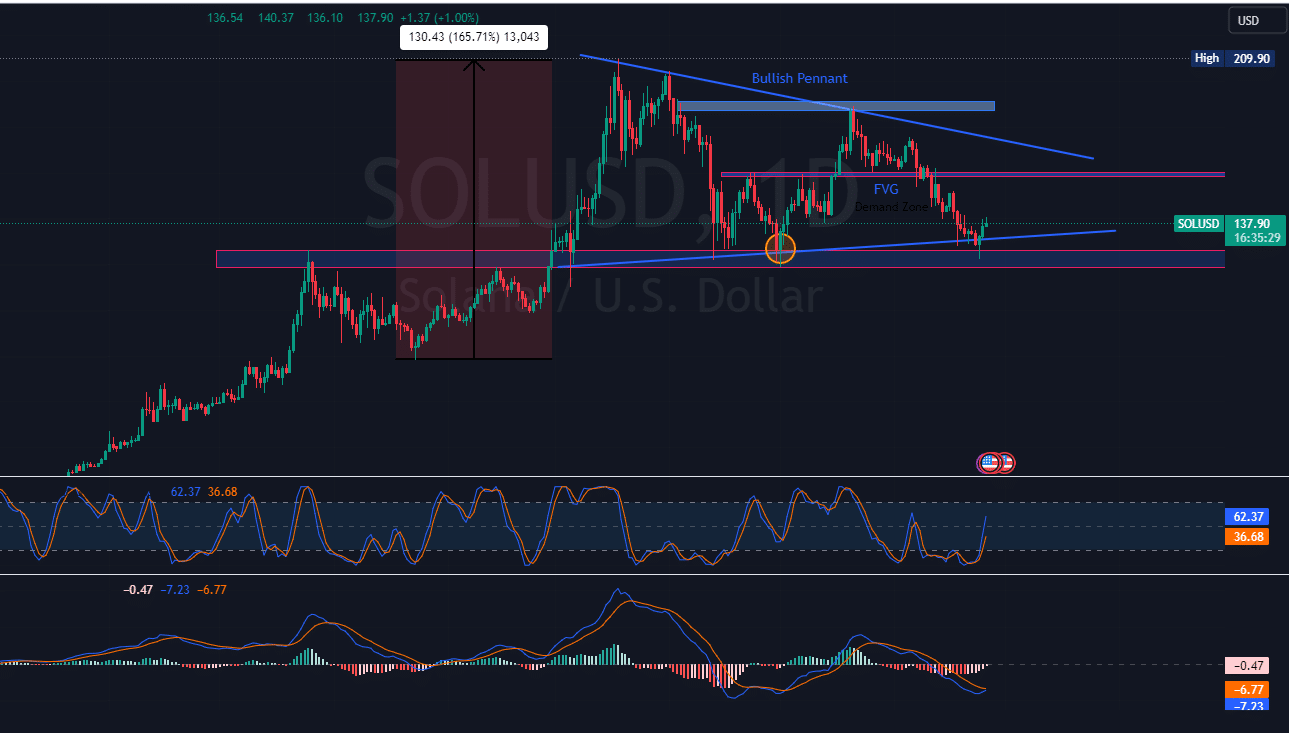

- Solana stabilizes at $122 support level after a 35% decline, showcasing potential for bullish momentum recovery.

- Over 377 million SOL tokens staked, indicating strong investor confidence and a commitment to network security.

Solana’s market performance demonstrates a notable trend of resilience and bullish potential amid prevailing market conditions. The cryptocurrency stabilized at a support level of $122 after experiencing a 35% decline since May 20th.

This support level has proven significant, as the price of Solana increased by 10% within the past 48 hours. Current trading figures from Ethnews list Solana at $136.33, showing a modest increase of 1.09% over the last 24 hours and 1.26% over the past week. The market capitalization of Solana reflects a similar uptrend, increasing by 1.13% to $63.11 billion.

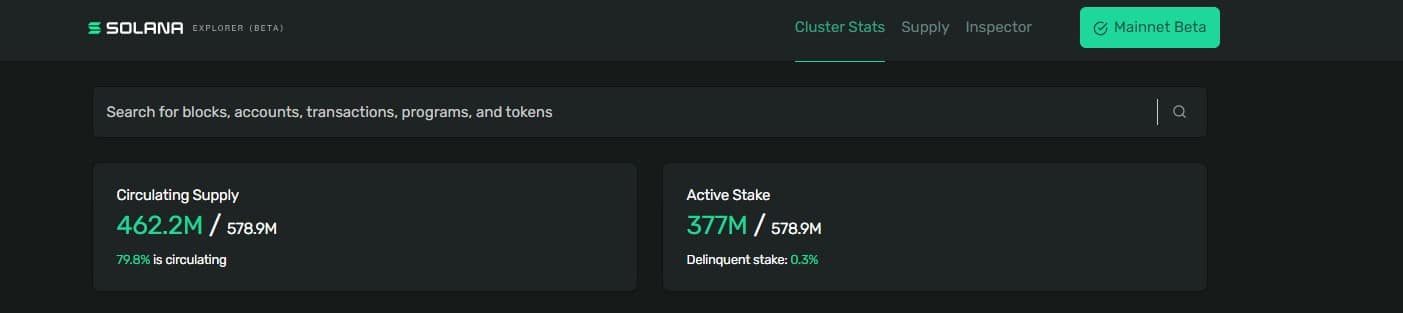

The circulating supply of Solana is an integral aspect of its market sector. Of the total 578.9 million SOL tokens, 462.2 million are actively in circulation, which constitutes approximately 79.8% of the total supply. This high rate of circulation indicates market activity and investor engagement.

Furthermore, staking statistics reveal that about 377 million SOL tokens, representing 65.1% of the total supply, are actively staked. This high staking activity suggests that a substantial portion of the supply is locked, potentially stabilizing prices and fostering confidence among investors.

Technical indicators such as the Moving Average Convergence Divergence (MACD) currently point to a decrease in bearish momentum, which might predict a minor price correction in the short term. However, the fundamental attributes of the network, combined with active market participation, provide a solid foundation for potential price recovery.

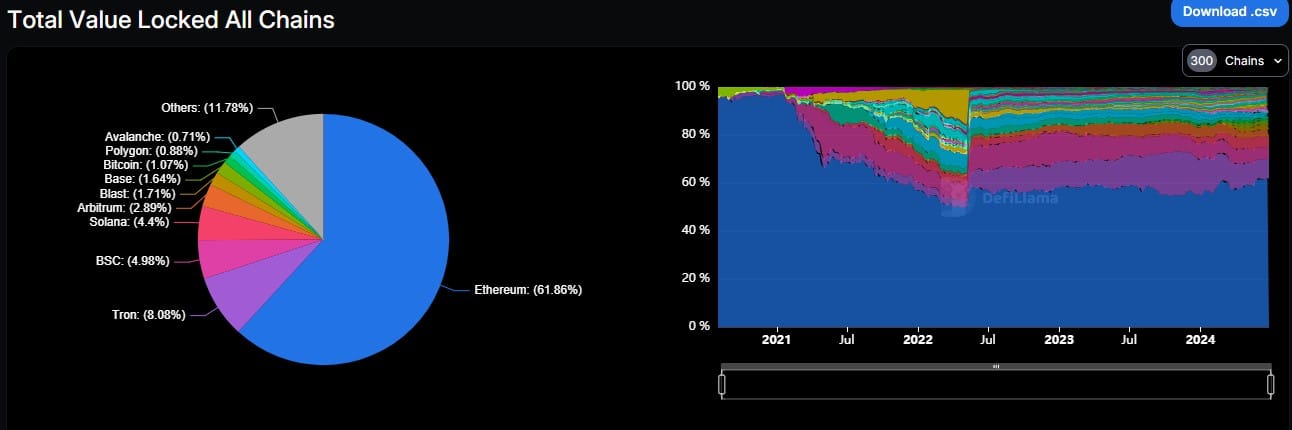

Investor sentiment towards Solana also appears robust, reflected by its presence in the decentralized finance (DeFi) sector. According to DefiLlama, Solana accounts for 4.4% of the total crypto market’s locked volume, indicating sustained confidence in its capabilities and future prospects.

While short-term market indicators suggest possible minor setbacks, the extensive use of Solana’s blockchain, combined with high staking rates and good market capitalization, underscores a strong foundation for future growth. Investors are advised to monitor these developments closely as they assess Solana’s potential trajectory in the cryptocurrency market.