- Grayscale Faces High Fee Challenges Compared to Industry Leaders Like BlackRock and Fidelity in ETF Arena.

- Despite Speculation, Analyst Doubts Grayscale Will Reduce Fees; Predicts Moderate Outflows from Upcoming Ether ETF.

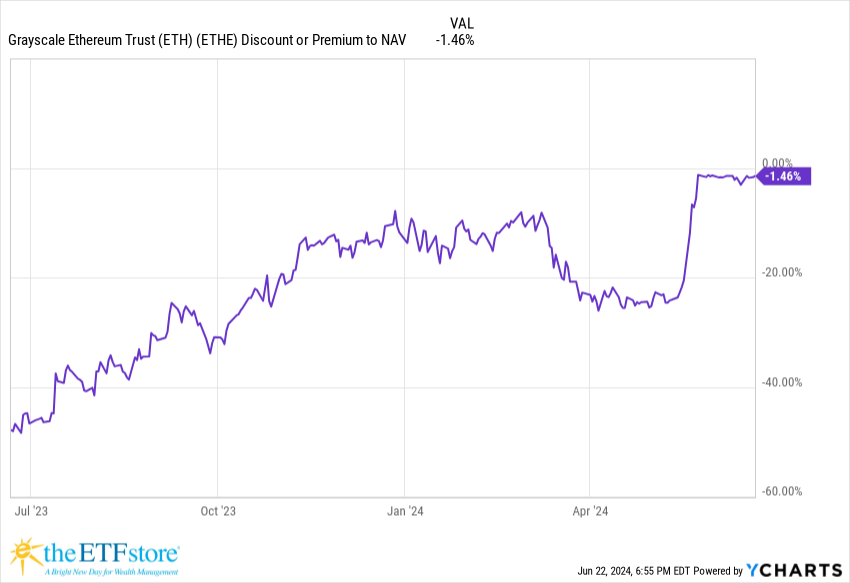

The Grayscale Ethereum Trust (GET) has reported a decrease in its discount to net asset value (NAV), now at 1.45% from a previous high of nearly 50% a year ago. This reduction aligns with the recent U.S. Securities and Exchange Commission’s (SEC) approvals of several Ethereum exchange-traded funds (ETFs), impacting the broader cryptocurrency investment sphere.

Was 20%+ just before “surprise pivot by SEC” in mid-May. – Source: @NateGeraci

Following these approvals, the SEC’s attention now turns to the approval of various S-1 registration forms required for these ETFs to commence trading. SEC Chair Gary Gensler hinted that the products might hit the market this summer, although a fixed timeline remains unannounced. ETF analyst Nate Geraci projects that final endorsements for Bitcoin ETFs could be imminent, potentially within the next week.

I’m deciphering this as spot eth ETFs will be approved this week…

Just me tho. https://t.co/rFrMThytgC

— Nate Geraci (@NateGeraci) June 23, 2024

Grayscale, known for its higher fee structure relative to competitors like BlackRock and Fidelity, faces competitive pressure. Grayscale’s Bitcoin Trust (GBTC) operates with fees significantly above the industry average, which has historically triggered substantial capital outflows.

Market speculation swirls around potential fee reductions by Grayscale to enhance its market position. However, Geraci expresses doubts about fee cuts for its major funds, instead suggesting that fee adjustments might target its newer, smaller offerings such as the Ethereum Mini Trust.

Geraci also forecasts moderate outflows from Grayscale’s forthcoming ETH ETF, expecting them to be less severe than those previously experienced by GBTC.

Ethereum (ETH) is currently trading at 3491.76 USDT, down 0.11% from the previous day. Recently, ETH has decreased by 2.13% over the past week and 7.68% over the past month.

ETH holds strong support around $3400, with resistance expected around $4000-$4800. Trading volume shows typical market behavior. Short-term, ETH could see a bullish turn if it successfully rebounds from its current support; otherwise, it might dip further. Long-term, positive regulatory signals and Ethereum ETF discussions could push ETH towards $4000-$4800.