- Spot Ether ETFs may lower Ethereum’s price to around $2,400, predicts Andrew Kang of Mechanism Capital.

- Institutional interest in Ethereum is notably lower than Bitcoin, influencing the potential success of ETH ETFs.

The introduction of spot Ethereum ETFs could potentially lower Ethereum’s market value to approximately $2,400, suggests Andrew Kang from Mechanism Capital. Ethereum, while rich in potential with its decentralized finance and Web3 applications, doesn’t attract as much institutional interest as Bitcoin, which might impact the inflow of capital into Ethereum ETFs.

Presently, Ethereum’s price stands at about $3,315, reflecting a decrease of 5.1% over the last 24 hours, a decline that aligns with broader negative market trends.

The anticipated further price drop could be influenced by several factors, including the subdued institutional enthusiasm compared to Bitcoin, predicted to result in lower capital inflows for Ethereum ETFs than those seen for Bitcoin.

To illustrate, Bitcoin ETFs drew approximately $5 billion in the six months following their launch. Applying similar metrics, Ethereum ETFs could see inflows of roughly $840 million during a comparable timeframe.

Does that mean ETH will go to zero? Of course not, at some price it will be considered good value and when BTC goes up in the future, it will be dragged up with it to some extent. Before the ETF launch, I expect ETH to trade from $3,000 to $3,800. After the ETF launch my expectation is $2,400 to $3,000. However, If BTC moves to $100k in late Q4/Q1 2025, then that could drag ETH along to ATHs, but with ETHBTC lower. “

Kang also points out the broader challenges Ethereum faces in market perception. Lower network transaction fees, due to reduced activities in decentralized finance and non-fungible tokens, could devalue Ethereum’s financial appeal, drawing parallels to overvalued tech stocks.

The recent unexpected regulatory approval of Ethereum ETFs left issuers with little time to develop and execute effective marketing strategies, further complicating the situation. The absence of staking options in the ETF proposals may also deter investors from converting their holdings, which could weaken the expected influx of capital.

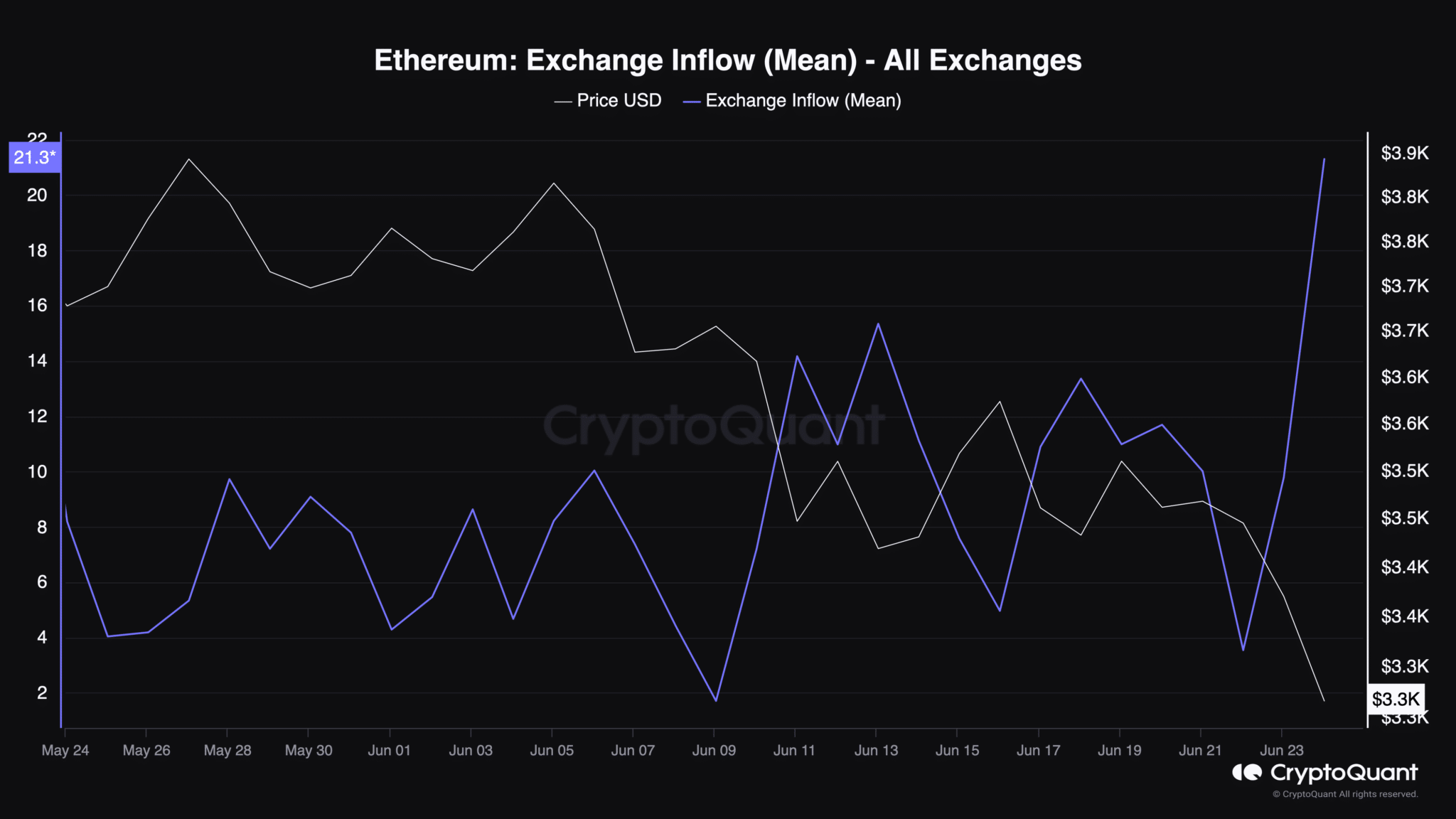

Despite Kang’s bearish perspective, Ethereum exhibits some positive signs. Notably, there has been a recent increase in daily active addresses, indicating a complex market trading. However, data from CryptoQuant highlights an increase in Ethereum deposits on exchanges, suggesting a possible rise in selling pressure.

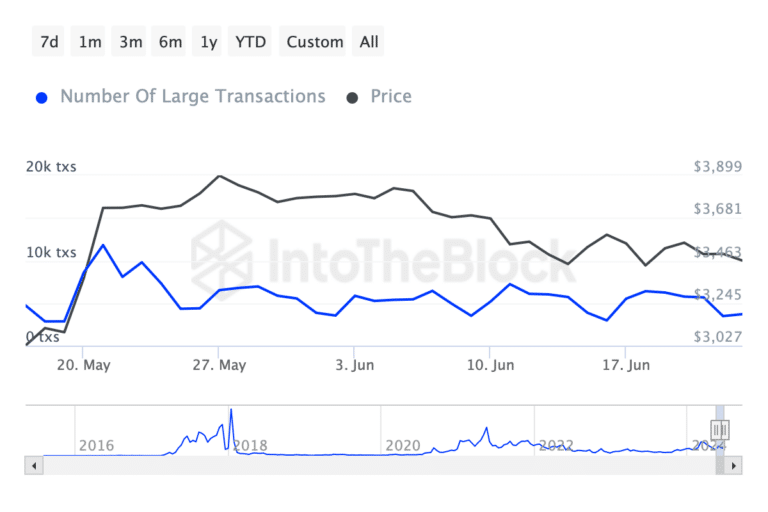

This observation is supported by IntoTheBlock’s data, which shows a decrease in large Ethereum transactions.

While the immediate future poses challenges for Ethereum, particularly with the initiation of its ETFs, the overall strength of its network and broader market might shape its future direction. If Bitcoin experiences a rally, it might also positively influence Ethereum’s value, albeit potentially at a lower relative valuation.