- U.S government’s holdings of 213,039 BTC could impact Bitcoin prices if sold, historically leading to declines.

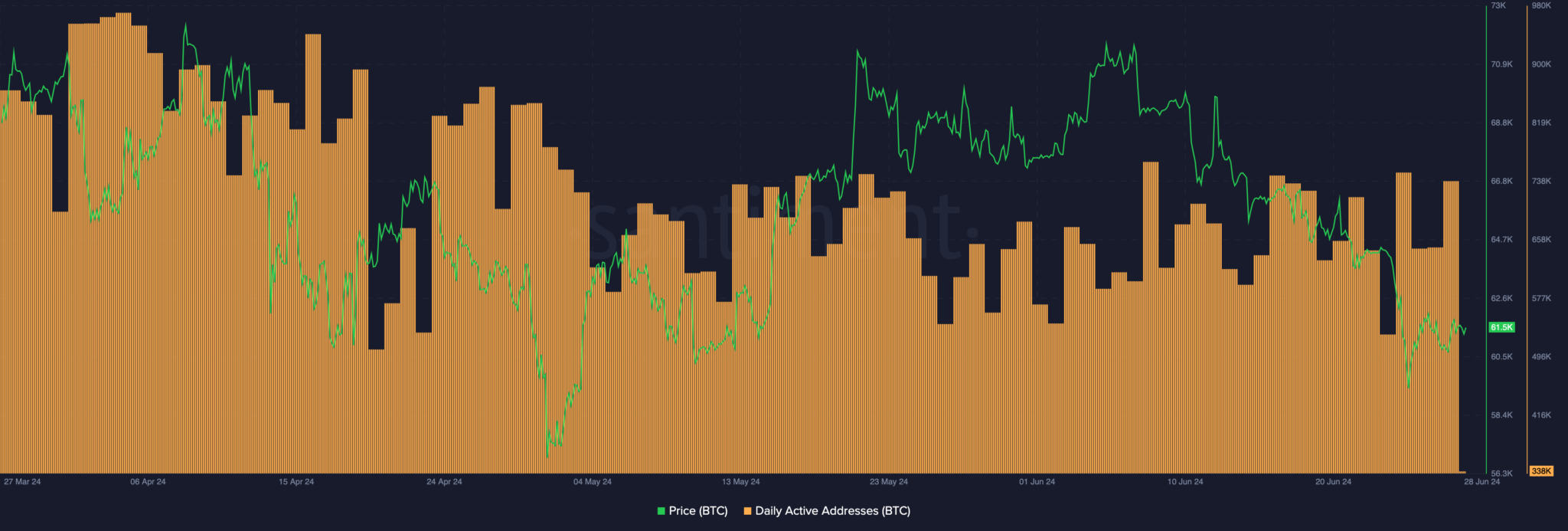

- Recent increase in daily active Bitcoin addresses suggests a drop in ecosystem interest, potentially lowering prices.

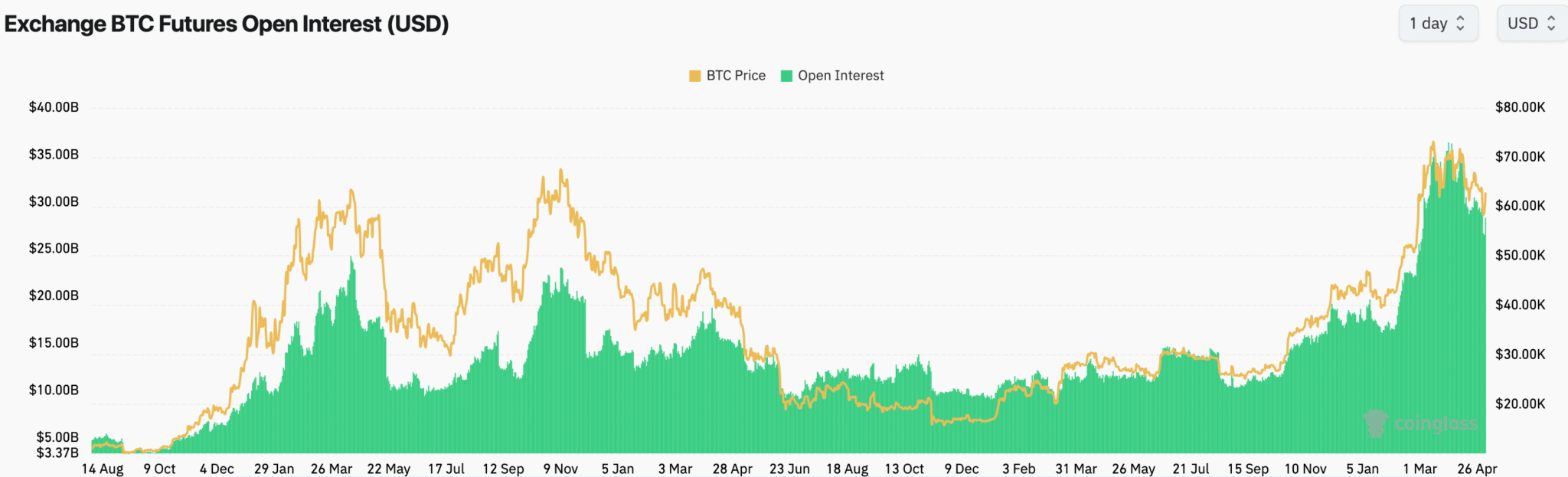

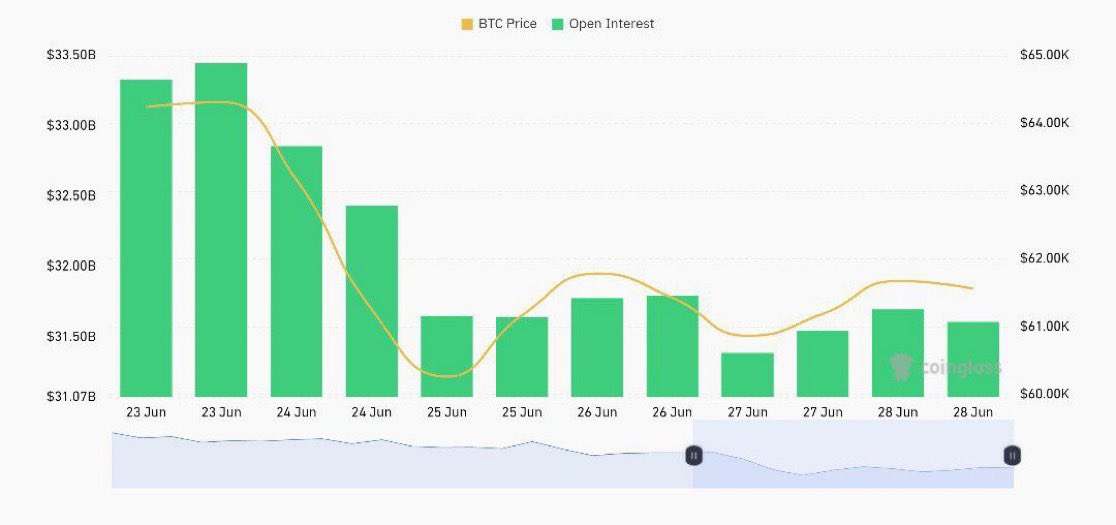

Bitcoin, while yet to fully recover from recent price dips, shows signs of potential volatility sparked by increasing trader interest. Despite a general decline in market sentiment and network activity, the surge in Open Interest suggests a growing focus on Bitcoin, hinting at anticipations of price movements.

Bitcoin Open Interest

The rise in Bitcoin’s Open Interest is notable as it reflects not just a speculative interest but an institutional one, potentially enhancing liquidity in Bitcoin’s futures market. This shift is significant because it may stabilize or even increase the cryptocurrency’s price volatility.

Market Positions and Their Implications

Data from Coinglass reveals a spike in short positions on Bitcoin, outnumbering long bets. This trend could lead to a short covering scenario, where short sellers might need to purchase Bitcoin to close their positions if a drastic price drop occurs.

Conversely, an unexpected price increase could trigger a short squeeze, compelling short sellers to buy back Bitcoin at rising prices, which could accelerate the price increase dramatically, as we have analyzed them previously on ETHNews.

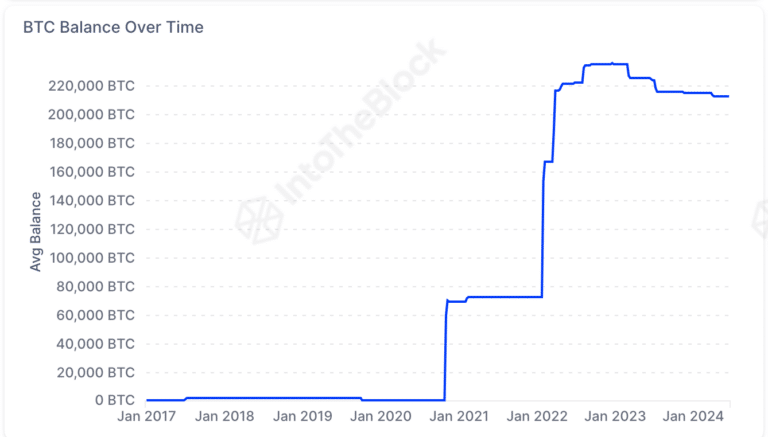

Impact of U.S Government Holdings

Another factor that might influence Bitcoin’s price trajectory is the U.S government’s holdings. Currently, the government holds approximately 213,039 BTC, valued around $13.10 billion. Historical trends show that whenever the U.S government sells part of its holdings, Bitcoin’s price tends to drop.

We have previously pointed out in ETHNews, potential sales in the future could trigger investor anxiety, leading to a market sell-off and further price declines.

Network Activity

The state of Bitcoin’s network also presents a mixed signal. While the number of daily active addresses has recently surged, this is often interpreted as declining interest in Bitcoin’s broader ecosystem, potentially exerting downward pressure on its price.

Looking Ahead

These factors together paint a complex picture of Bitcoin’s market position. Increased Open Interest and institutional attention suggest a bullish outlook, while the predominance of short positions and potential government actions could bear negatively on the market. Additionally, changes in network activity levels are crucial to watch, as they often precede shifts in trading price.

Investors and market watchers are thus advised to keep a close eye on these indicators, as they could impact Bitcoin’s price direction in the coming days. As the market stands at a crossroads, the interplay of these factors will likely dictate the short-term price movements of this leading cryptocurrency.