- LINK’s price, which is currently at $13.25, is resilient in the face of a recent weekly decline of 10.36%, indicating a possible turn in the market.

- Vertex’s integration of Chainlink Data Streams may increase LINK’s market appeal and facilitate recovery.

Chainlink (LINK) is currently trapped in the midst of a bearish market, as indicated by a recent price decline. Despite challenges, LINK has showed resilience with slight rebound.

According to CoinMarketCap data, LINK’s price stands at roughly $13.25, representing a 4.95% increase in the previous 24 hours, while it still indicates a 10.36% drop over the past week.

[mcrypto id=”12352″]Investor Sentiment and Market Analysis

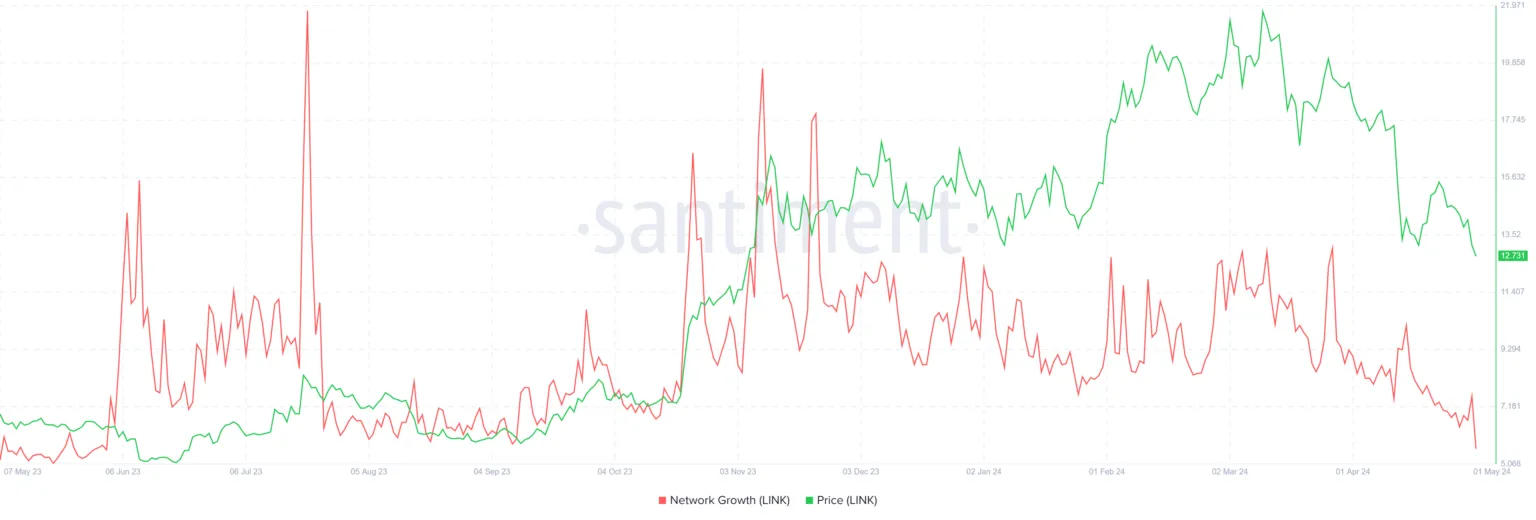

In the short term, investors have shown a pessimistic outlook that is in line with predictions of further declines in the price of LINK. A dramatic decline in network growth, which has reached a yearly low, supports this opinion.

Network expansion, a critical indicator determined by the rate of new address creations, indicates Chainlink is losing its grip in the market.

Additionally, Vertex, a decentralized exchange (DEX) built on Arbitrum, integrated Chainlink Data Streams into its mainnet. According to a previous report by ETHNews, it hopes to increase investor interest by enhancing the speed and security of its trading operations.

LINK Valuation Insights and Potential Price Movements

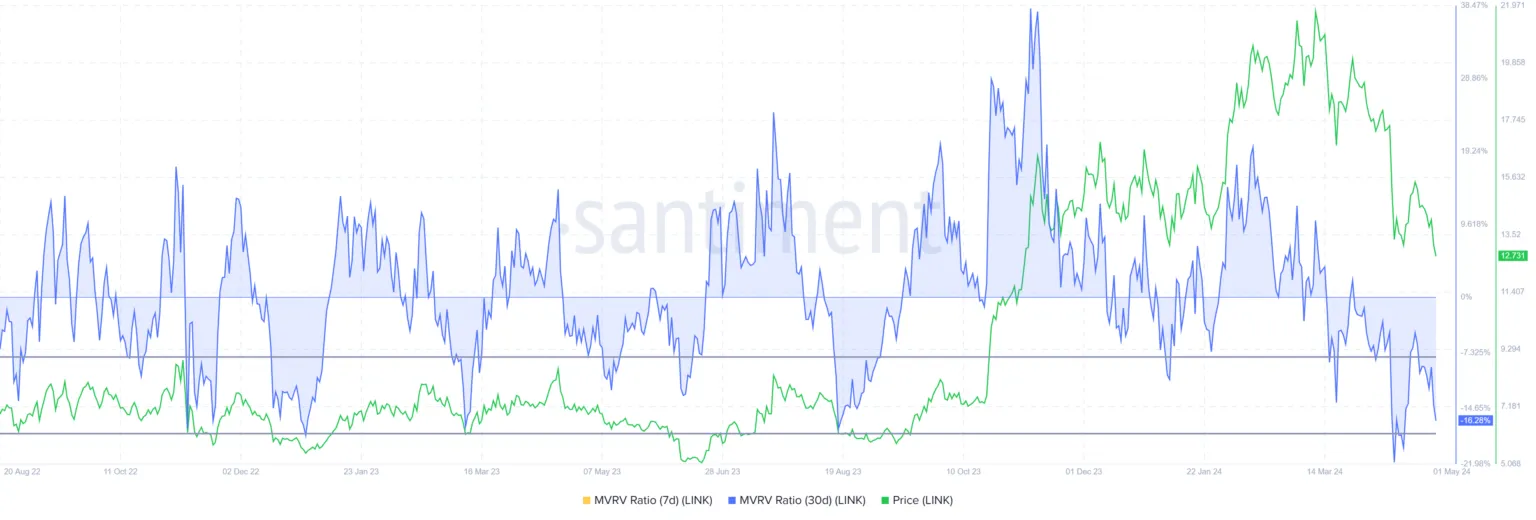

Despite the market challenges, LINK is currently undervalued, as indicated by the Market Value to Realized Value (MVRV) ratio. With a 30-day MVRV ratio of -16%, investors appear to be losing money, which may encourage token accumulation.

LINK has historically recovered from comparable positions, suggesting that there may be a “opportunity zone” for investors.

In the immediate term, LINK might see more drops, especially if it breaks through the $12.7 support level. The price may rise to $14.8 or higher in the event that LINK is able to maintain its hold above this support and regain the 23.6% Fibonacci Retracement level.