- Glassnode data indicates a correlation between high Tether inflows to exchanges and subsequent rises in Bitcoin prices.

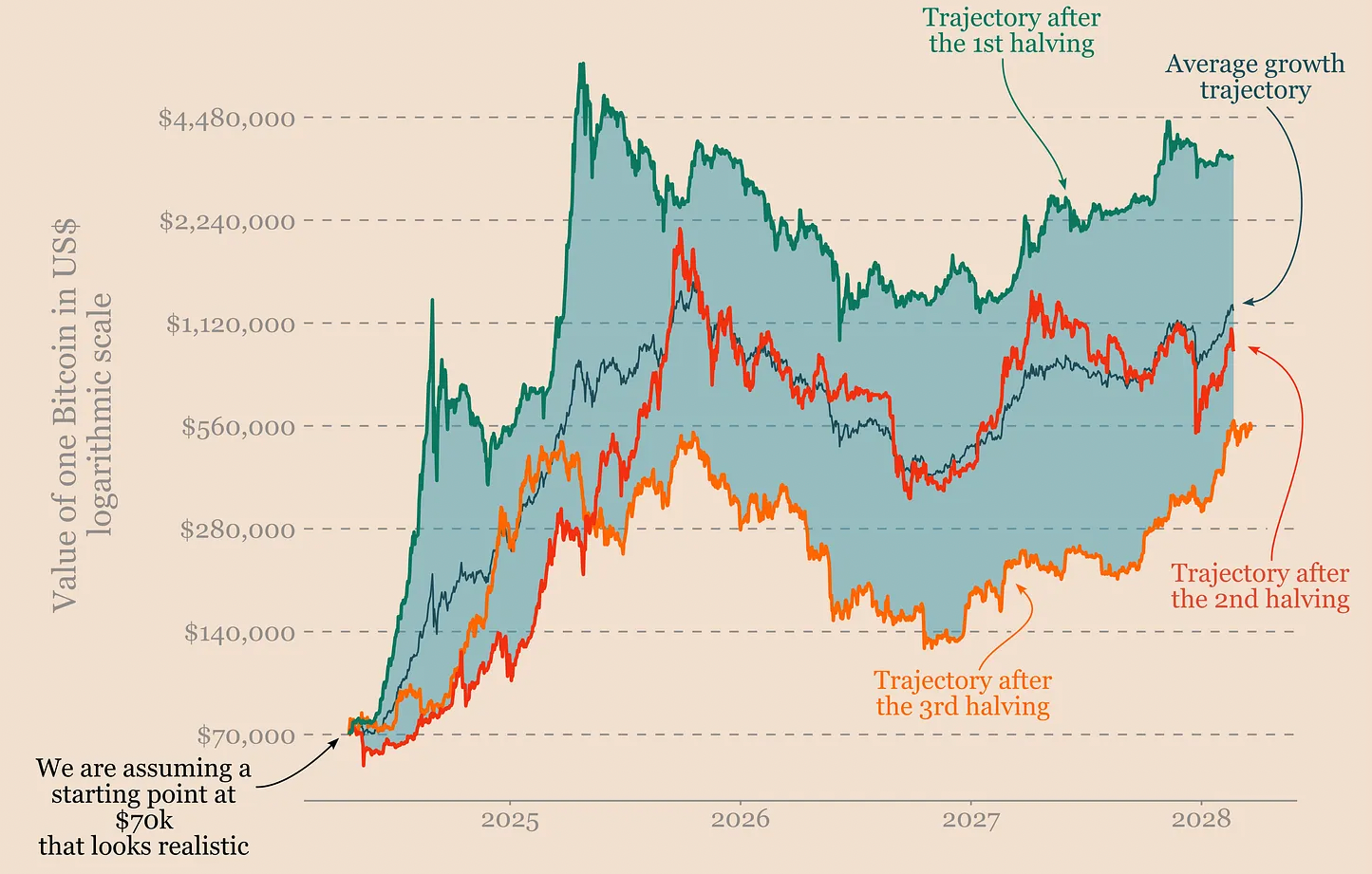

- Analysts predict Bitcoin could reach between $140,000 and $4.5 million following historical patterns of post-halving price surges.

Recent developments in the cryptocurrency market suggest an upcoming shift in Bitcoin prices, driven by a notable increase in stablecoin issuance.

According to a report from KuCoin Research, this trend is primarily linked to the forthcoming Bitcoin supply halving, set to occur in one week.

Historically, such events have influenced Bitcoin’s market value, leading to an increase in trading activities.

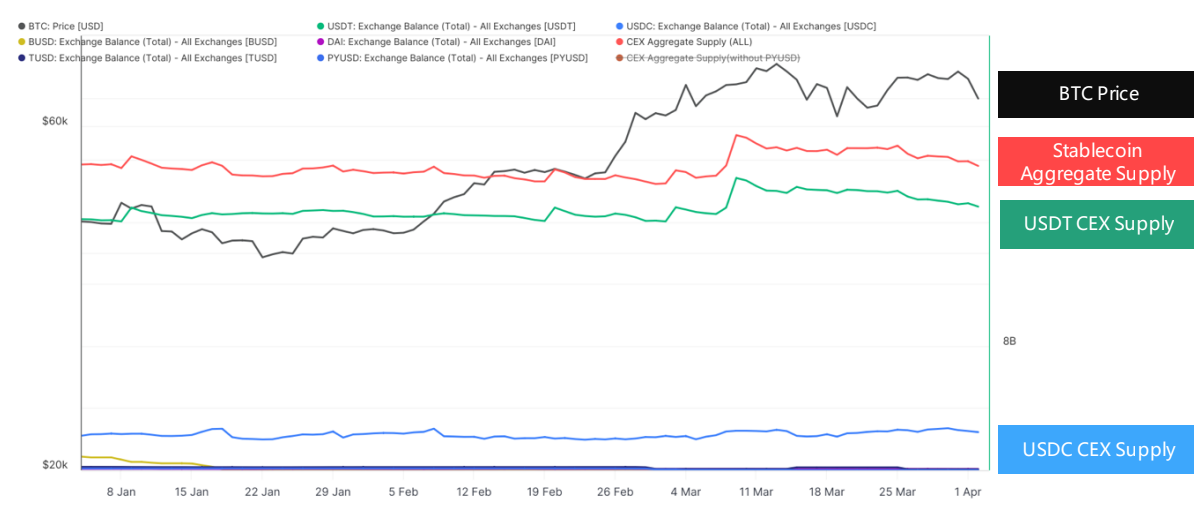

Analytical data from Glassnode supports these findings, indicating that the highest single-day inflow of Tether to exchanges occurred on March 3.

This influx coincided with a significant rise in Bitcoin’s price, surpassing its previous all-time high of $69,800 on March 5. This correlation suggests that increased stablecoin inflows to exchanges may precede positive price movements in Bitcoin.

Read more: Bitcoin ETFs face hurdles, Celestia and AI Altcoin see an investment rebound

Furthermore, the overall balance of stablecoins on exchanges has increased recently, rising from $19.7 billion on April 7 to $20.34 billion.

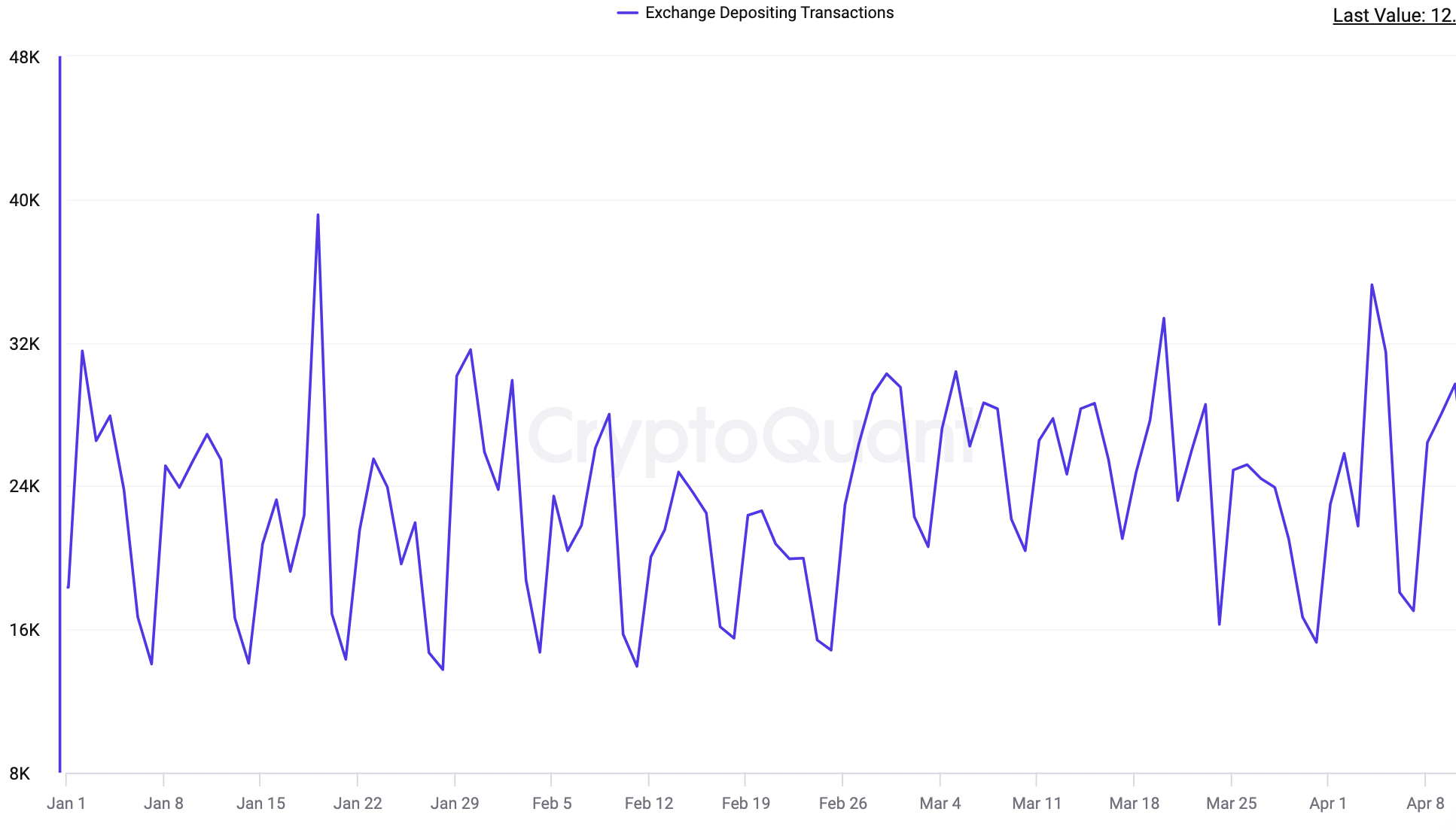

Alongside this, the number of transactions involving stablecoins being deposited to exchanges has also risen, as reported by CryptoQuant. This activity indicates that traders might be positioning themselves for a potential uptrend in Bitcoin prices.

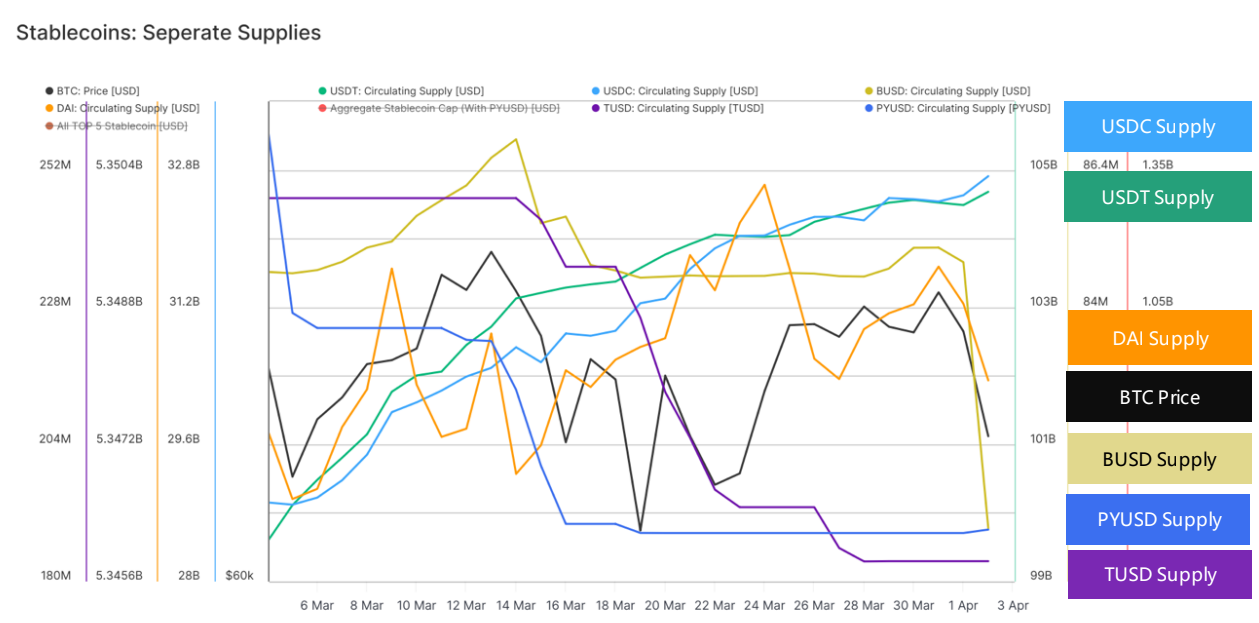

The total market capitalization of stablecoins has grown by 2.8% from April 1, reaching $154.7 billion, with Tether making up more than 69.1% of this figure. This growth in stablecoin balances on exchanges and their market caps is often viewed as an indicator of traders’ positioning in anticipation of market movements.

Looking ahead, projections about Bitcoin’s price trajectory are optimistic. Influencers within the cryptocurrency community, such as The Moon on the X social network, predict that Bitcoin could potentially reach $100,000 soon.

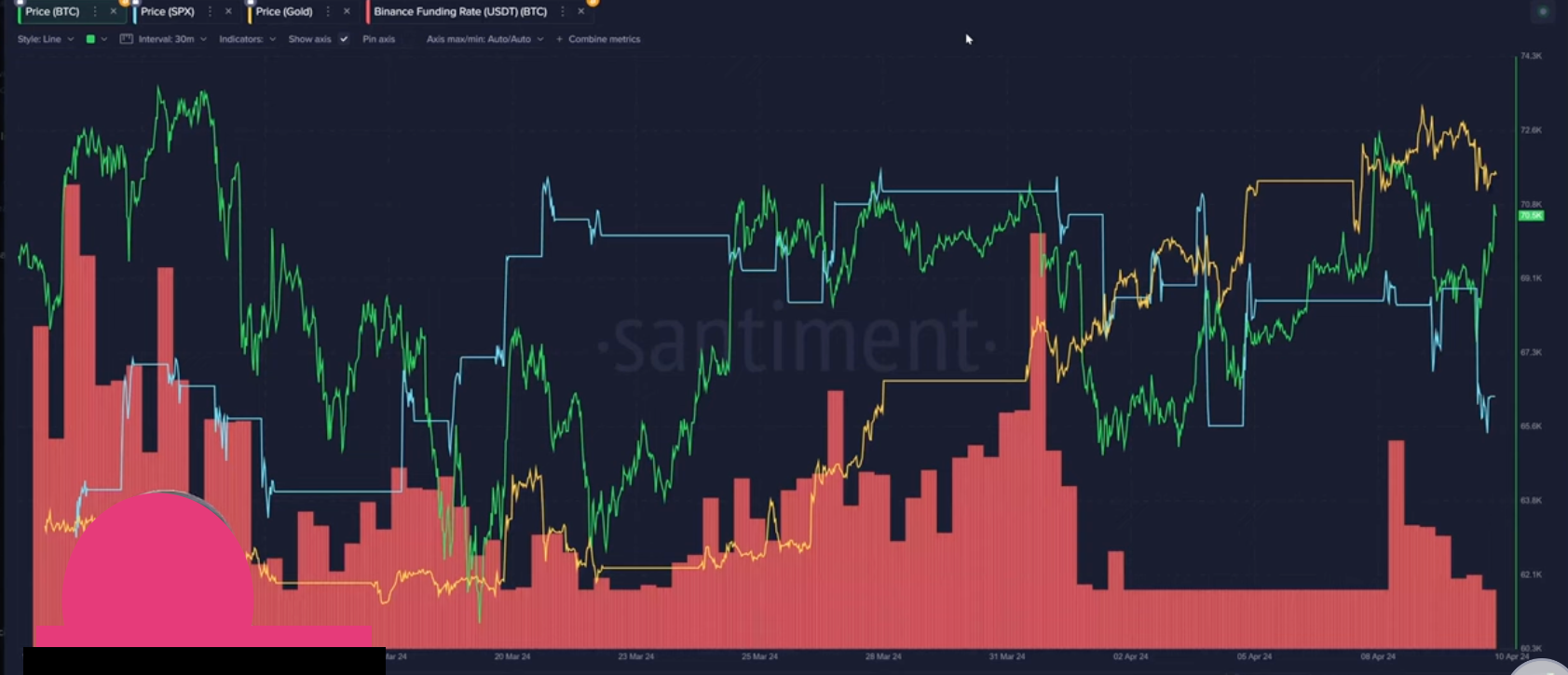

This sentiment is echoed by analysts at Santiment, who noted a divergence between Bitcoin and traditional stock markets like the S&P 500, historically a bullish signal for Bitcoin.

Econometrics, a price analysis firm, suggests that if Bitcoin follows the pattern of past halving events, its price could see a dramatic increase, potentially reaching between $140,000 and $4.5 million per coin.

These projections highlight the significant potential for growth in Bitcoin’s value, reflecting traders’ confidence as indicated by the recent stablecoin activities.

The current price of Bitcoin (BTC-USD) is approximately $66,500.73, which marks a decline of 5.98% as of the latest update