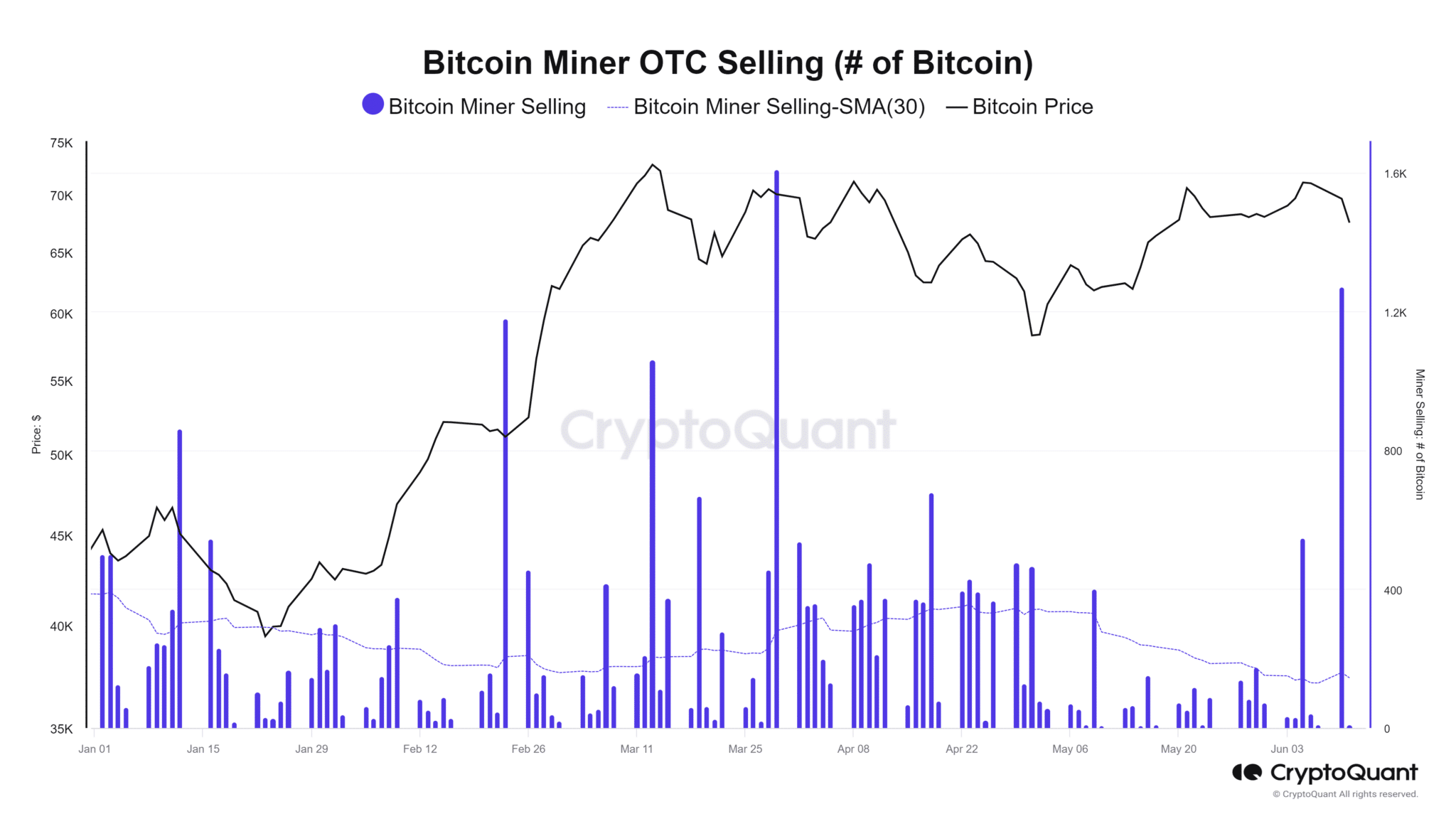

- Recent miner sales conducted off-chain not reflected in exchange volumes, yet open interest remains stable.

- Largest OTC Bitcoin sale since March involved around 1,200 BTC, suggesting miner capitulation amid market decline.

Bitcoin miners recently executed sales exceeding $83 million, with Bitcoin’s value now approaching $67,000. This activity has occurred in the context of a broader downturn, marked notably on June 11 when the most significant price reduction was recorded. In these instances, miners typically sell their holdings, aiming to secure profits as market values decline.

This pattern of sales by Bitcoin miners is not immediately evident on cryptocurrency exchanges. Despite the outward lack of change, the market’s open interest has maintained stable levels, suggesting sustained trading activity.

Detailed examination of Bitcoin miner reserves indicates a slight decrease in holdings, which remain around 1.8 million BTC. The data reveals a reduction in the outflow to exchanges, which corroborates the observation of decreasing reserves.

Further insights become apparent through analysis of Over the Counter (OTC) sales. According to information from CryptoQuant, a notable transaction in late March involved the sale of approximately 1,200 BTC. Such sales, known as miner capitulation, may signal either financial pressures or strategic profit-taking by miners due to the declining market.

In terms of market trends, Bitcoin has shown a negative trajectory over the last week. Specifically, a drop from the $70,000 range to about $68,000 was noted between June 6 and 7.

A subsequent decline on June 11 reduced its value further to the $67,000 range. This downturn positions Bitcoin near its short-term moving average support, around $65,000, suggesting a critical juncture for the cryptocurrency’s price.

The Relative Strength Index (RSI), an indicator of market momentum, shows Bitcoin below the neutral level, with a current reading around 47. This figure typically suggests a bearish market trend.

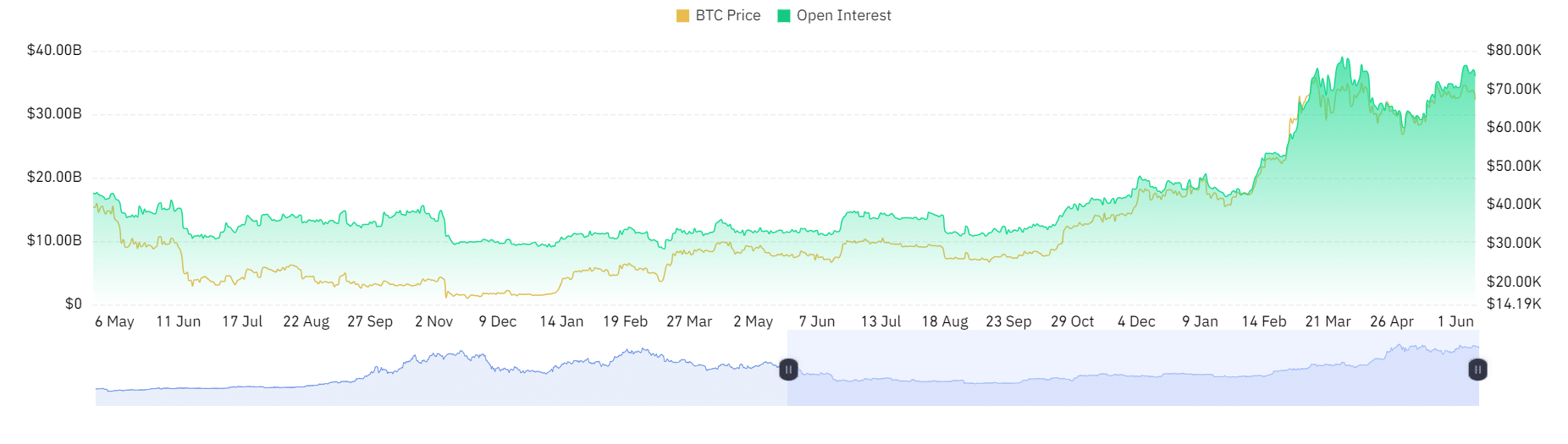

Despite these challenges, Bitcoin continues to draw considerable interest, as evidenced by sustained high levels of open interest. Current figures show about $34 billion in open interest, close to the all-time high of $39 billion achieved in March when prices were above $70,000.

This robust interest, even amidst falling prices, indicates that many market participants view the lower prices as potential investment opportunities rather than signs of a prolonged downturn.