- Bitcoin faces 13% drop in two days, anticipating halving event with expectations of recovery.

- CryptoQuant analysis suggests continuation of Bitcoin’s bullish cycle, based on short-term reversal patterns.

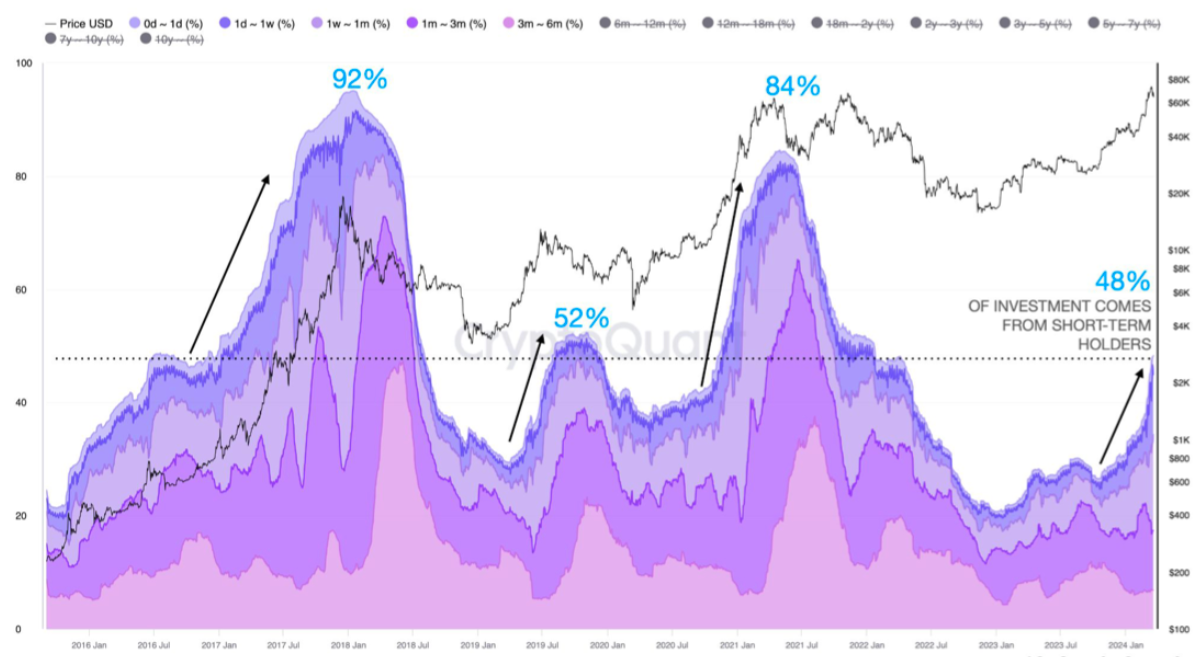

According to CryptoQuant data, 48% of Bitcoin investment comes from short-term holders, while in a conventional bull cycle, between 84% and 92% of investment is typically contributed by these recent investors.

This, described by analysts as a “pre-halving retracement,” anticipates Bitcoin’s halving event, a key moment for the cryptocurrency that is just around the corner, approximately 30 days away.

As with other CryptoQuant analysis we have covered on ETHNews, this is not the end of the Bitcoin bull cycle. Despite the recent drop, key indicators suggest that most of the current investment is coming from short-term holders, a pattern still far from that characteristic of previous bull cycle endings.

This, coupled with valuation metrics that do not yet reflect a market peak, points to a continuation of the uptrend.

The halving of bitcoin has raised different scenarios within the Wall Street investor sector, leading to a number of deductions that you can read about here on ETHNews.

These will leave us with a reduction from 6.25 BTC to 3.125 BTC per block mined from now on, thus increasing BTC appreciation opportunities for the next 5 years from $150,000 to $250,000 according to market research conducted by Standard Chartered Bank.