- Dormant since 2018, a Bitcoin wallet reactivates, transferring 8,000 BTC valued at approximately $536.5 million, stirring market interest.

- Funds moved from Coinbase to Binance without preliminary test transactions, deviating from common large-scale transaction practices.

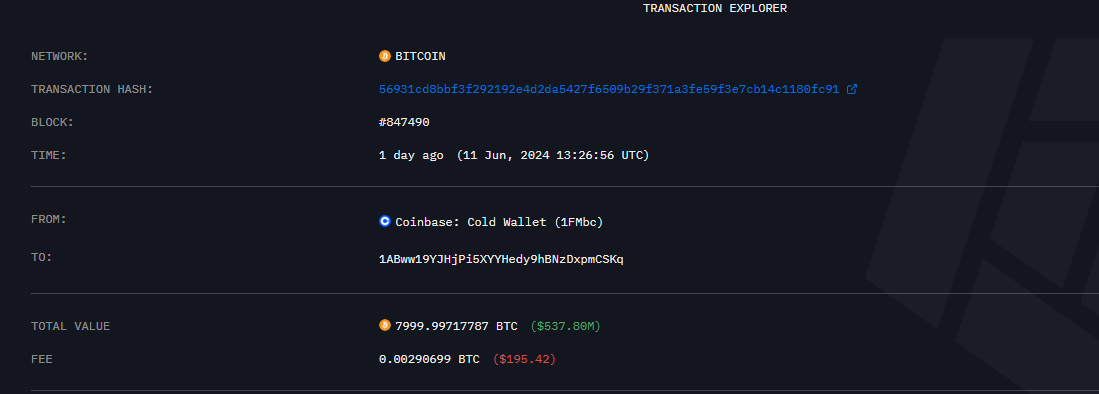

In a recent and unexpected move, a Bitcoin wallet inactive since 2018 sprang to life, transferring 8,000 BTC worth approximately $536.5 million. This transaction has captured the attention of cryptocurrency trader and investors, hinting at possible shifts in the market.

Transaction Details and Market Impact

The wallet, associated historically with Coinbase’s cold storage, directed the funds to a well-known Binance deposit address. This transfer did not follow the typical protocol of conducting a test transfer first, which is common practice for large-scale transactions to ensure security.

The original acquisition of these coins dates back to late 2018, when Bitcoin was trading around $3,750. Given the current trading price of approximately $67,302 per Bitcoin, the original investment has appreciated markedly.

Speculations on Future Movements

This abrupt wallet activity has led to speculation about the owner’s intentions, particularly whether they are preparing to sell the bitcoins, which could increase selling pressure in the market. Historically, the activation of dormant wallets, especially those linked to exchange addresses, has been a precursor to market sell-offs, reflecting owners’ desires to capitalize on price increases.

Broader Market Conditions

This event occurs amidst a challenging period for the cryptocurrency market, which has seen a general downturn. Bitcoin itself has witnessed a 6% decline over the past week, with a slight 0.7% drop in the past 24 hours.

The total market valuation has also dipped, currently standing at around $2.57 trillion, a 1.3% fall within a single day.

Increased Network Activity

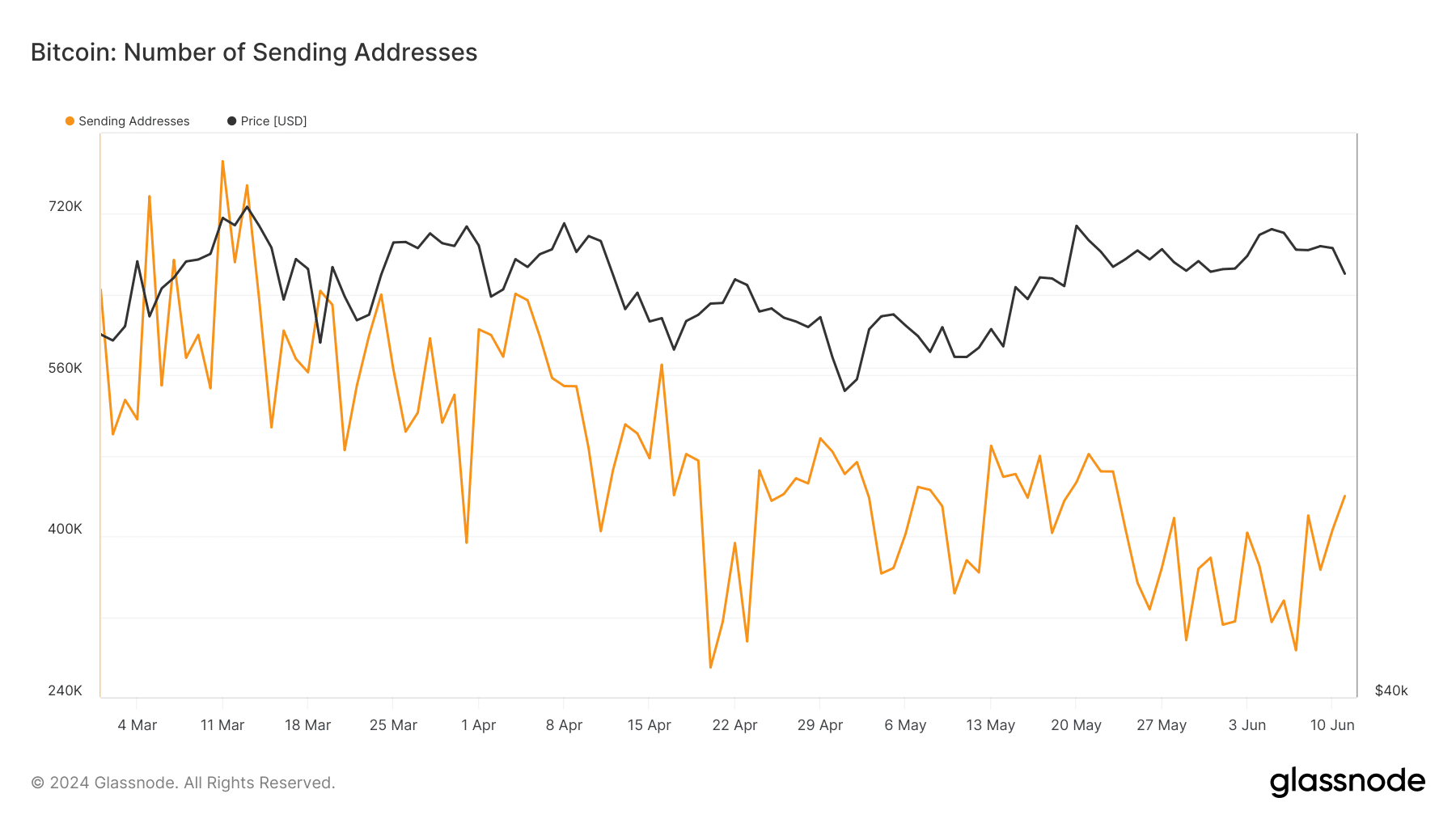

Despite the market’s recent struggles, there has been an uptick in activity within the Bitcoin network. According to data from Glassnode, the number of active sending addresses on the Bitcoin network has increased from below 300,000 to over 400,000.

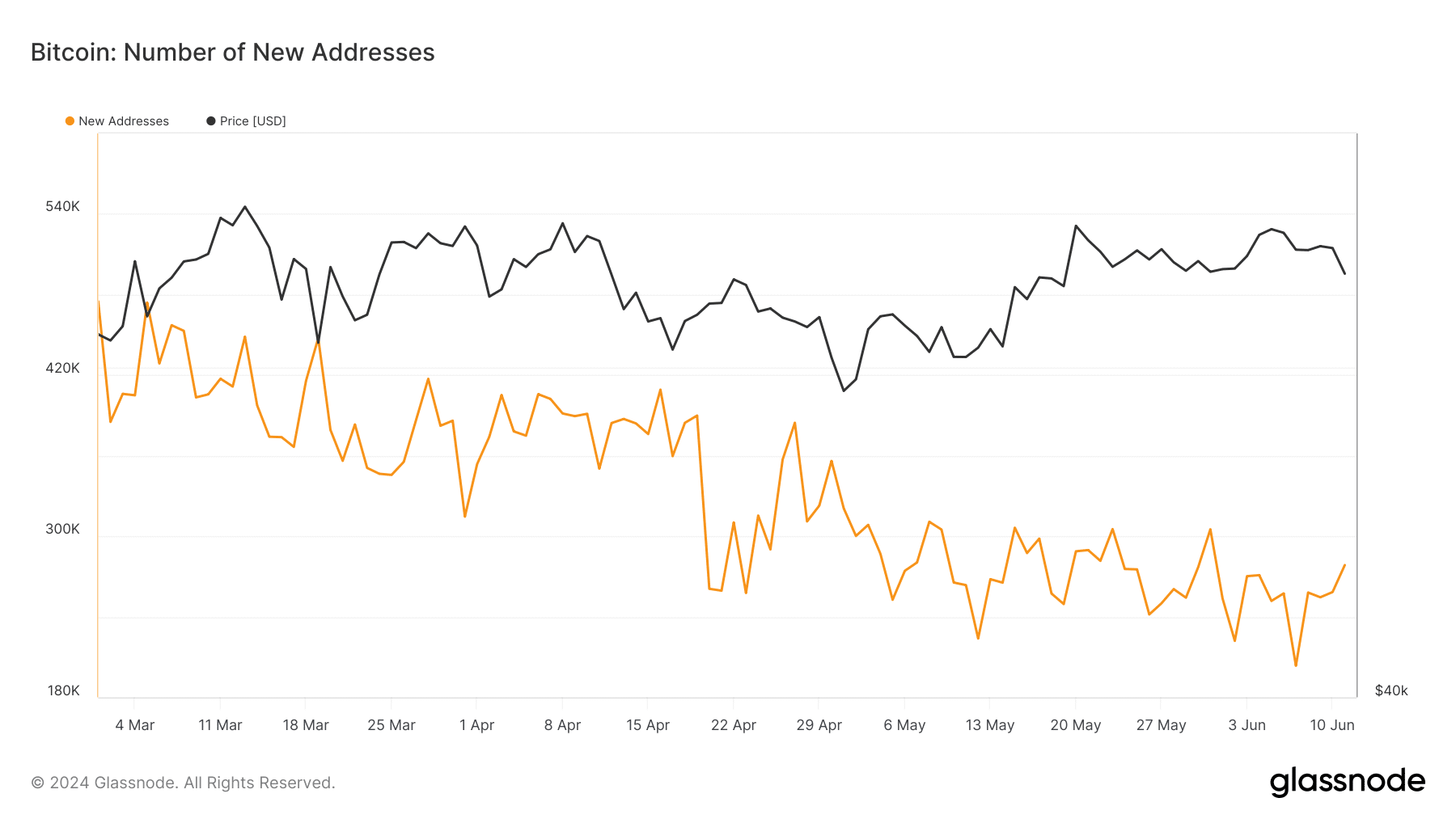

Additionally, there is a noticeable rise in the creation of new Bitcoin addresses, with figures moving from 203,000 to 278,000 recently. This suggests a heightened interest in Bitcoin, possibly as both new and returning investors enter the market.

Looking Ahead

While the full impact of this $536.5 million transaction is yet to be seen, such movements are crucial for market observers and participants. They not only reflect individual strategies but also have the potential to influence broader market sentiments and trends.

As Bitcoin continues to navigate through its complex landscape, the community remains alert to how such significant transactions can shape the market’s future.