- Ethereum’s price surge to $2,826 highlights its growing market presence alongside significant staking activity.

- The amount of ETH staked has more than doubled in the past year, indicating increased confidence in Ethereum’s future.

In the rapidly evolving landscape of cryptocurrency, Ethereum has once again captured headlines with a significant price surge, reaching $2,826 in a rally led predominantly by Bitcoin. This increase is not just a testament to Ethereum’s growing market presence but also reflects a broader, bullish sentiment across the cryptocurrency sector.

Ethereum Staking Gains Momentum

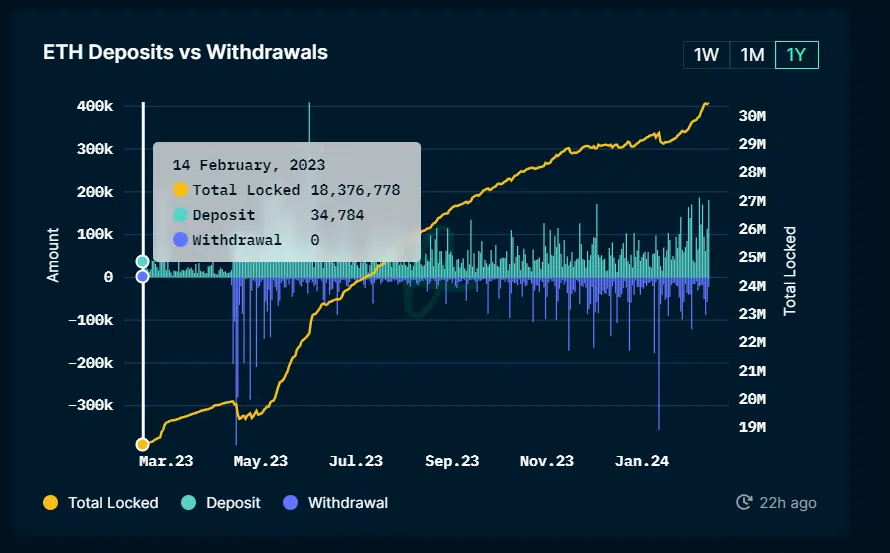

Parallel to the price surge, Ethereum’s staking ecosystem has witnessed a remarkable uptick. Data from Nansen, a leading on-chain analytics platform, reveals a substantial growth in the amount of ETH tokens committed to Ethereum’s staking contract, particularly on the Beacon Chain.

As of February 14, a whopping 30,659,864 million ETH tokens were locked, highlighting the community’s confidence in Ethereum’s future.

The same day saw an intra-day deposit volume of 18,172 ETH, with a relatively minor withdrawal of 197 tokens. With Ethereum’s market value pegged at $2,803 at that time, the monetary value of these staked assets approximated to $86 million.

However, this figure pales in comparison to the real-time data provided by Etherscan, which shows an even more significant increase in staked ETH, with the current figure standing at 39,140,039 ETH.

This translates to an astonishing $111,392,405,125 locked by network validators, underscoring the growing trust and investment in Ethereum’s network security and potential returns from staking. To explore this development in more depth, you can watch the YouTube video below:

An Upward Trend

Notably, a chart from Nansen illustrates a consistent upward trend in the number of tokens locked in the Ethereum staking contract over the past year. This growth is significant, with the staked amount more than doubling from 18.4 million ETH a year ago to the present figures.

This trend showcases the increasing adoption of Ethereum staking as a viable investment strategy, despite the price of ETH not doubling in the same timeframe.

Analysis of Nansen’s data reveals that the major players in Ethereum staking include Lido Finance, Coinbase, Figment, Binance, and Kraken.

These entities collectively control over 58% of all staked ETH, indicating a concentration of staking power among a few leading validators. This concentration highlights the importance of these platforms in supporting Ethereum’s network security and their significant role in the staking ecosystem.

At the time of writing, the price of ETH has risen 0.75% in the last 24 hours, reaching a price of $2,813.39. This represents an increase of 13.90% over the past 7 days.