- Market sentiment reflects cautious optimism among Bitcoin HODLers, anticipating a rebound despite current bearish indicators.

- Decreased hash rate poses challenges for Bitcoin mining, potentially impacting network security and short-term price market.

Bitcoin investors have demonstrated resilience despite recent market declines, maintaining their positions amid turbulent conditions. As Bitcoin’s price decreased, holders predominantly refrained from selling, indicating their strong belief in the cryptocurrency’s long-term potential.

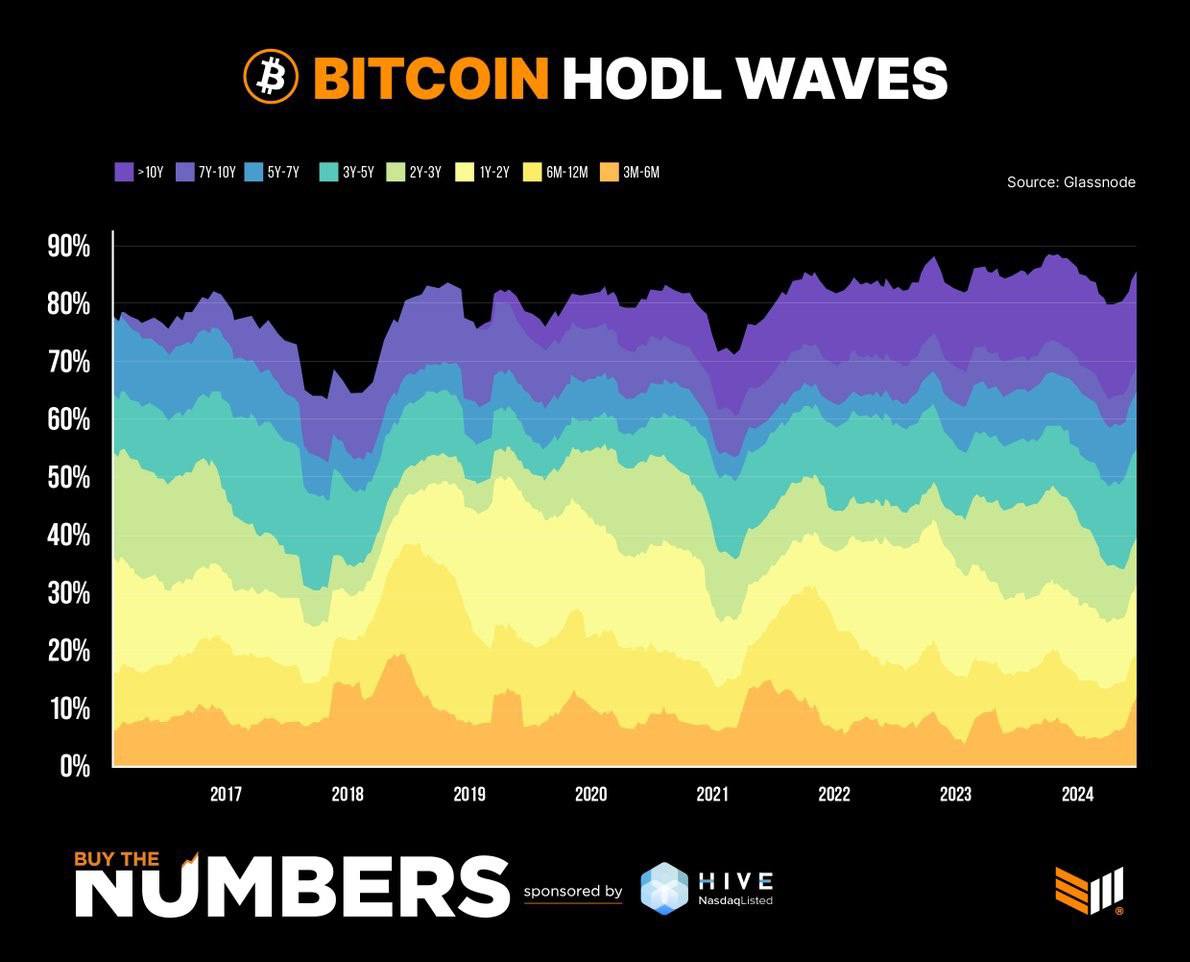

Recent data By ETHNews, shows that a significant majority of Bitcoin addresses continued to hold onto their assets, with less than 10% of Bitcoin being actively traded in recent months. This strategy, known as HODLing, reflects investors’ choice to retain their assets rather than sell them, even during periods of price downturns.

The current sentiment among HODLers suggests cautious optimism. Many anticipate a future recovery for Bitcoin, viewing the recent price decline as a temporary setback. This belief is supported by historical trends where market corrections have often been followed by renewed bullish trends.

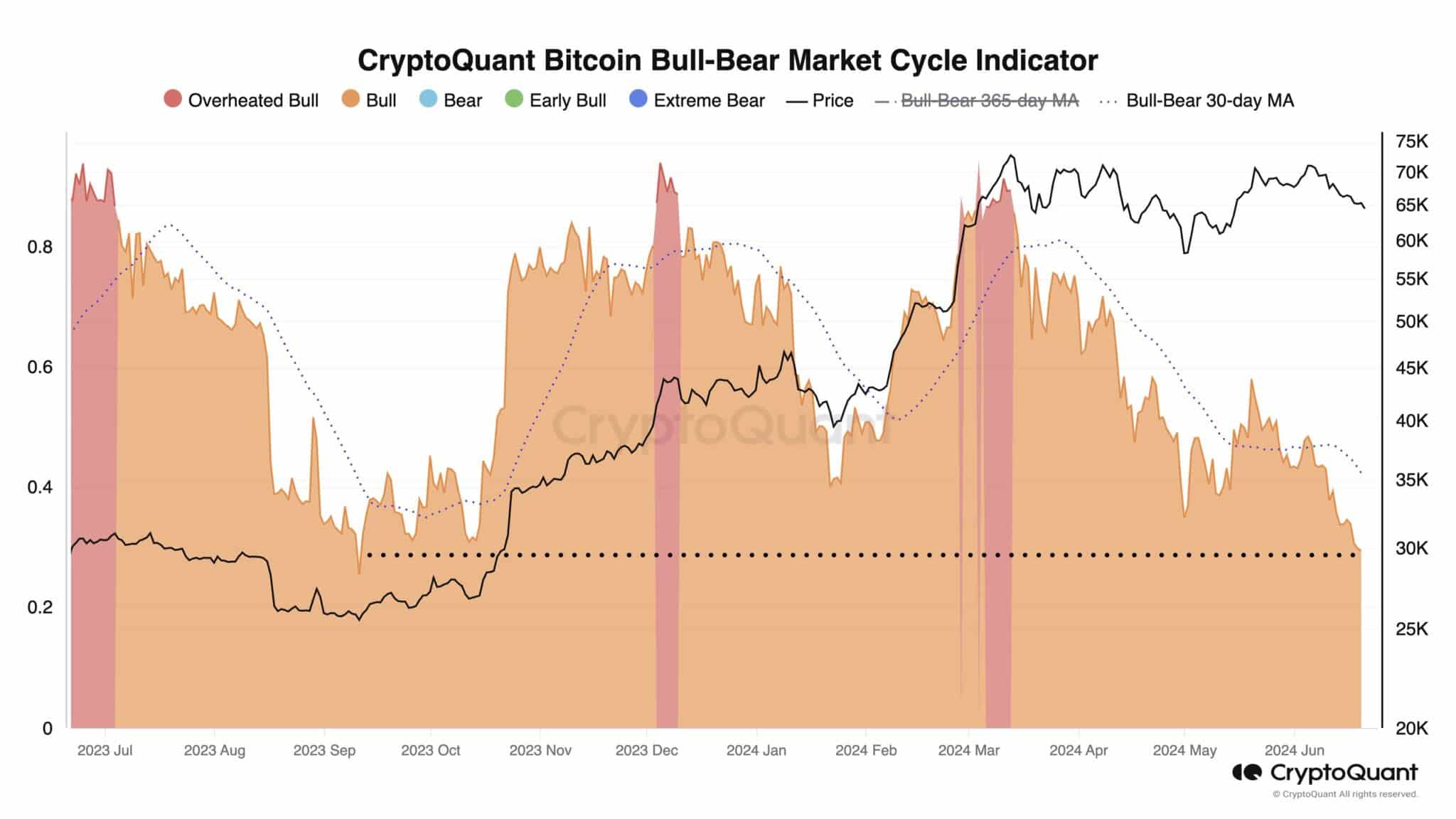

However, some investors may hesitate to sell at current prices, concerned about potential losses if Bitcoin’s value rebounds in the near future. This cautious approach aligns with broader market indicators, such as the Bitcoin cycle indicator, which indicates a decline in bullish sentiment compared to previous months.

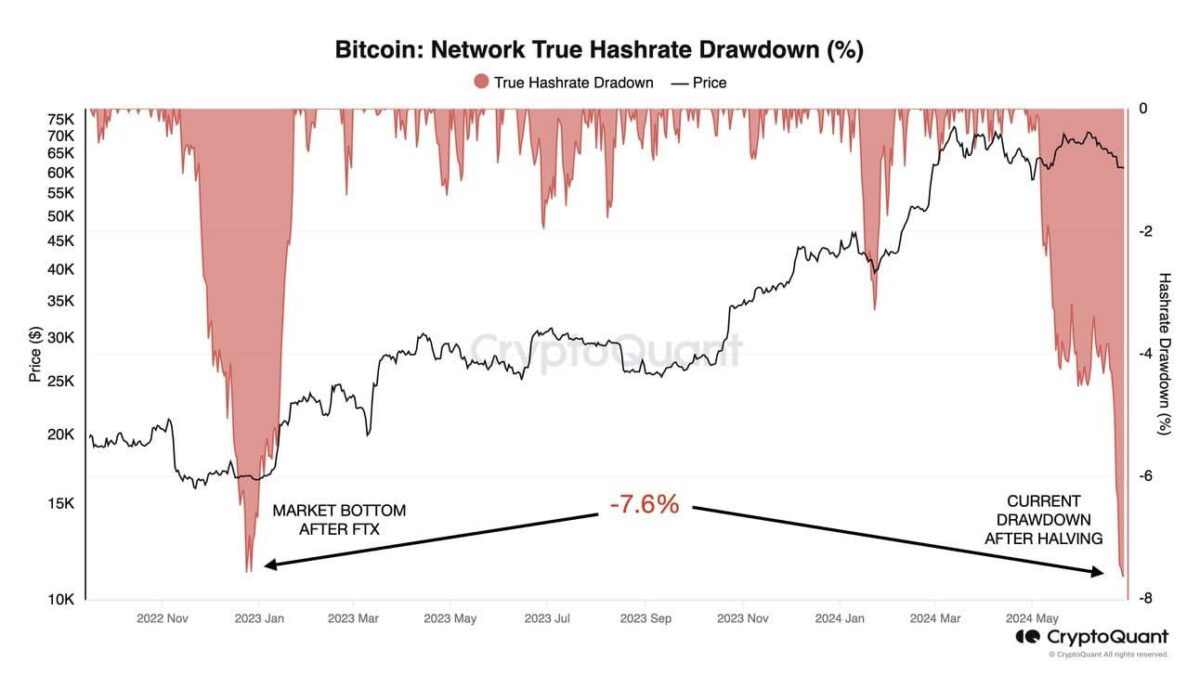

Additionally, the performance of Bitcoin miners is critical in shaping the cryptocurrency’s future trajectory. Recent reports indicate a notable decrease in hash rate, which measures the processing power securing the Bitcoin network. Such declines, similar to past market downturns, could potentially lead to increased centralization of Bitcoin mining operations.

Moreover, a drop in hash rate often coincides with miner capitulation, where miners sell significant amounts of Bitcoin to maintain profitability. This selling pressure could further impact Bitcoin’s price negatively in the short term.

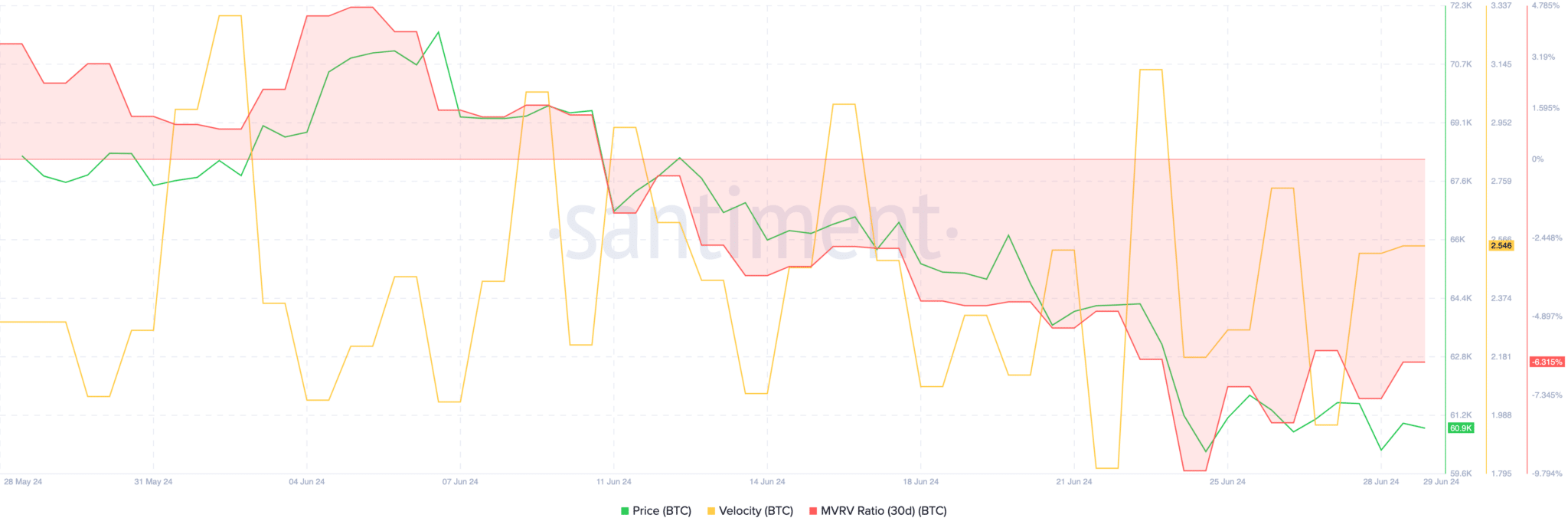

Despite these challenges, Bitcoin’s current trading price shows resilience amid market uncertainties. The increased trading velocity indicates heightened activity among traders, responding to market dynamics with increased transaction frequency.

Looking forward, the steadfast commitment of Bitcoin HODLers and the broader cryptocurrency community will likely play a pivotal role in stabilizing market conditions. As stakeholders navigate through fluctuating prices and mining challenges, the future of Bitcoin hinges on their confidence and strategic decisions.