- The price of Bitcoin has fallen, falling 10.84% in the last week and 4.39% in the last 24 hours.

- The Bitcoin halving is intended to reduce mining rewards and energy consumption, restricting energy demand even as the network increases.

According to data from CoinMarketCap, the price of Bitcoin (BTC) has taken a sharp tumble, falling to $63,074.92—a decrease of 4.39% over the last 24 hours and showing a 10.84% drop across the previous week.

This decline, which comes after a brief surge that raised hopes, has surprised and alarmed traders and investors.

Market Response to the Volatility of Bitcoin

The market for cryptocurrencies has its eyes trained on the looming April 20, 2024, Bitcoin halving; therefore, the abrupt drop carries substantial imports. This event, widely expected to have a massive impact on Bitcoin’s value fluctuations, will halve the rewards granted to miners for newly minted blocks.

Such halving periods have, in the past, foreshadowed sizable cost swings. The upcoming reduction in mining incentives adds new uncertainty during a time of already heightened volatility.

While short-term price dips are common, some perceive this plunge as a concerning sign given the anticipation surrounding the fast-approaching halving date.

Increased Liquidation and Market Attitude

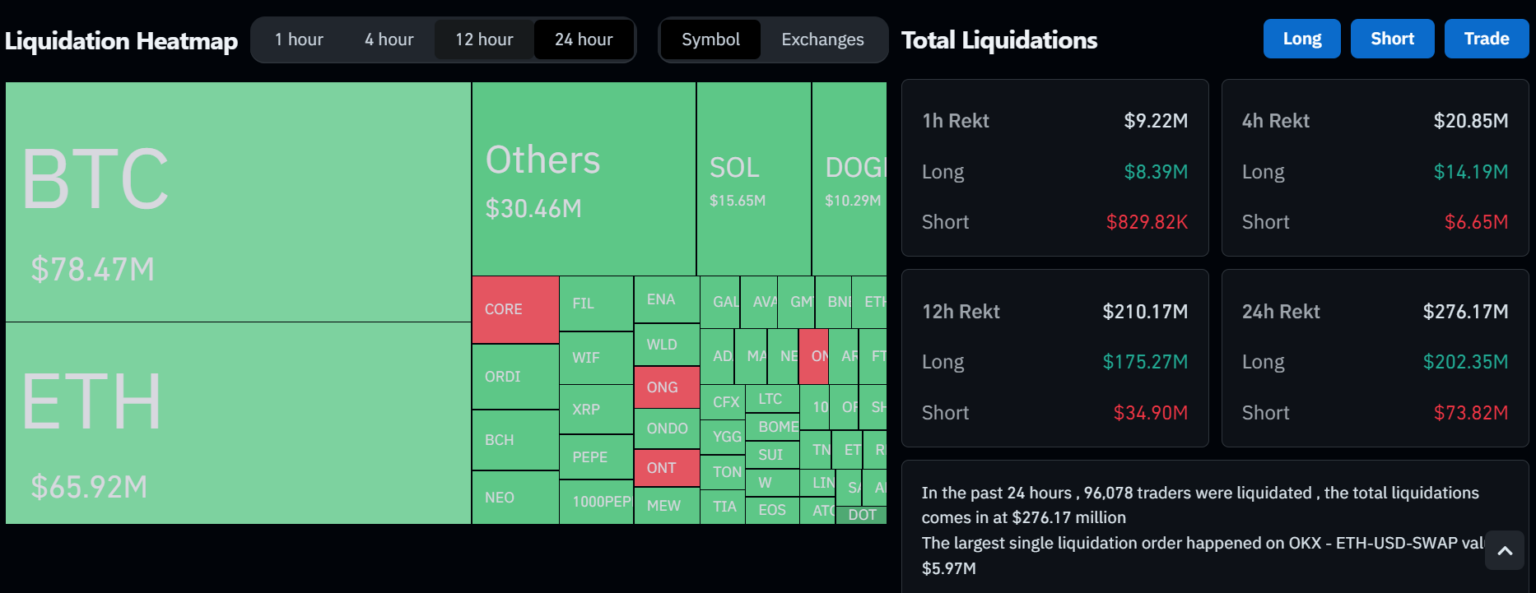

There was significant unrest in financial markets overnight, triggering automatic closures of positions for nearly 96,000 investors. CoinGlass reported the complete liquidated sum amounted to approximately $276.17 million, with long positions accounting for $202.35 million and short positions for $73.82 million.

The volatility rippled through other areas of the cryptocurrency ecosystem. The Bitcoin Fear and Greed Index, which measures market sentiment, plunged from an overly confident “Greed” rating of 74 to a more cautious 65, highlighting the fragility of the recent rally and concerns around ongoing macroeconomic and geopolitical instability.

This indicator gauges investor mood and could potentially predict future price changes based on investors’ emotional responses.

Additionally, geopolitical worries have led to wider market corrections, which has complicated matters. But when spot Bitcoin and Ethereum ETFs were legalized in Hong Kong, there was a temporary uptick in price that briefly drove Bitcoin above $66,000.

This regulatory development seems to have a positive effect on the market’s stability and wide adoption of cryptocurrencies.

Additional information from ETHNews emphasizes that the halving process is intended to gradually reduce Bitcoin’s energy consumption in addition to having an impact on price. Even with network growth, it is not anticipated that the energy demand linked to Bitcoin will surpass national consumption levels as the reward for mining declines.

This suggests that Bitcoin’s activities will be more sustainably conducted in the face of growing governmental scrutiny due to environmental concerns.

Bitcoin Cycles

Rekt Capital, a cryptocurrency analyst, has discovered a “pre-halving retrace” pattern that suggests Bitcoin values may briefly decline before rising in the future. This pattern appears to be reoccurring and has been repeatedly seen during prior Bitcoin cycles.

#BTC Bull Market Progress:

▓▓▓░░░░░░░ 36.2%

(Progress bar based on standard Halving Cycles)$BTC #Crypto #Bitcoin pic.twitter.com/OF3m4Eu2dl

— Rekt Capital (@rektcapital) April 15, 2024

Bitcoin stays above its re-accumulation range during the halving week, despite the recent market downturns, suggesting potential stability or gain as the halving event approaches.