- Bitcoin faces a critical moment with $6.6 billion in options set to expire, affecting market stability.

- Market analysts focus on the $57K ‘max pain’ point, where financial risk to options sellers is minimized.

Bitcoin is currently at a juncture, with $6.6 billion of its options set to expire, potentially exacerbating the volatility in its price, which hovers around the $60K mark. Historically, Bitcoin has faced challenges maintaining its value in similar circumstances, occasionally dipping to levels such as $56K and $58K.

The upcoming expiration of a considerable volume of crypto options, totaling over $10 billion, of which $6.6 billion are tied to Bitcoin, is expected to inject more uncertainty into the market.

Analysts point to the $57K “max pain” price level—where financial risk to options sellers is minimized at expiration—as a critical point. Bitcoin’s price has often aligned with this level at past expiries, although it is influenced by multiple market factors.

Despite the potential for increased downward pressure, QCP Capital, a crypto trading and hedge firm, predicts that Bitcoin will maintain the $60K support level.

‘We think the 60k support will be defended’

They reference decreased selling pressure and an increase in activity in US Bitcoin ETFs as positive indicators. Data from Soso Value confirm that Bitcoin ETFs have reversed a seven-day streak of outflows, showing net inflows over the past three days.

However, there are concerns about short-term investors who may sell off their holdings if the price falls further.

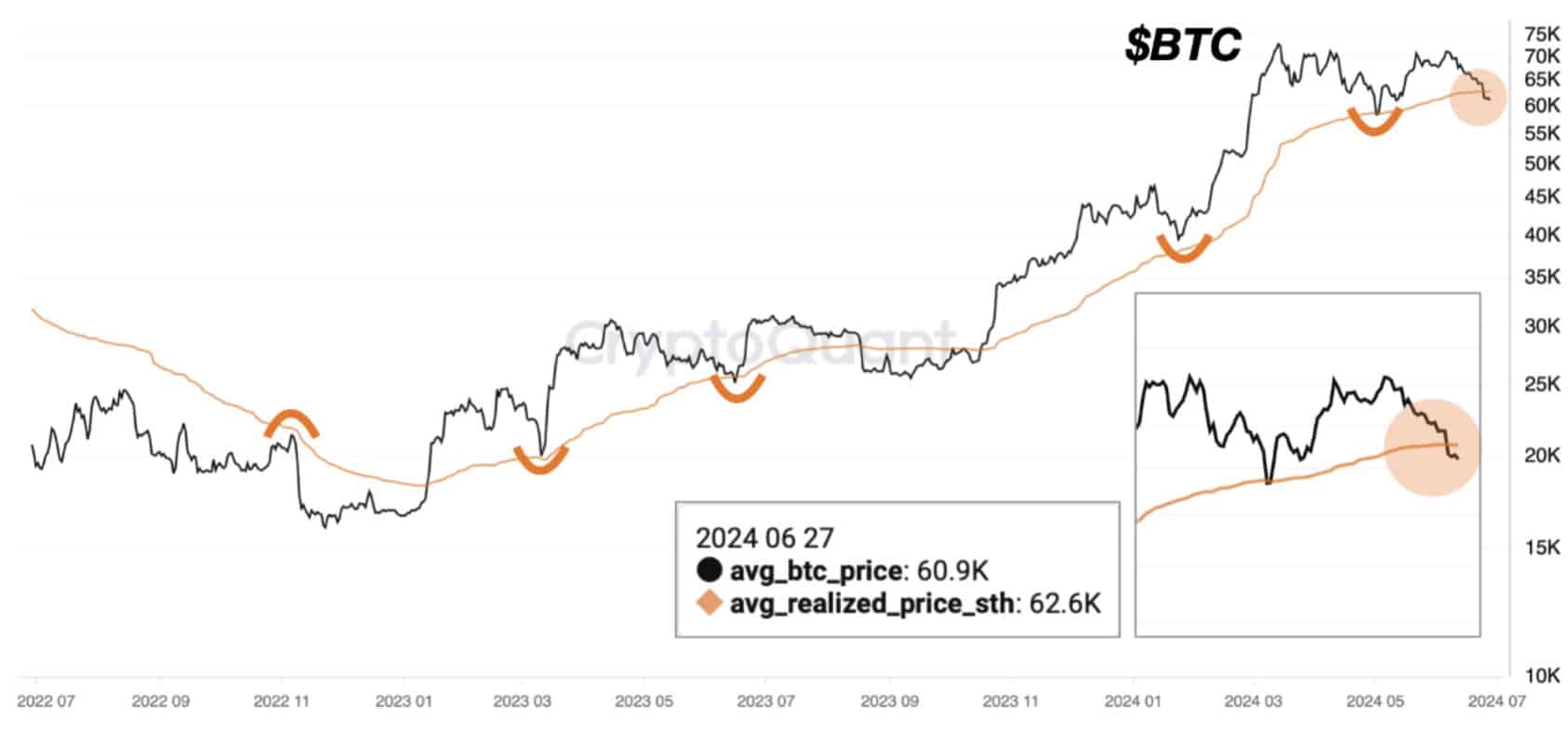

According to an analysis by CryptoQuant, Bitcoin’s price has dropped below the short-term realized price of $62.6K, suggesting that this could become a resistance level unless the price recovers quickly.

BTC price breaks below the short-term average realized price!

“If the price does not move above the sth price quickly, it will likely turn into a resistance level for the price going forward.” – By @marketmakercopy

Full post 👇https://t.co/StbPMLmlQT pic.twitter.com/R02ySzLaFv

— CryptoQuant.com (@cryptoquant_com) June 27, 2024

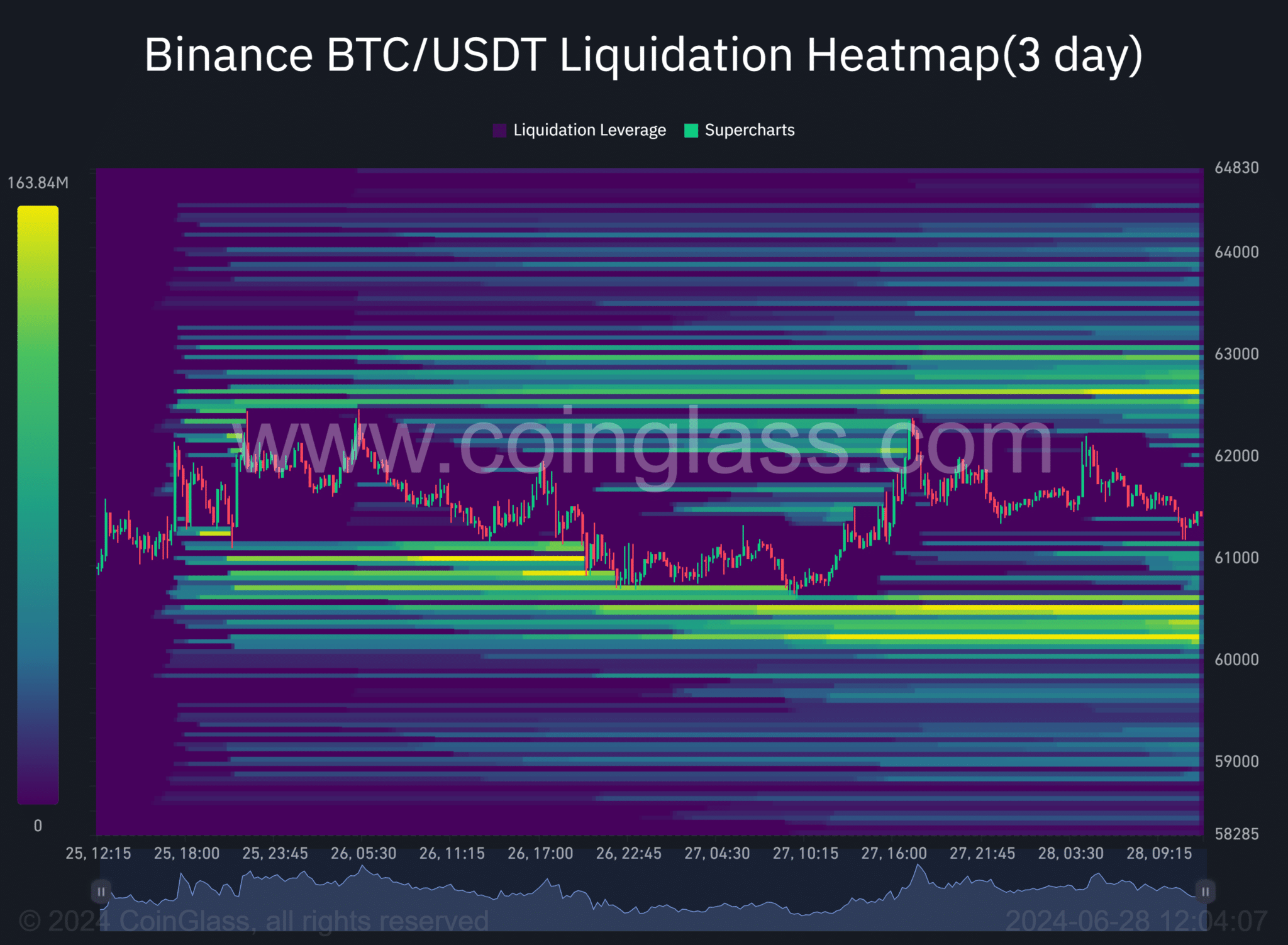

Further analysis by ETHNews through a liquidation heatmap shows liquidity clusters around $60.2K and $60.4K, with another important cluster at $62.6K.

Price movements often target these liquidity-rich zones, hinting that while the market might pressure Bitcoin towards $57K, there’s also potential for recovery back to around $60K and possibly up to $62.6K.

As the expiry date looms, the interplay of market mechanics and investor reactions will determine Bitcoin’s capacity to endure this period of instability. Investors and market watchers will likely keep a keen eye on developments, poised to react to the cryptocurrency’s next moves.