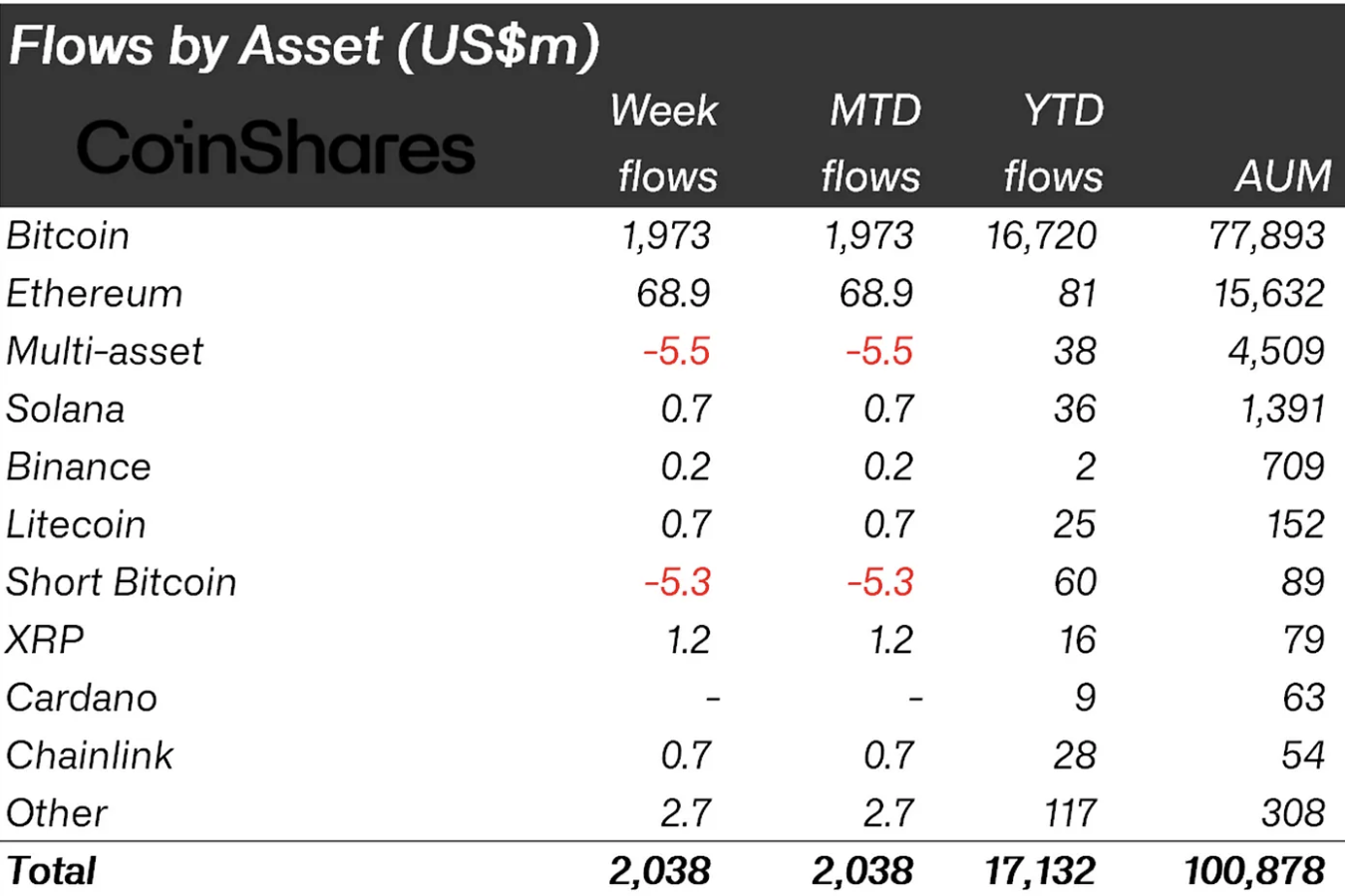

- Bitcoin leads with $1.97 billion of the total $2 billion in weekly crypto inflows, as reported by CoinShares.

- Ethereum secures $69 million in investments, marking its highest weekly inflow since a significant peak in March.

Last week, the cryptocurrency market saw an influx of approximately $2 billion, with Bitcoin capturing a staggering $1.97 billion of this total, according to the latest report from CoinShares.

Ethereum followed with an investment of $69 million, marking its highest inflow since a peak earlier in March.

Market and Investment Trends

The weekly report by CoinShares, which covers investment referencing digital assets including cryptocurrencies, highlighted the continued interest in Bitcoin and Ethereum. The dominance of Bitcoin in the recent inflows suggests that many investors see robust potential in the long-term value of the coin despite current market conditions.

James Butterfill, CoinShares’ Head of Research, attributed the influx primarily to shifts in economic indicators and expectations of monetary policy adjustments in the United States.

He noted:

“We believe this turnaround in sentiment is a direct response to weaker than expected macro data in the US, bringing forward monetary policy rate cut expectations.”

“This change helped push total assets under management (AuM) above the $100 billion mark for the first time since March of this year.”

Short-Term Outlook: Sideways Movement Expected

Despite the influx, Bitcoin’s price has not shown movement, trading sideways for most of the last week, with current prices around $69,373.

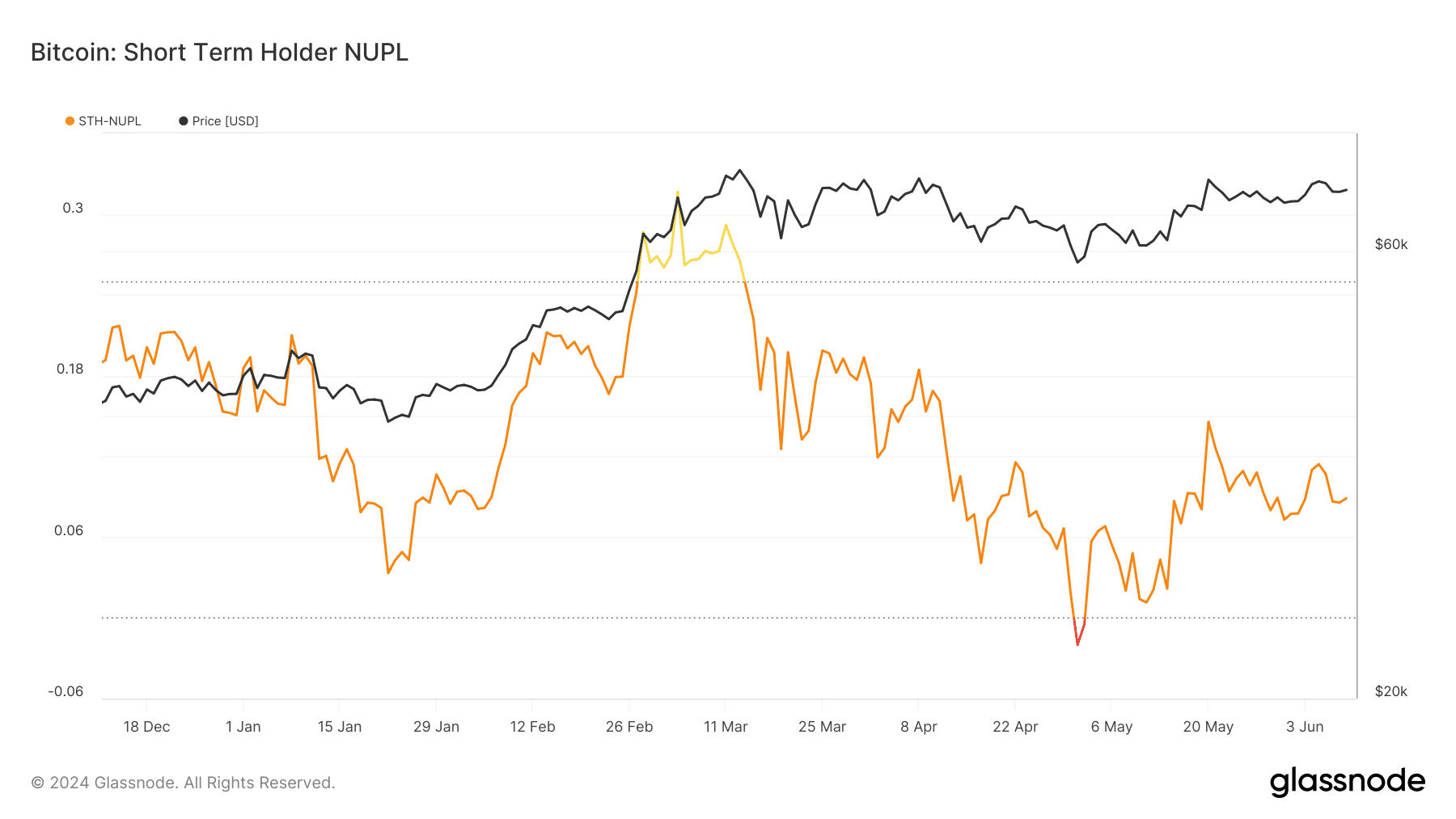

The behavior of short-term investors, assessed through the Short Term Holder-Net Unrealized Profit/Loss (STH-NUPL) metric, shows a cautious sentiment.

The STH-NUPL, which gauges the sentiment of holders who have owned Bitcoin for less than 155 days, currently stands at 0.085 in the ‘hope’ zone. This suggests that short-term holders are not confident in an immediate price increase, potentially leading to continued sideways price movement.

Analyzing Market Sentiment and Future Predictions

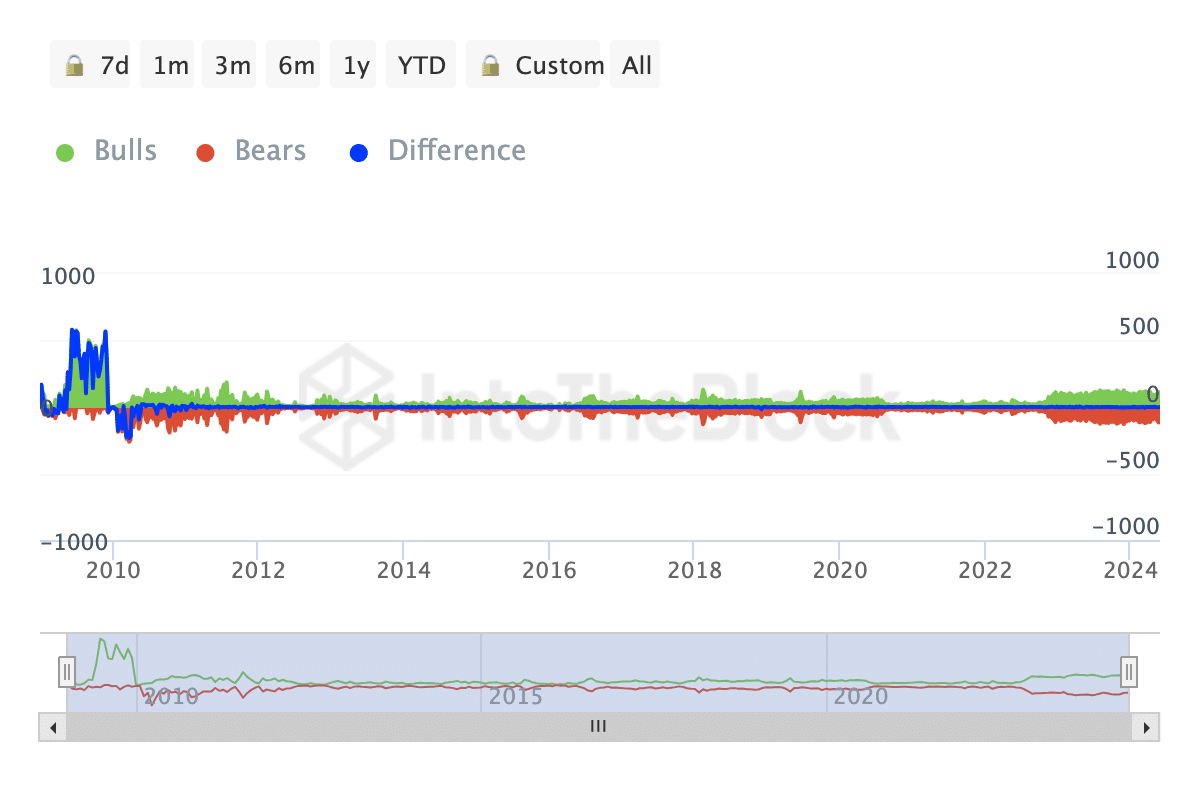

The Bulls and Bears indicator from IntoTheBlock, which tracks the activity of addresses that bought or sold 1% of the trading volume in the last 24 hours, indicates a neutral stance with no clear dominance of buying or selling pressure. This neutrality is likely to keep Bitcoin trading within a tight range for the immediate future.

Given the current market conditions and investor sentiment, Bitcoin might maintain its current levels unless there is a market shift.

A bearish turn could see prices drop to around $68,000, whereas a more favorable market environment could push them back up to approximately $71,000.

The substantial investments flowing into Bitcoin highlight its perceived stability and potential amidst uncertain economic conditions.

While short-term market trends suggest a period of lateral movement, the overall investor interest in Bitcoin remains strong, signaling continued confidence in its long-term value.