- Litecoin has a chance to rise, but there will be strong resistance beyond $100.

- A future halving of Bitcoin might be advantageous for the price and network of Litecoin.

Litecoin (LTC) has been gaining traction in the cryptocurrency world with its recent price trends and strategic movements as it prepares for significant market milestones. Despite a hard trend of lower highs since March 2022 and a struggle to break through the $100 barrier, Litecoin shows positive signs of an impending rally.

Navigating LTC Market Barriers

The path to resurgence for Litecoin is laden with challenges, particularly with a downtrend that has persisted since the previous year, positioning the $100 level as a critical psychological.

Despite these difficulties, technical indicators like the Relative Strength Index (RSI) and Awesome Oscillator (AO) are sending out encouraging signals that the market is becoming more bullish. These indicators are vital for Litecoin as it endeavors to push past prevailing resistance, setting sights on the $119.84 weekly high as a prospective target for capitalizing on gains.

The Ripple Effect of Bitcoin’s Halving

The April 20 Bitcoin halving event adds intrigue to LTC’s market prospects. According to a previous report by ETHNews, Bitcoin halvings have had an impact on mining and investing strategies all over the cryptosphere.

Given Litecoin’s stature as a key Proof of Work (PoW) network, it is well-positioned to potentially reap benefits from the anticipated shifts in mining focus and investment flows post-halving. The following video has taken a deeper look at this development, giving you more insight.

Surge in Network Participation

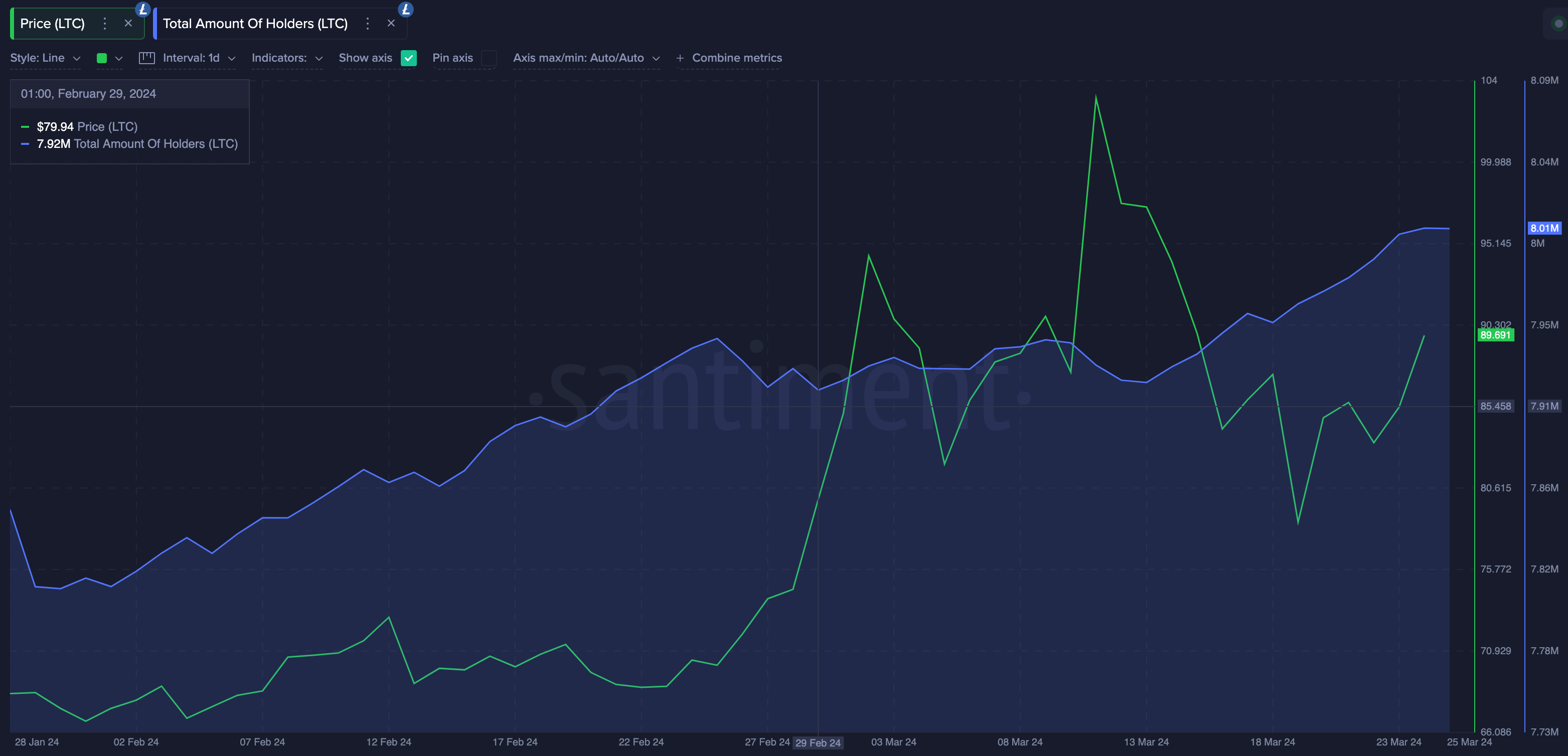

On-chain data showing a significant increase in active Litecoin users is evidence of the surge in network participation, which further strengthens Litecoin’s market position.

The network saw an increase of 90,000 active holders in March 2024 alone, pushing the total to an impressive 8.01 million, signifying robust user growth and engagement within the Litecoin ecosystem.

LTC’s price has gained 1.8% to $91.32, bringing its market capitalization to $6,802,713,663. This represents a more than 15% increase over the last seven days.