- Traders targeting $340 with BNB face liquidation risk; low leverage is recommended to avoid losses.

- Increased trading volume and negative financing rate suggest caution; rebound towards $400 possible if conditions change.

For BNB, the current market situation shows a duality in traders’ expectations and strategies. With the Binance Coin [BNB] price at $326.93, there is a general uptrend in the cryptocurrency market. However, those traders targeting $340 could face liquidations if BNB experiences a pullback.

Liquidation, a common phenomenon in leveraged trading, occurs when a position is automatically closed due to an insufficient margin balance or upon reaching the stop-loss area.

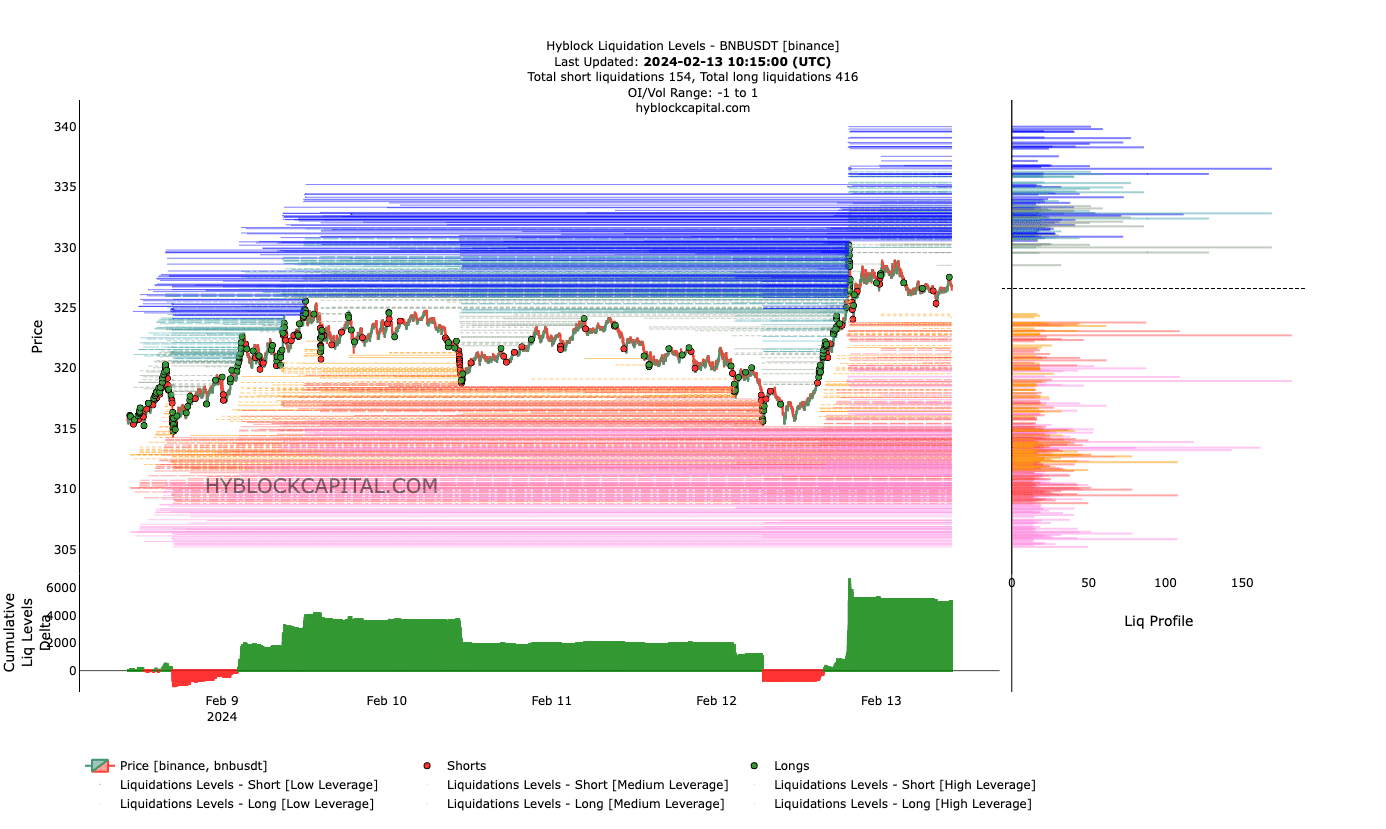

At this time, it is not advisable to place bets with high leverage. Analysis by ETHNews on BNB Settlement Levels shows a liquidity build-up from approximately $329 to $340, indicating estimated points where large-scale liquidations could occur.

While this does not imply that BNB cannot reach those prices in the short term, it would be prudent for traders planning to open long positions to use low leverage to avoid potential wipeouts.

The Cumulative Liquidation Level Delta (CLLD), which sums the difference between all long and short liquidation levels, is positive for BNB, suggesting a possible complete retracement and bearish bias. If confirmed, BNB’s price could fall to $315.

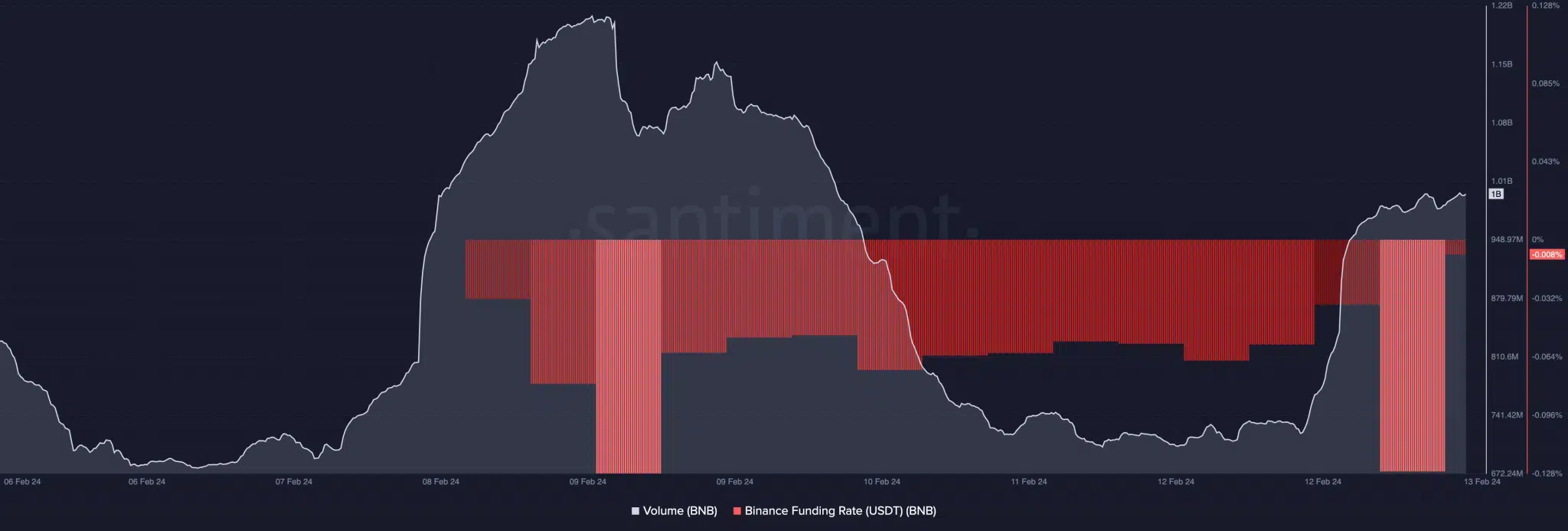

On theother hand, the $1 billion volume increase could be linked to the growing interest in the cryptocurrency. If BNB’s price continues to rise along with volume, it could surpass $327 in the near term. With this in mind, if the price falls while volume increases, BNB could lose upside momentum and correct by as much as 10% in the coming weeks.

As for the Funding Ratio, which is the cost of holding an open position in the derivatives market, it was found to be negative at the time of analysis. A negative Funding Ratio suggests that the perpetuity price is trading at a premium to the spot price.

Although the negative reading indicates that short positions are not aggressive, a rebound may not be immediately likely. Considering that, if the metric turns extremely negative, reaching -0.01%, BNB’s price could recover, making a move towards $400 plausible.

This scenario for BNB gives us a signal about the importance of a cautious trading strategy, especially for those using leverage. The dynamics between trading volume, settlement levels and the funding rate offer a complex picture that investors must consider in order to make informed decisions in a market that continues to exhibit volatility.