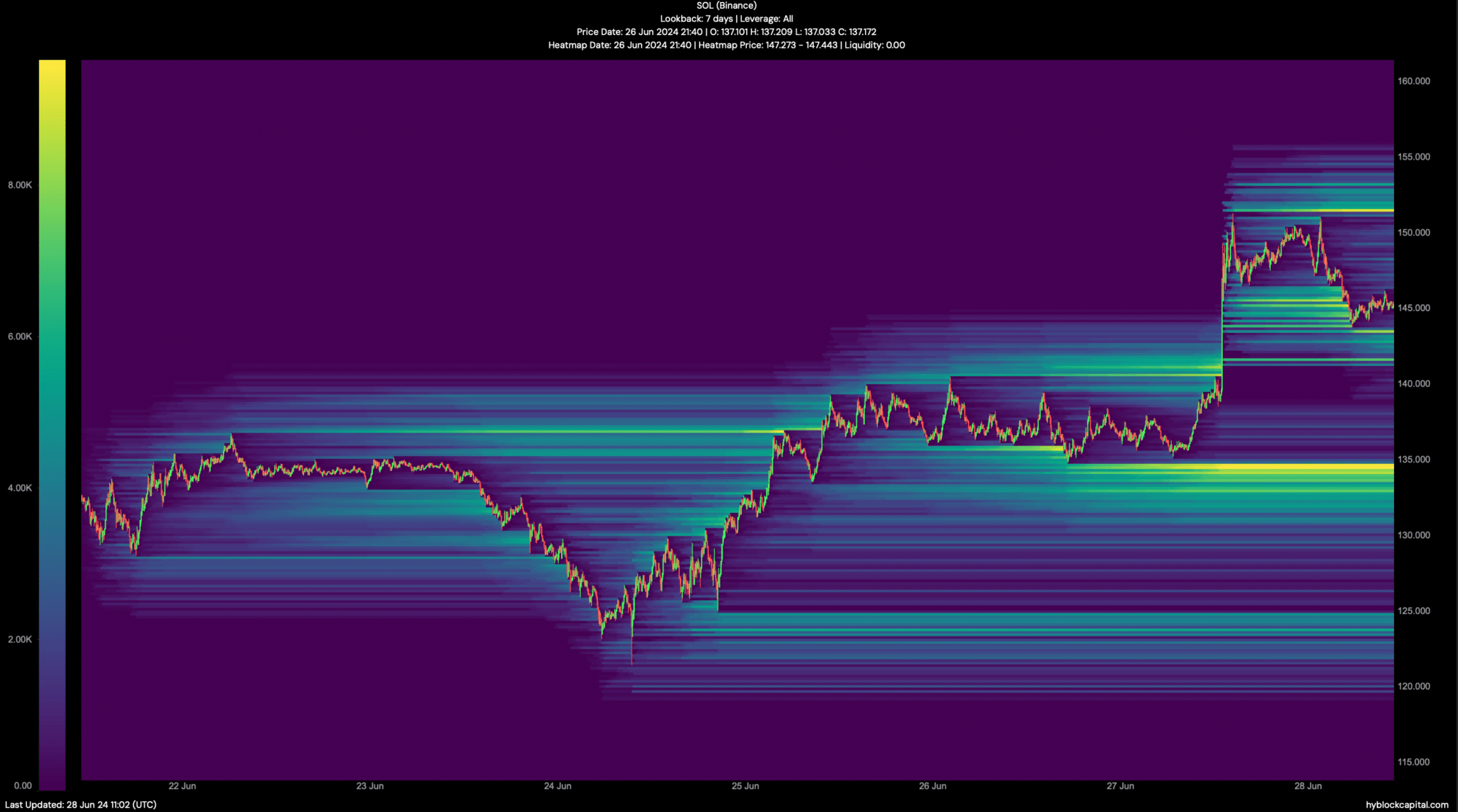

Over the past week, Solana experienced a price surge of over 9%, peaking at $145. Recently, there was a minor retraction in its price to $144.8, while its market capitalization remained above $67 billion.

This minor retraction took place against the backdrop of growing positive sentiment in the cryptocurrency market.

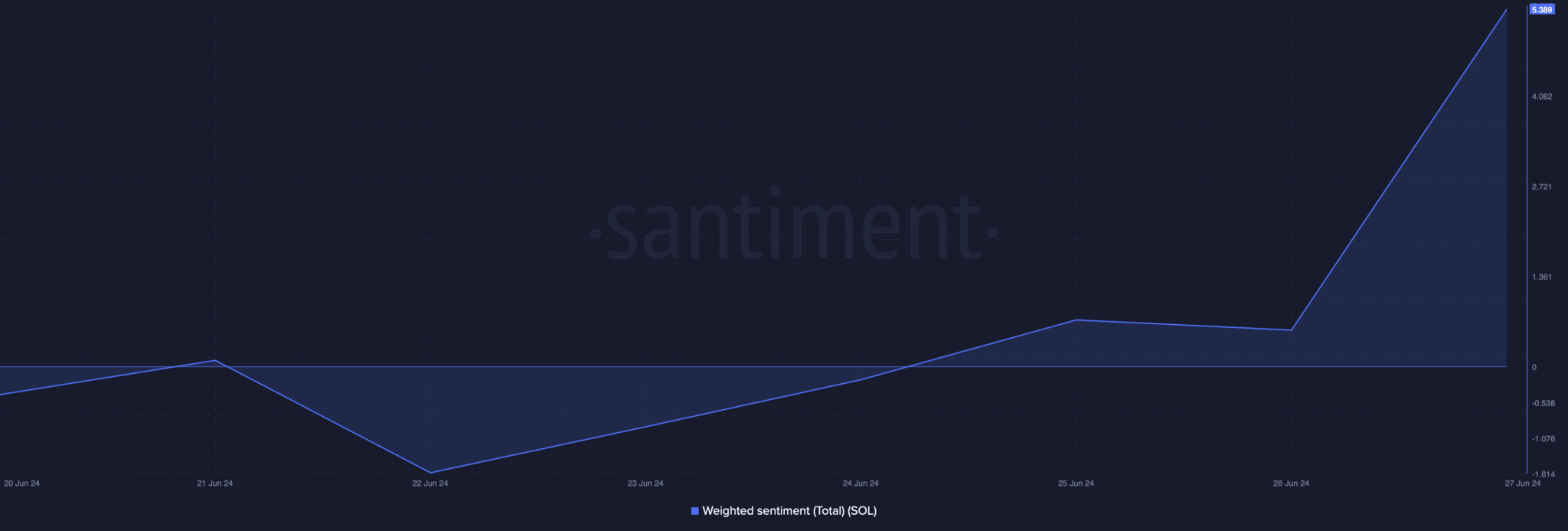

Recent data from ETHNews shows a 4% rise in Solana’s value in the last 24 hours. Despite these gains, indicators from Santiment suggest an increase in fear of missing out (FOMO) among traders, which historically has often led to a reversal of price gains.

While Solana experienced a price increase, Avalanche (AVAX) also saw a rise, although without a significant increase in FOMO, suggesting it might face less immediate volatility. According to on-chain data from Coinglass, there has been an increase in the long/short ratio for Solana, typically an indicator of strong bullish sentiment among traders.

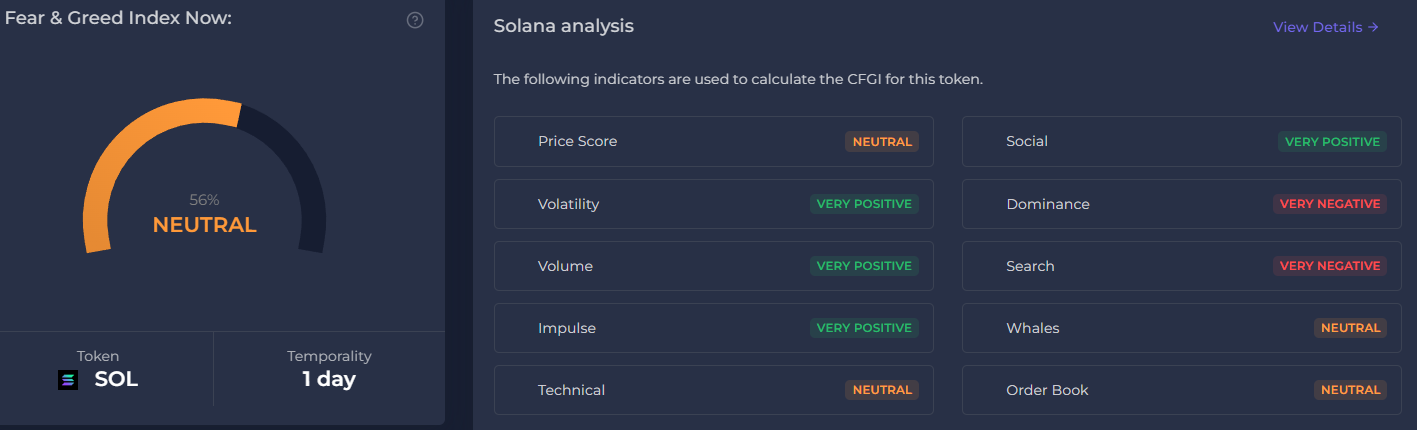

Nevertheless, the fear and greed index for Solana is at 56%, indicating that the market might be entering a phase of greed. This level often precedes a market correction.

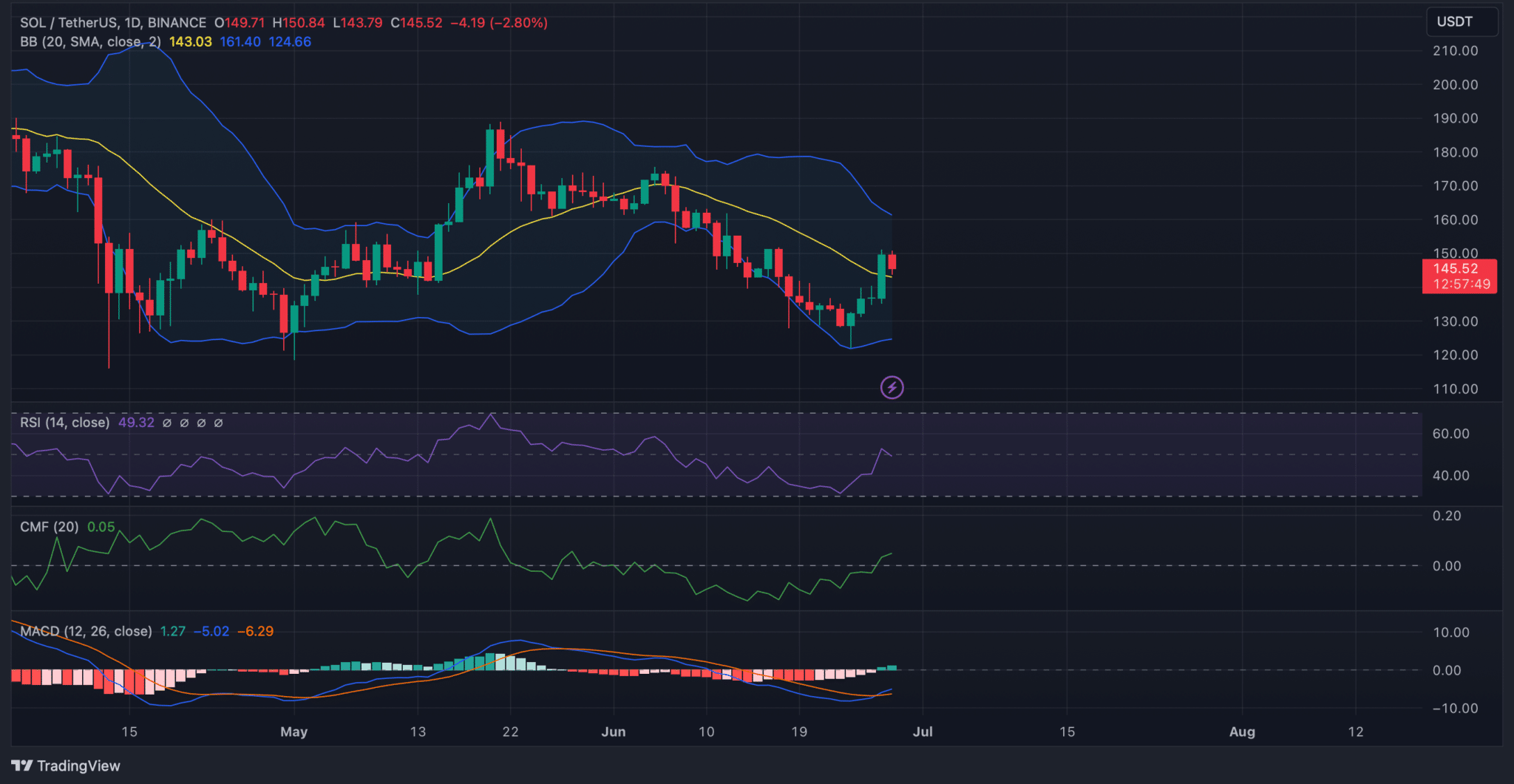

The Bollinger Bands indicate that Solana is moving into a less volatile zone, and the Relative Strength Index (RSI) shows a decrease after a significant climb, which could suggest a forthcoming decline in Solana’s price.

Further, while the Chaikin Money Flow (CMF) indicates an inflow of capital, suggesting sustained interest, the Moving Average Convergence Divergence (MACD) confirms a bullish crossover, hinting at possible ongoing price increases.

Despite these complex signals, ETHNews analysis from Hyblock Capital’s data suggests that if the bullish trend continues, Solana could surpass $150 soon. Conversely, a market correction could lead to a drop to around $141.

Given these data, investors should monitor these developments closely, as they could affect Solana’s pricing in the near future.