- Fetch.ai may hit $3, according to its bullish trend, which is indicated by a recent rise in whale investments and a favorable technical pattern.

- FET shows investor accumulation and a bullish double-bottom pattern, pointing to possible large market developments.

The market outlook for the well-known altcoin Fetch.ai (FET) is currently favorable, which is primarily due to the optimism of its investors and new strategic alliances in the AI research and development sector.

Previously, Fetch.ai, SingularityNET, and Ocean Protocol announced the Superintelligence Alliance. According to prior ETHNews reports, the objective of this new conglomerate is to develop into the biggest independent AI research and development company.

Market Movements and Investor Sentiment

In order to serve as the economic glue that combines the FET, OCEAN, and AGIX tokens into a single entity, the alliance unveiled the ASI token. This action is anticipated to improve cooperative breakthroughs in AI technology and optimize efforts among the involved platforms.

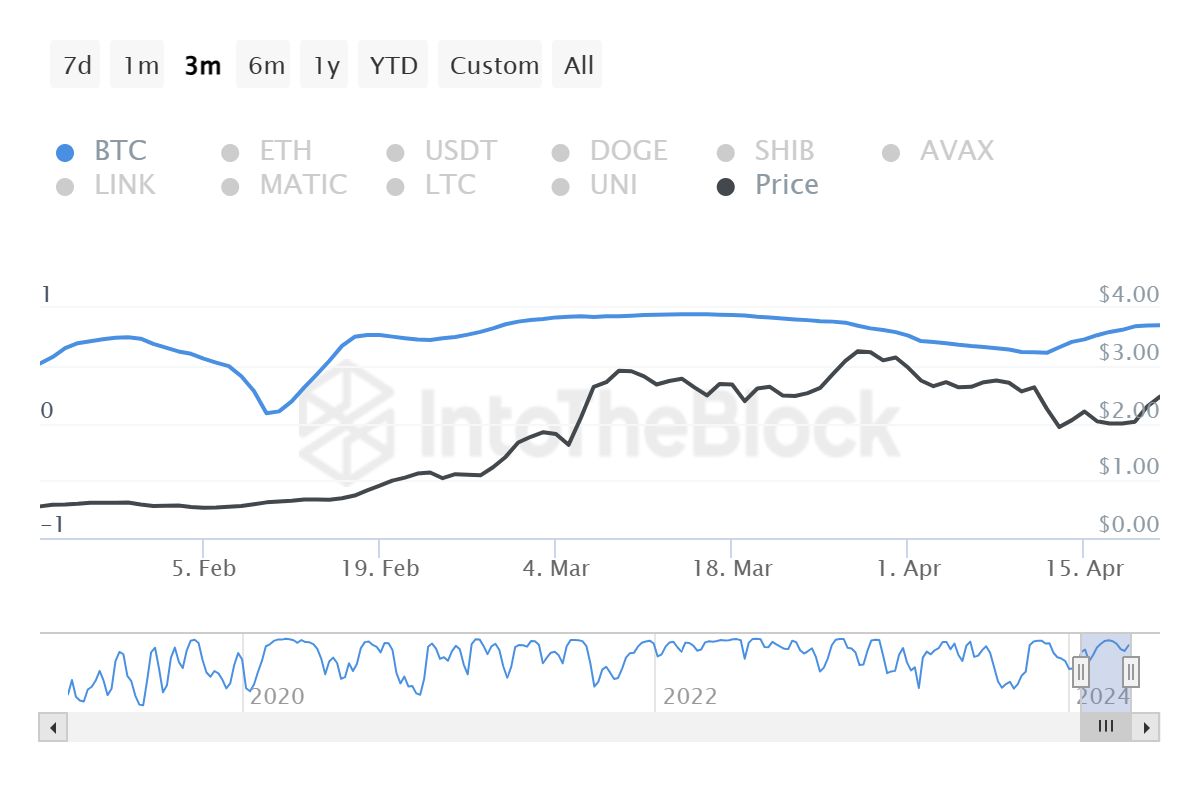

Strategic alliances, in addition to notable market activity, are driving the positive outlook for Fetch.ai. Big pocket investors, referred to as “whales,” have added $59 million to their holdings in the previous 48 hours.

This change in strategy from holding to accumulating, supported by the overall market dynamics, indicates a growing sense of confidence in an imminent rally.

The market behavior of the cryptocurrency also largely depends on Bitcoin’s post-halving optimism, echoing earlier coverage by ETHNews.

Also, there is a strong correlation between Fetch.ai and Bitcoin, which experienced a recent halving event. Historically, these occurrences cause a supply shock, which raises the price of Bitcoin and benefits linked assets like Fetch.ai.

Technical Analysis and Price Movements

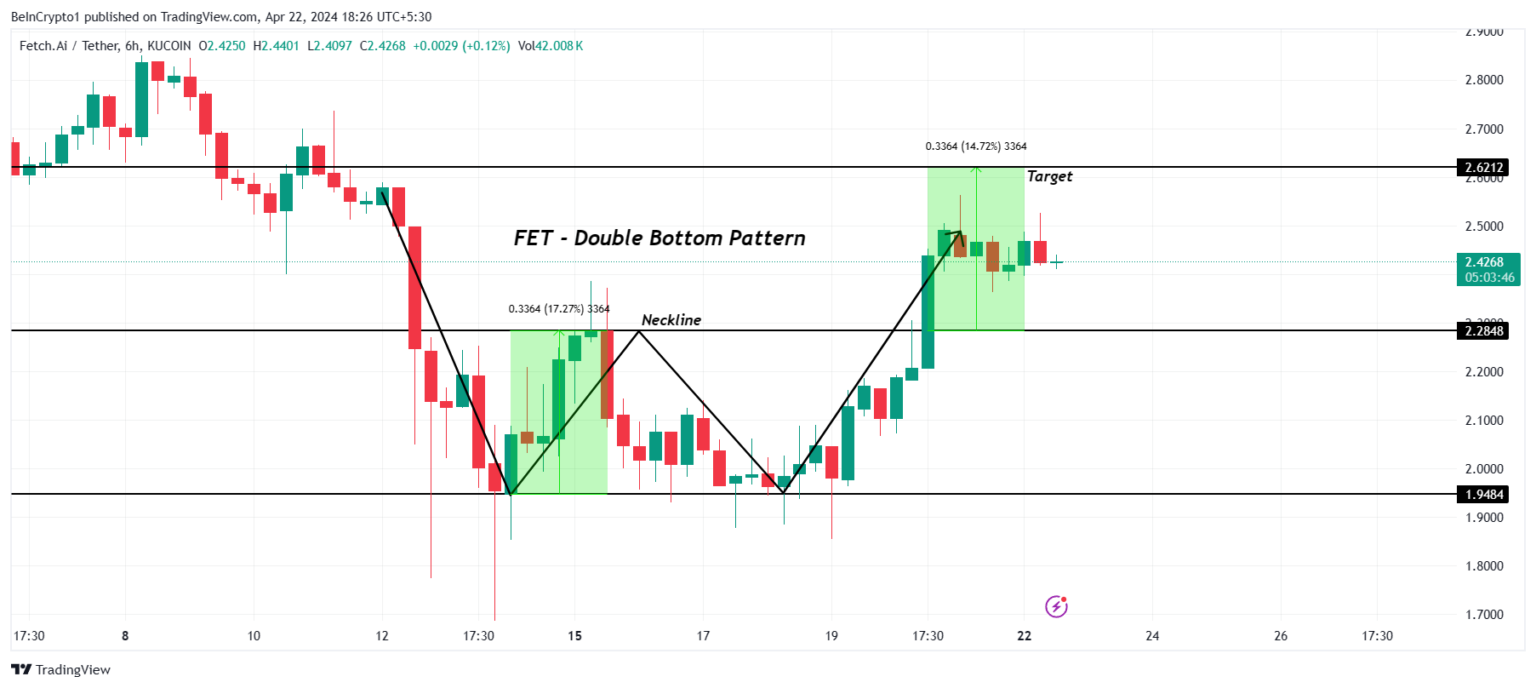

Technically speaking, the price action of FET is building a bullish double-bottom pattern, and the price at $2.42 suggests that there may be a reversal from the current decline.

The goal chosen in accordance with this pattern is 14.72% above the neckline, indicating substantial upward potential, after breaking through the neckline at $2.28.

There are possible hazards, though, to take into account. Should bearish indications prevail, Fetch.ai may attempt a retest of the $2.28 neckline as support. If this level is not held, the bullish argument may be refuted, and the price may drop to $2.10, wiping out recent gains.