- Accumulation addresses are defined by a lack of withdrawals and holding over 10 BTC, excluding miners and exchanges

- Investors stockpile Bitcoin before the halving, betting on its value to increase as new Bitcoin creation rate halves

On April 16, Bitcoin traders seized an opportunity as the cryptocurrency’s price dipped below $63,000. During this period, a staggering 27,700 Bitcoins, valued at approximately $1.7 billion, were transferred into “accumulation” wallets.

These wallets, characterized by their lack of historical withdrawals and holdings of over 10 BTC, are typically used by investors who intend to hold onto their assets long-term, rather than trade them on exchanges.

This recent influx set a new record for daily transfers to such wallets, surpassing the previous record of 25,500 Bitcoins on March 23. The activity indicates a robust confidence among Bitcoin holders, reinforcing their commitment to the digital asset during price fluctuations.

Analysts note that this behavior is common around the $63,000 price mark, suggesting it as a critical support level for the currency.

Accumulation addresses are distinguished from others by strict criteria, including inactivity in terms of withdrawals and a track record of at least seven years. Notably, these addresses are carefully vetted to exclude those associated with miners and cryptocurrency exchanges, ensuring the data accurately reflects genuine investor behavior rather than business operations.

The phenomenon of bolstering holdings during price dips isn’t new but underscores the ongoing belief among some investors that Bitcoin remains a valuable long-term investment.

This strategy is particularly pronounced as the market anticipates the upcoming Bitcoin halving, an event that historically influences price increases due to the reduced rate of new Bitcoins entering circulation.

As the market approaches this milestone, the strategic accumulation of Bitcoins could be a savvy move for those betting on the cryptocurrency’s future value.

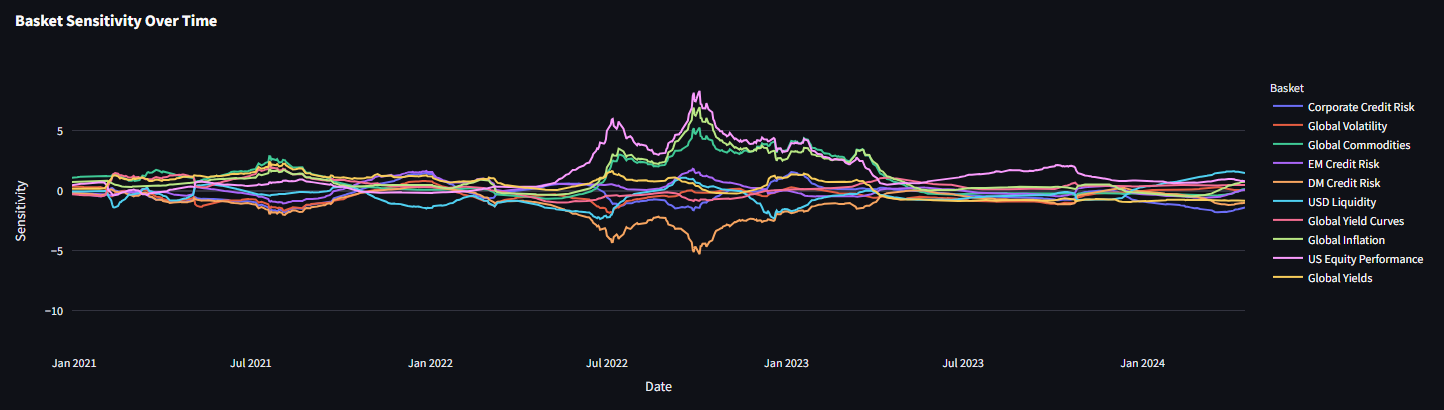

This year’s Bitcoin halving event coincides with unique market conditions shaped by extensive institutional engagement and evolved trading frameworks, possibly affecting its anticipated economic impact.

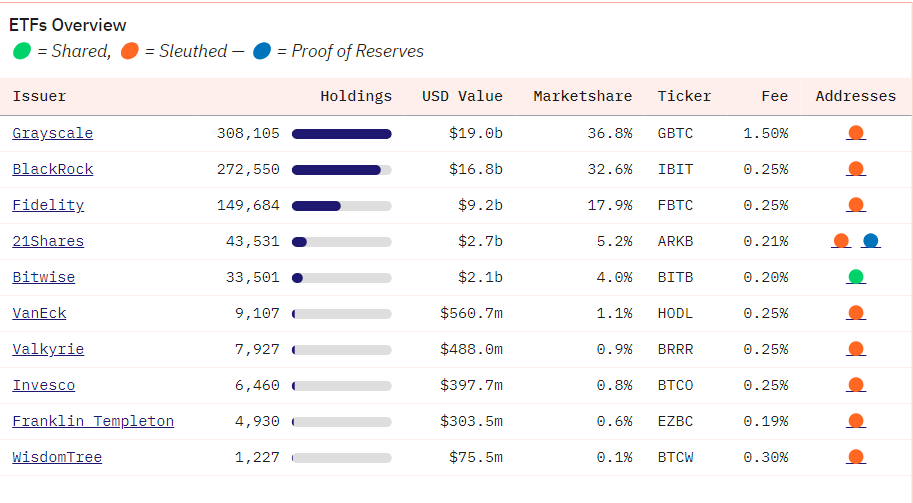

Unlike previous cycles, significant investments from institutional players and the successful launch of numerous bitcoin ETFs have introduced a higher level of liquidity and market integration for bitcoin.

The halving, a scheduled reduction of mining rewards that diminishes the number of new bitcoins entering circulation, historically precedes significant increases in Bitcoin’s price due to reduced supply.

However, with the current advanced market awareness and preparation by large institutional entities, the expected reduction in supply might have already been factored into bitcoin’s present value.

For instance, BlackRock’s bitcoin fund has seen substantial inflows, indicating strong institutional interest which may stabilize price fluctuations post-halving. These investors typically have a longer-term investment horizon which could smooth out potential volatility caused by reduced miner rewards.

Additionally, global economic conditions such as increased interest rates and inflation contrast starkly with the climate during previous halvings. These changes make high-risk investments like bitcoin less appealing to certain investors, potentially tempering a post-halving price surge.

Technological developments within the Bitcoin network, such as the implementation of the Ordinals protocol, have also introduced new functionalities and revenue opportunities for miners. These advancements could influence economic activity on the blockchain and alter the historical effects of the halving.

While the upcoming Bitcoin halving will decrease the daily output of new bitcoins from approximately 900 to 450, its impact on the market might be moderated by these substantial institutional and economic changes.

The integration of bitcoin into mainstream financial products, along with macroeconomic factors, are pivotal considerations that may influence the traditional outcomes associated with past halvings.