- Strong investor optimism and less selling pressure have kept Ethereum over $3,000, suggesting a possible rebound.

- Future regulatory changes and the transition of short-term to mid-term investor holdings could have a big influence on Ethereum’s pricing and stability.

Amidst attention on the cryptocurrency market and concerns surrounding World War 3, Ethereum (ETH) has managed to maintain a price above $3,000. This indicates a strong level of market confidence and suggests that investor resilience may be the driving force behind a possible comeback.

Investor Behavior and ETH Market Dynamics

Ethereum has continuously maintained its price above $3,000 during the last few trading sessions. In addition to giving the cryptocurrency a foundation, this degree of support has demonstrated the tenacity and resolve of its investment base.

HODLing, or holding onto investments—a practice that distinguishes Ethereum investors from other investors during volatile periods—is becoming more and more popular.

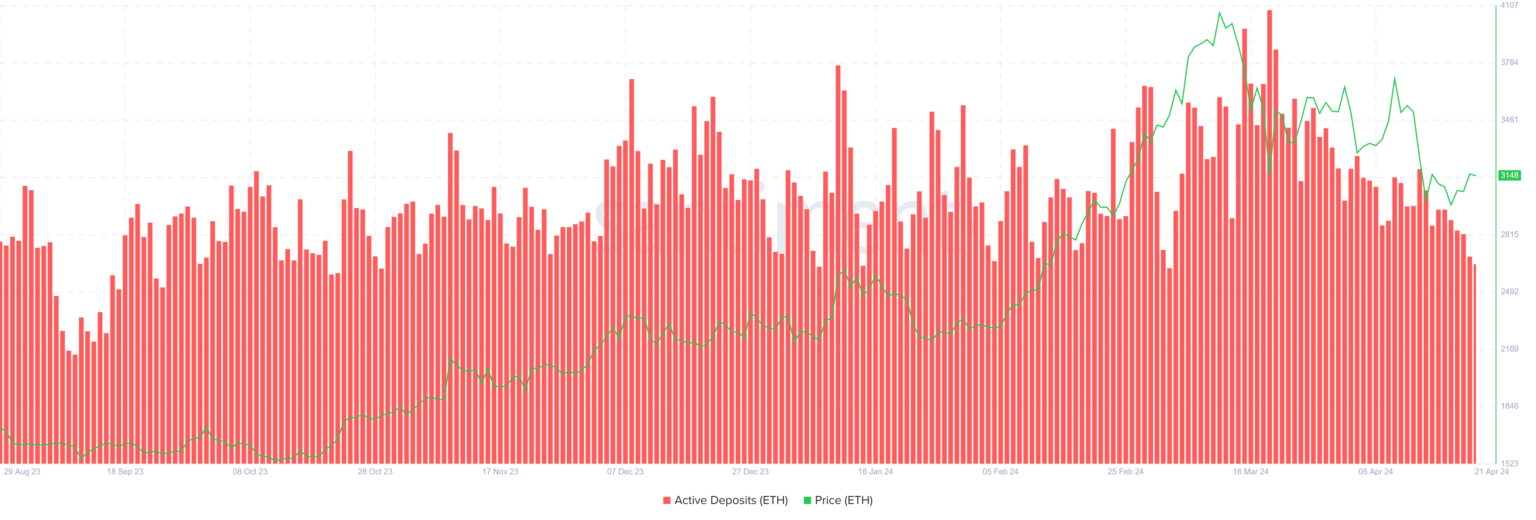

An other indication of this tendency is the decline in active deposits on the Ethereum network. A large quantity of active deposits typically signals investor preparedness to sell, either to realize gains or to reduce losses.

Nevertheless, Ethereum’s active deposits have dropped to a level not seen in seven months, indicating that fewer investors may be considering selling their holdings and lessening the possibility of significant sell-offs.

Changes to the Investment Period

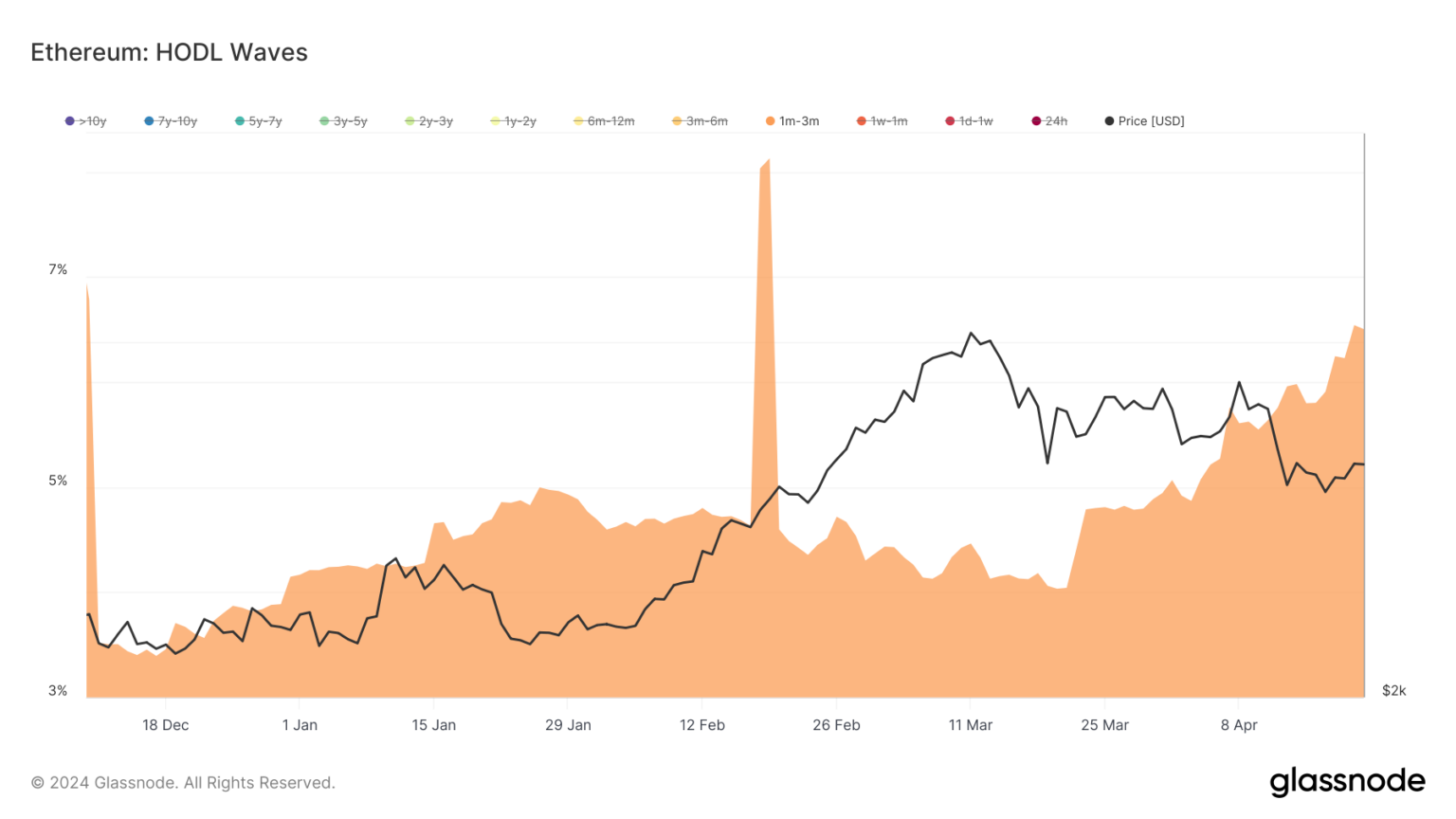

There has been a noticeable movement in the investor population, with a large supply shift from short-term to mid-term investors. According to Glassnode data, investors held a significant increase in Ethereum for a period of one to three months, totaling an addition of 638,000 ETH, which is valued at more than $2 billion.

This change suggests a stronger belief in the platform’s mid-term performance potential and mitigates the impact of short-term speculative trading on Ethereum’s price stability.

Possibility for Prices to Soar

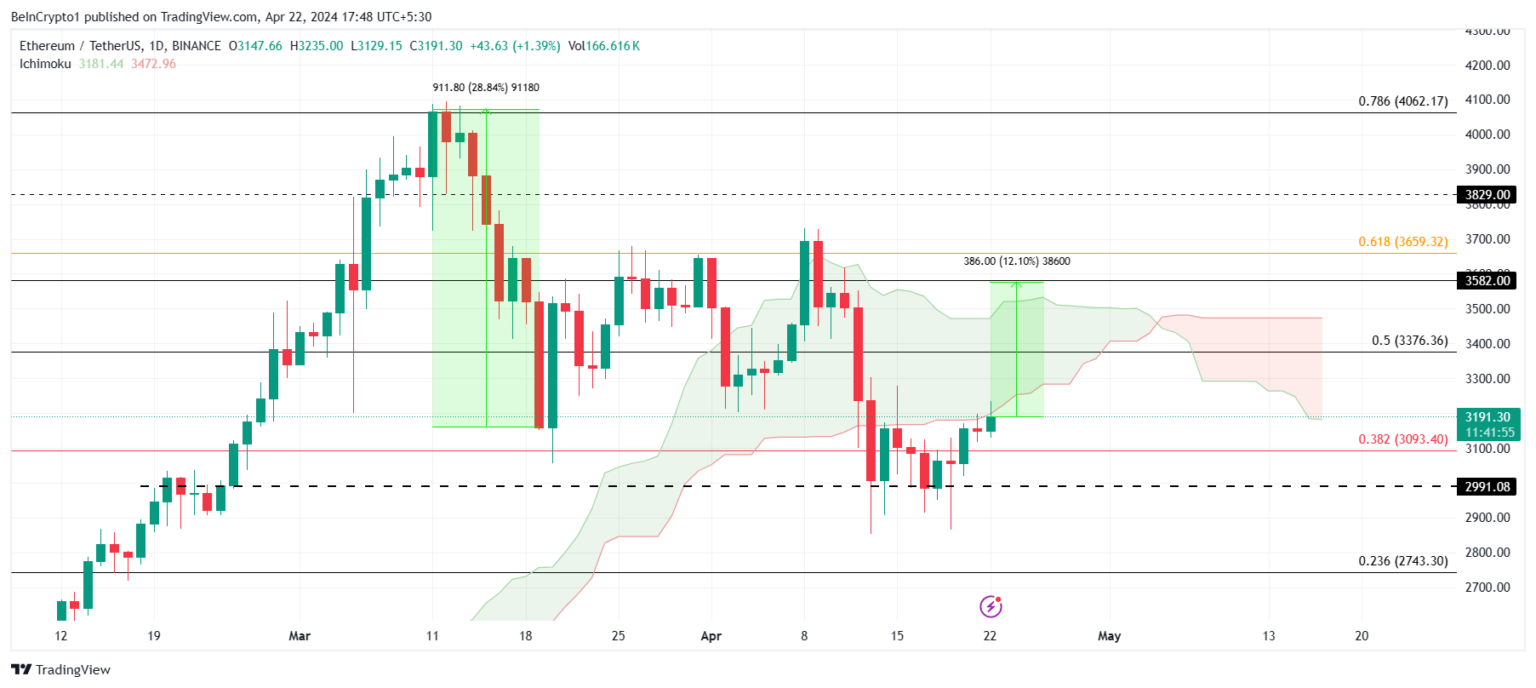

The price of Ethereum is expected to approach $3,500 due to the optimistic sentiment among its holders. Ethereum’s price trend indicates that it is gradually approaching $3,376.

This corresponds to the 50% Fibonacci retracement level from a prior high of $4,575 to a low of $2,743. The price may rise above the psychologically important $3,500 mark if this resistance is overcome, indicating further upward momentum.

But there are challenges, too. Ethereum runs the risk of dropping back to earlier support levels, especially at $3,093, if it is unable to clear the 50% Fibonacci level. Such a drop would not only reverse the present generally constructive trend, but it would also weed out many speculative positions.

Previously, in addition to the market’s volatility, Ethereum’s impending Pectra Upgrade was the highlight, which would incorporate EIP-3074 to improve wallet functionality and the overall user experience, as previously reported by ETHNews.

A Market Update and Changes in Regulations

At the time of writing, Ethereum’s price is $3,159.68, which is a 1.60% fall over the day so far. It has more than $10.66 billion worth of volume transactions, according to the latest data from CoinMarketCap.

As previously reported by ETHNews, the United States’ Securities and Exchange Commission (SEC) is also seeking public opinion regarding spot Ethereum Exchange-Traded Funds (ETFs).

The recently proposed spot Ethereum ETFs by Bitwise, Fidelity, and Grayscale, all respected asset management companies, may well affect investor sentiment and Ethereum’s regulatory environment.