- Ethereum’s resurgence following the halving of Bitcoin is in stark contrast to a precipitous decline in staking volumes, which suggests a decline in network activity.

- Ethereum has recently dropped to $3,170.22, but if specific price levels are met, there may be positive catalysts in store.

Ethereum (ETH) has given conflicting signals as the cryptocurrency market reels from the most recent halving of Bitcoin.

The network has struggled with staking downturns and large outflows, yet its market price has remained resilient. In light of these developments, here’s a thorough examination of Ethereum’s current status.

Staking Declines Despite Improvement

Due to its effect on miners’ payouts, the Bitcoin halving event is a key milestone for cryptocurrencies. This event also has an indirect impact on Ethereum. After halving, Ethereum showed a recovery in value after first seeing a price decline.

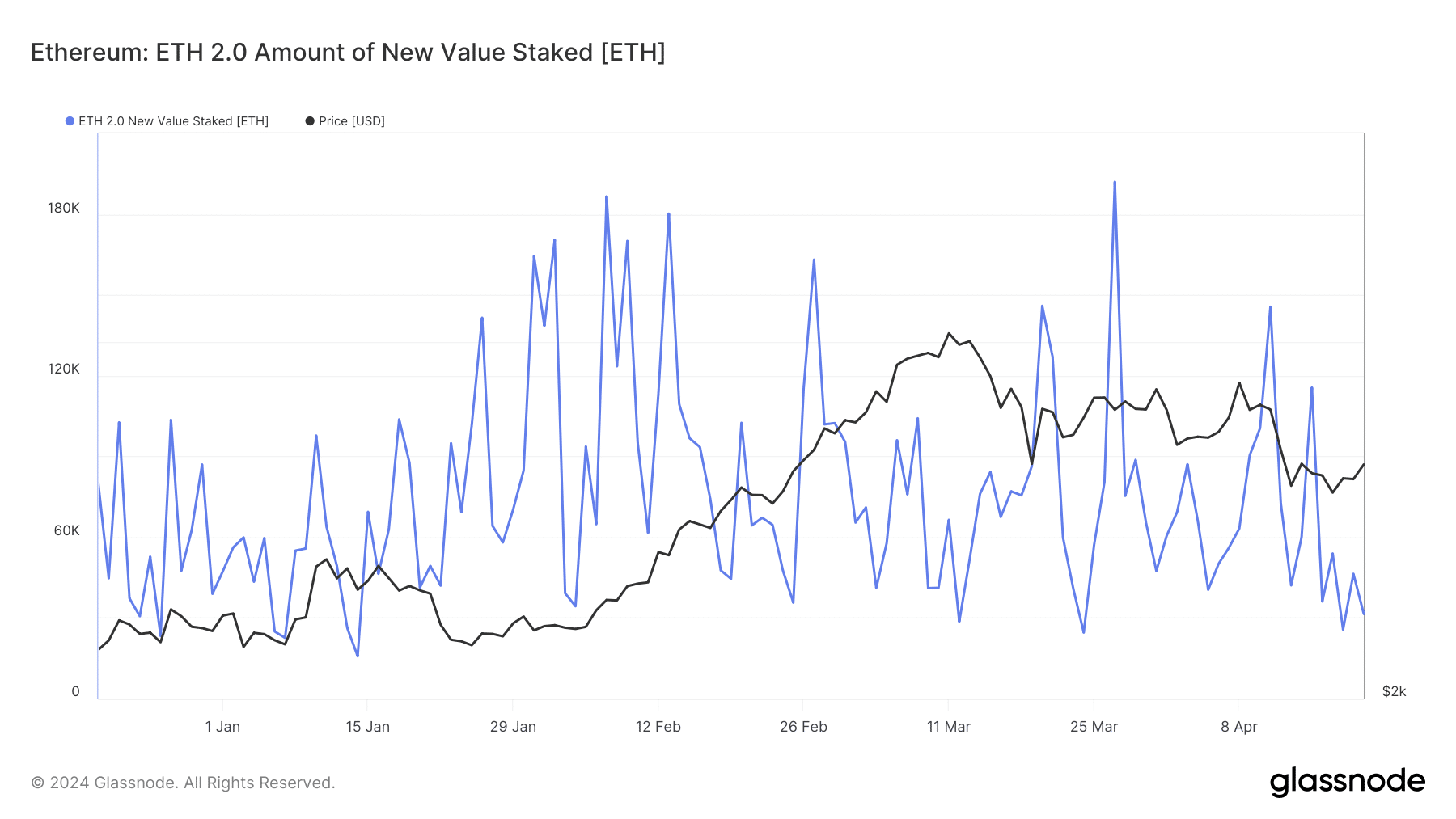

Ethereum’s staking activity, however, reveals a different picture. The volume of new stakes has decreased, which is problematic.

Staking volumes first peaked at around 115,000 ETH around April 15th, but they then abruptly dropped to 31,441, representing a fall of almost 80,000. It suggests that people are becoming less confident or interested in using staking to secure the network.

ETH Staked Overall Is Still High

Even with daily swings in staking, the total amount of ETH staked is still substantial, exceeding 43.9 million. This implies a sustained dedication from a segment of the Ethereum community, despite a decline in daily contributions, in line with what ETHNews previously disclosed.

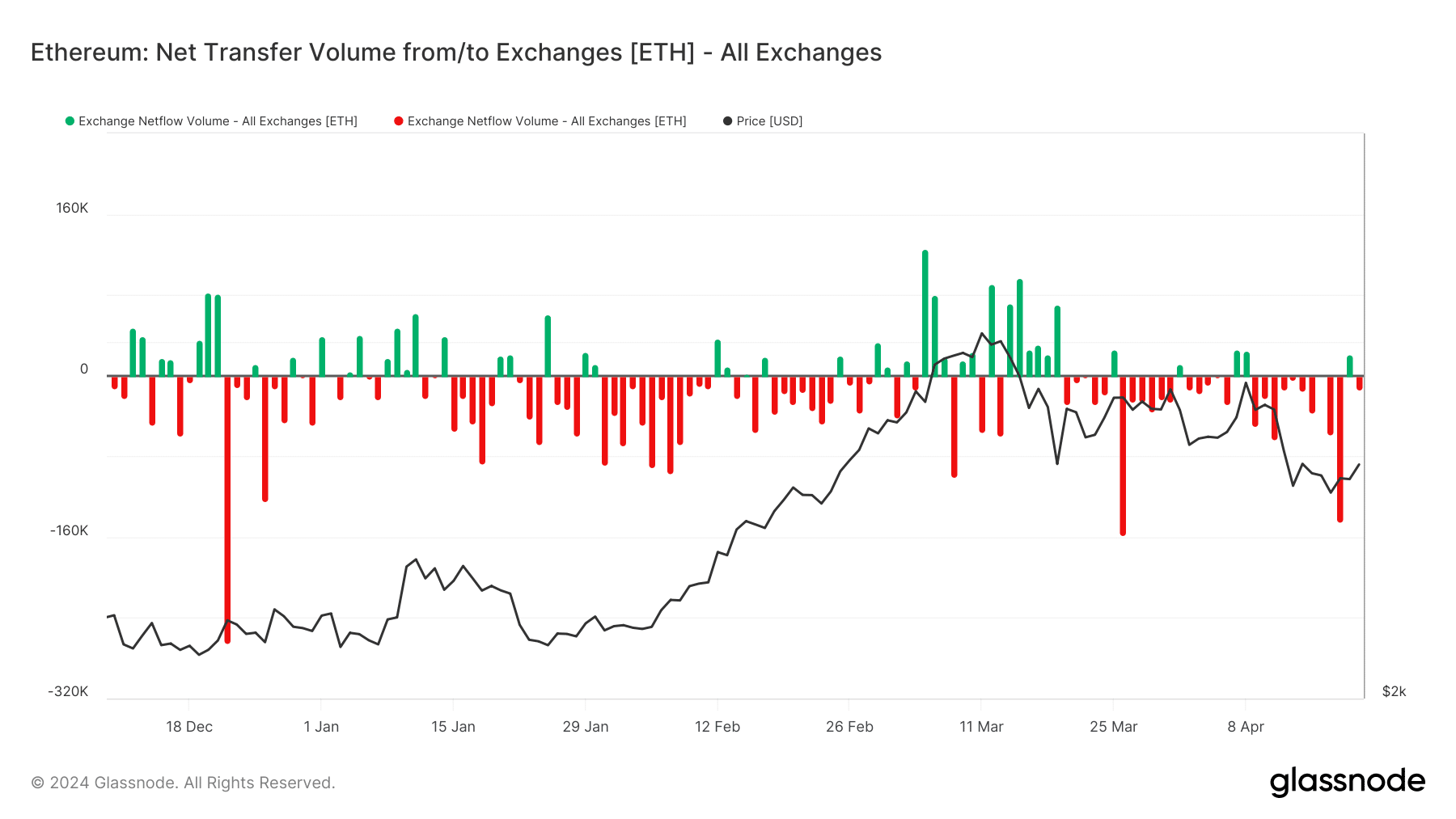

In the days that have followed April 20, the Ethereum market has experienced more outflows than inflows; one of the biggest outflows was observed on April 18th, totaling approximately 144,800 ETH.

This trend points to a departure from exchanges, which could be seen as a move toward private storage options or as a readiness for future price volatility.

Trends in ETH Prices and Analyst Forecasts

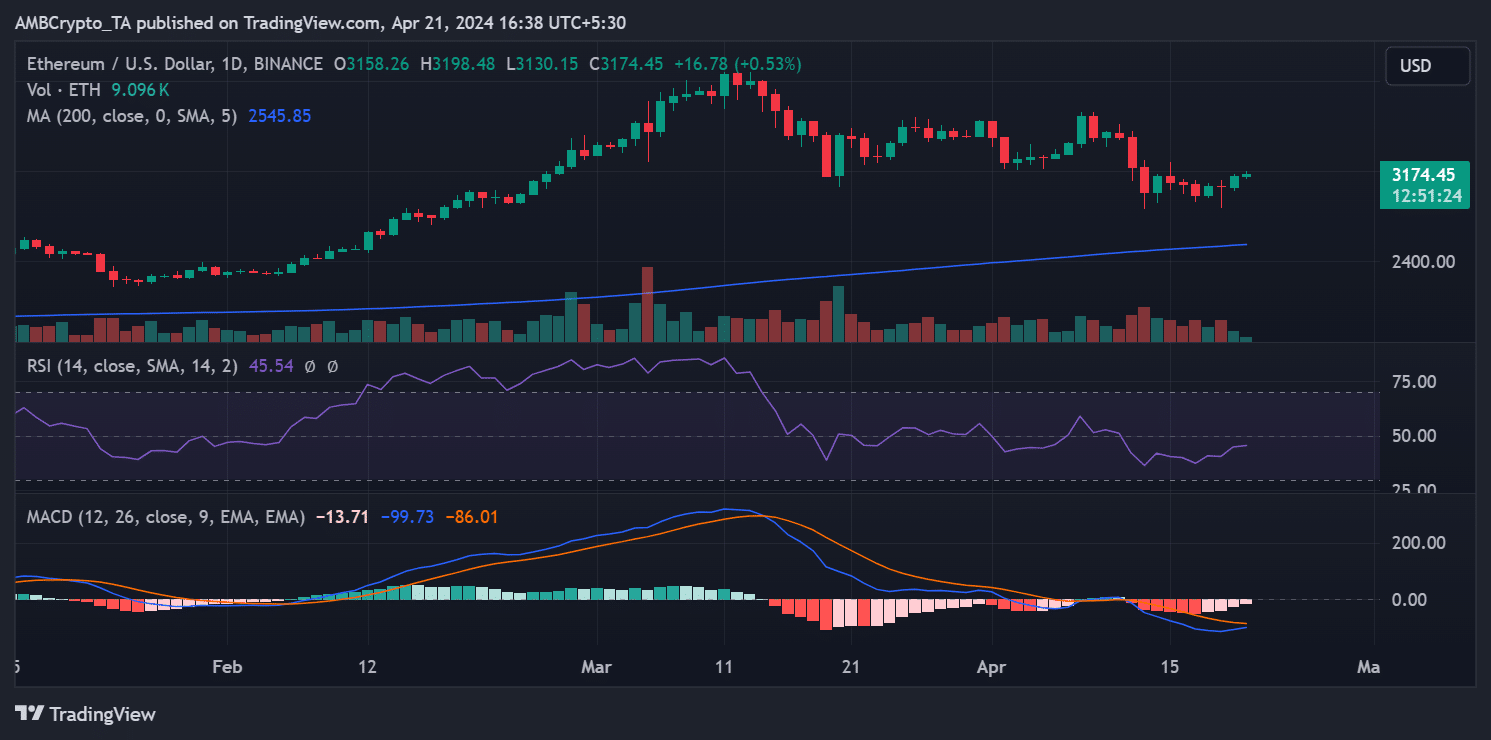

As of this writing, ETH is trading at $3,170.22, down 1.31% from the previous day and a little less than 2.48% from the previous week.

Since Ethereum’s Relative Strength Index (RSI) is still below the neutral line, suggesting that there may be more bearish momentum ahead, the price movement is still unclear.

But opinions on the market could change. A popular cryptocurrency analyst, Cryptoninja.eth, said that Ethereum would continue to rise positively if prices breached a particular “orange area” on his charts, which were posted on X.

LONG: #ETHUSDT $ETH by @melikatrader94

Opportunity for price to move up if it breaks the orange area, consider setting a stop limit order.

Enrols: https://t.co/CexC9C3jGH#crypto #market_analysis #tradingopportunity pic.twitter.com/CV9nILPpp4

— Cryptoninja.eth (@DrCryptoNinja) April 23, 2024

On the other hand, if prices drop further, he finds a possible buying zone near $2,500, which also happens to be the lower bound of a Down Channel pattern.