- Experts in cryptocurrency feel that when market conditions change, Bitcoin’s dominance may be waning and altcoins may become more popular.

- Bitcoin displays a 9.89% weekly decline despite a minor price increase, which is indicative of further market turbulence and investor hesitancy.

Long regarded as the cornerstone of the crypto market, Bitcoin may be losing its strong dominance, providing opportunities for altcoins to shine.

The founder of MNTrading, Michal van de Poppe, recently shared his thoughts on X, pointing out that Bitcoin’s dominance might have reached a limit.

There we go for #Bitcoin.

I think the bottom is close. #Altcoins start to wake up in their Bitcoin pairs, which means that the rotation is started.

The bottom for altcoins is likely in (BTC pairs). Bitcoin dominance has likely peaked. pic.twitter.com/mDWqXmatP1

— Michaël van de Poppe (@CryptoMichNL) May 1, 2024

Peak of Bitcoin Dominance? Expert Crypto Signals

Current market data, which shows a minor increase in BTC price to $57,727.19 with a moderate daily advance of 0.70%, lends credence to this conjecture. But a more comprehensive view that includes a 9.89% drop in the last week and persistently negative tendencies points to fundamental market risks.

There are further indications that Bitcoin’s dominance is declining. Another well-known cryptocurrency trader, Matthew Hyland, noticed that Bitcoin is losing significant support levels.

He is still wary and would rather wait for the weekly market close to verify if the market grip of Bitcoin is indeed being broken. The altcoin market is beginning to take shape, despite Bitcoin’s imposing presence frequently overshadowing it.

These cryptocurrencies are currently outperforming Bitcoin, as van de Poppe pointed out, suggesting that there may be a rotation in which investors move their money from the comparatively stable Bitcoin to the more volatile altcoins.

The Shaky Throne of BTC’s Effect on Crypto Market Cap

TradingView data, which shows that Bitcoin’s dominance is currently 53.90%, a slight decline from earlier figures but still a gain since the beginning of the year, supports this story.

The volatility of market share introduces intricacy to investor tactics, especially considering the current state of the market and the Federal Reserve’s upcoming decisions, which have historically resulted in withdrawals from significant cryptocurrency investments, in line with what ETHNews previously disclosed.

The trading team IncomeSharks contributed to the conversation on X by expressing their confidence regarding the robustness of altcoins and their potential benefits in the event that Bitcoin’s price volatility persists in the months ahead.

#Bitcoin – Dominance dropping. If price continues to chop for a few months alts could take advantage. A lot of alts holding up surprisingly well today. pic.twitter.com/VQiG2zxJlq

— IncomeSharks (@IncomeSharks) May 1, 2024

This viewpoint is important because it highlights how flexible the market is and how nimble cryptocurrency investors can be.

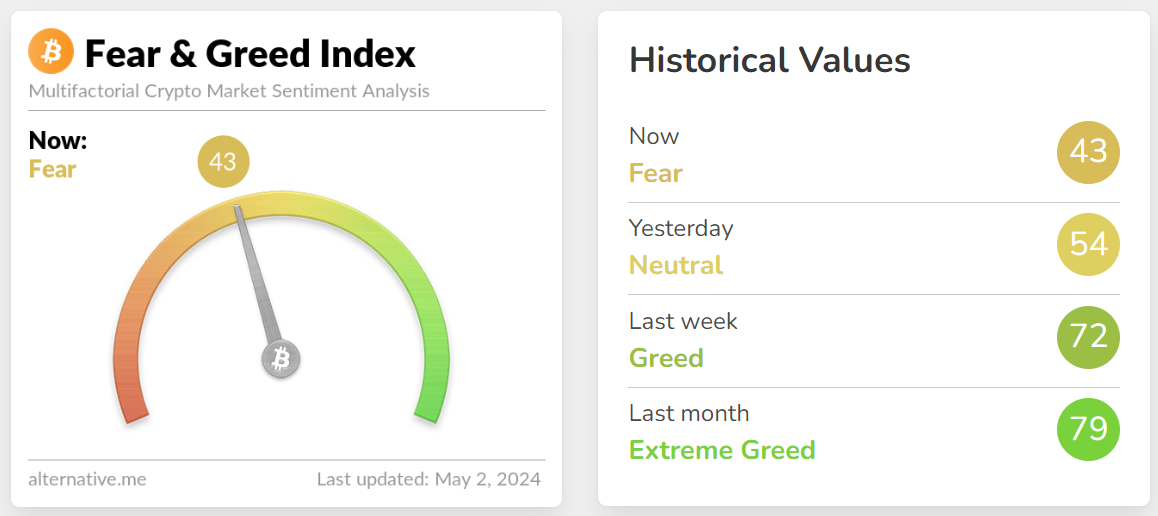

The general sentiment of the market is by no means positive, though. Today, the crypto apprehension and Greed Index showed a sharp increase in investor apprehension, falling to a level of 43 from the neutral score of 54 the day before.