- Grayscale Bitcoin ETF (GBTC) experiences reduced outflows, recording a significant drop to $75 million on April 3, indicating investor confidence.

- Significant Bitcoin purchases by Blackrock’s IBIT and FBTC ETFs contribute to a total inflow of $113 million across Bitcoin ETFs.

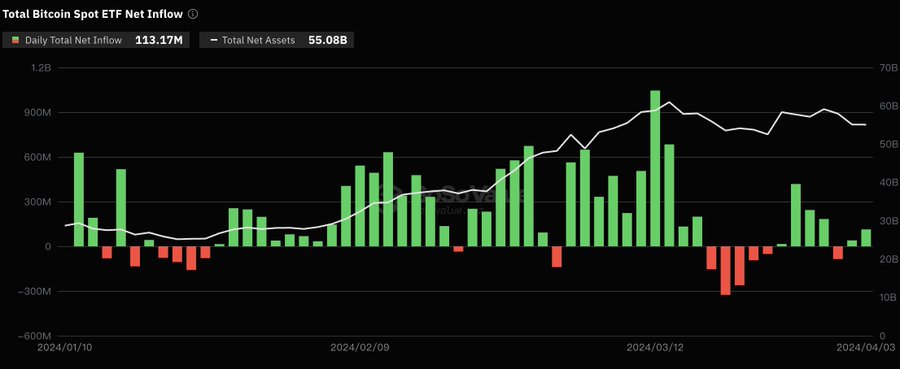

Recent data indicates a shift in the cryptocurrency market, particularly regarding Bitcoin, as institutional interest seems to persist. This is evident from the activities in Bitcoin Exchange-Traded Funds (ETFs) and futures markets.

[1/4] Bitcoin ETF Flow – April 2024

All data in. $113.5m net inflow pic.twitter.com/jwE1QJmVdj

— BitMEX Research (@BitMEXResearch) April 4, 2024

The Grayscale Bitcoin ETF (GBTC) experienced a decrease in outflows, recording a significant reduction to $75 million on April 3, the lowest since February 26. This reduction in outflows coincides with an increase in inflows into spot Bitcoin ETFs, signaling a possible resurgence of investor confidence.

In detail, on April 3, Blackrock’s IBIT ETF purchased $42 million worth of Bitcoin, while FBTC acquired $117 million, marking its highest purchase since March 26.

According to SoSoValue, the total net inflow into Bitcoin spot ETFs was $113 million yesterday. The Grayscale ETF GBTC experienced a net outflow of $75.14 million for the day, bringing GBTC's total historical net outflow to $15.23 billion.

The Bitcoin spot ETF with the highest… pic.twitter.com/0r8YDKmkfj

— Wu Blockchain (@WuBlockchain) April 4, 2024

These transactions contributed to a total inflow of $113 million across all Bitcoin ETFs on that day.

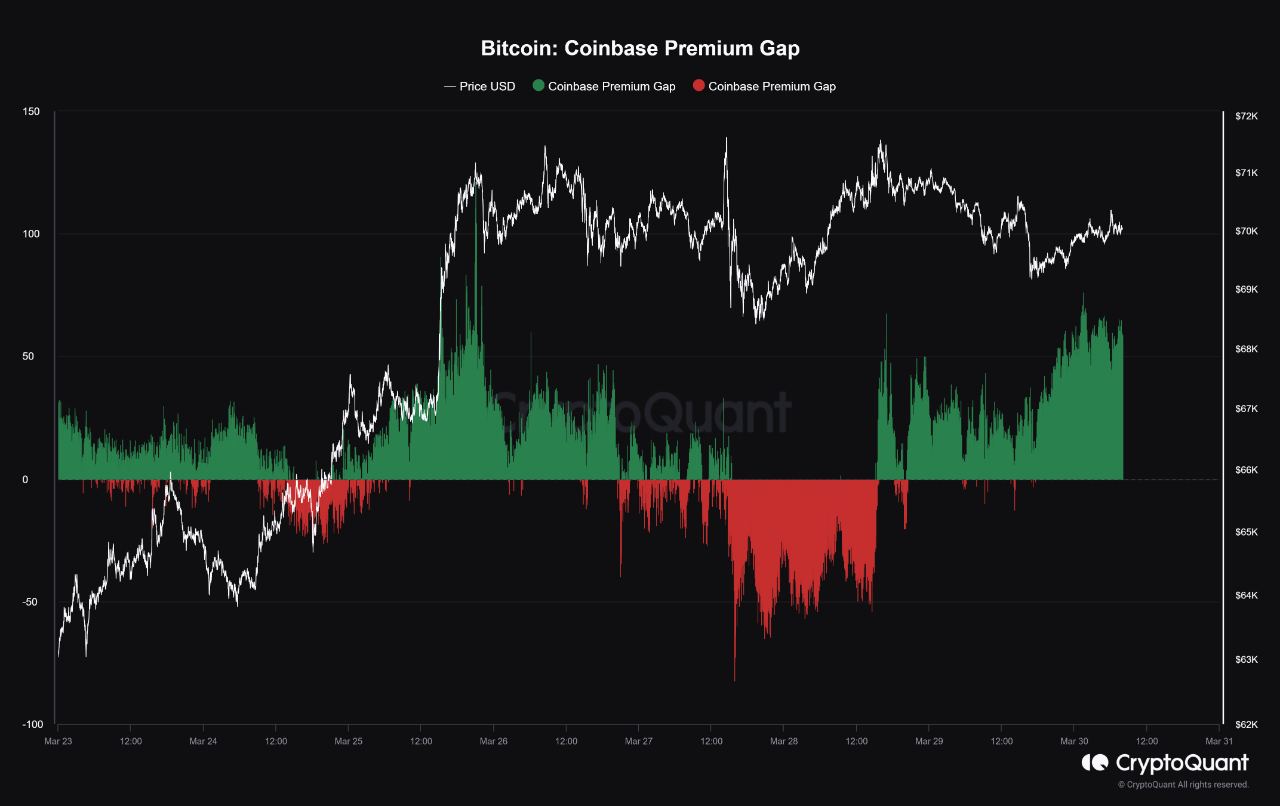

The futures market provides additional insights into the institutional interest in Bitcoin. An increase in the Coinbase Premium, which is the price difference between Coinbase and other international exchanges, suggests that U.S. institutions are actively purchasing Bitcoin.

GBTC sent only 329 #Bitcoin to its Coinbase premium account (~$22m)

Much less than yesterday. Last two days we had outflow lower than $100m.

Good signals so far. To assess that the selloff may be over we should monitor the outflow at least till Tuesday next week.

If we have it… https://t.co/RZxWkCW3yh pic.twitter.com/FAGdLa1bax— Alessandro Ottaviani (@AlexOttaBTC) April 4, 2024

This premium serves as an indicator of strong U.S. institutional engagement in the cryptocurrency, particularly noted during periods of increased inflows into U.S. Bitcoin ETFs.

Additionally, there has been a notable movement of Bitcoins off exchanges, with approximately 18,828 BTC being transferred. This suggests that institutions may be moving their Bitcoin holdings to more secure storage solutions, such as private wallets or cold storage, potentially leading to a supply shock in the market.

Related: Bitcoin ETF Boom Surpasses Miner Production: Halving to Propel Price to $100,000

CryptoQuant’s analysis points to a continuous period of positive Bitcoin futures funding rates, indicating a strong bullish sentiment in the market.

However, it is important to note that historically, such optimistic sentiment often precedes price corrections, which could offer buying opportunities for investors.

The current trends in the Bitcoin market highlight a phase where institutional interest remains robust, evidenced by the dynamics in ETFs and futures.

The decrease in GBTC outflows, significant ETF inflows, with volatility and institutional activities likely to influence Bitcoin’s price trajectory in the foreseeable future.

The current price of Bitcoin (BTC-USD) is approximately $67,565.39, marking an increase of $881.15 or 1.32%. Bitcoin’s price range for the day has been between $65,149.30 and $67,638.40, with a 52-week range of $24,797.17 to $73,750.07.