- New spot Bitcoin ETFs accumulate more than 200,000 BTC, surpassing holdings of giants such as MicroStrategy and Tether.

- BlackRock and Fidelity lead with Bitcoin ETFs, showing investor preference for new options over Grayscale’s GBTC fund.

The recent emergence of nine U.S. spot Bitcoin ETFs, excluding Grayscale’s converted fund, has marked a point of growing interest in the cryptocurrency sector.

These funds, in less than a month of operations, now manage over 200,000 BTC in assets, a volume that underscores the growing acceptance and confidence in Bitcoin as a viable investment asset.

Impressive Growth in the Bitcoin ETF Sector

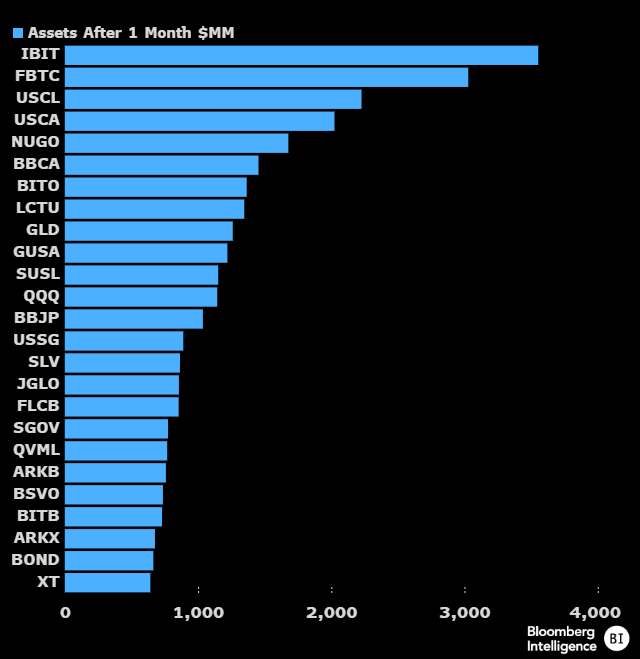

Since their launch on Jan. 11, these ETFs have amassed 203,811 BTC, valued at $9.5 billion as of yesterday’s close, according to K33 Research. Notable among them are names like BlackRock (IBIT), Fidelity (FBTC), Bitwise (BITB), and others, which now hold about 1% of the total Bitcoin supply, surpassing the holdings of big players like MicroStrategy and more than triple those of Tether.

BlackRock’s ETF (IBIT) leads with over 80,000 BTC in assets under management, followed by Fidelity’s FBTC with over 68,000 BTC. This dominance of IBIT and FBTC highlights not only the interest in Bitcoin but also the confidence in these financial institutions to manage cryptoassets efficiently.

Market Impact and Investor Confidence

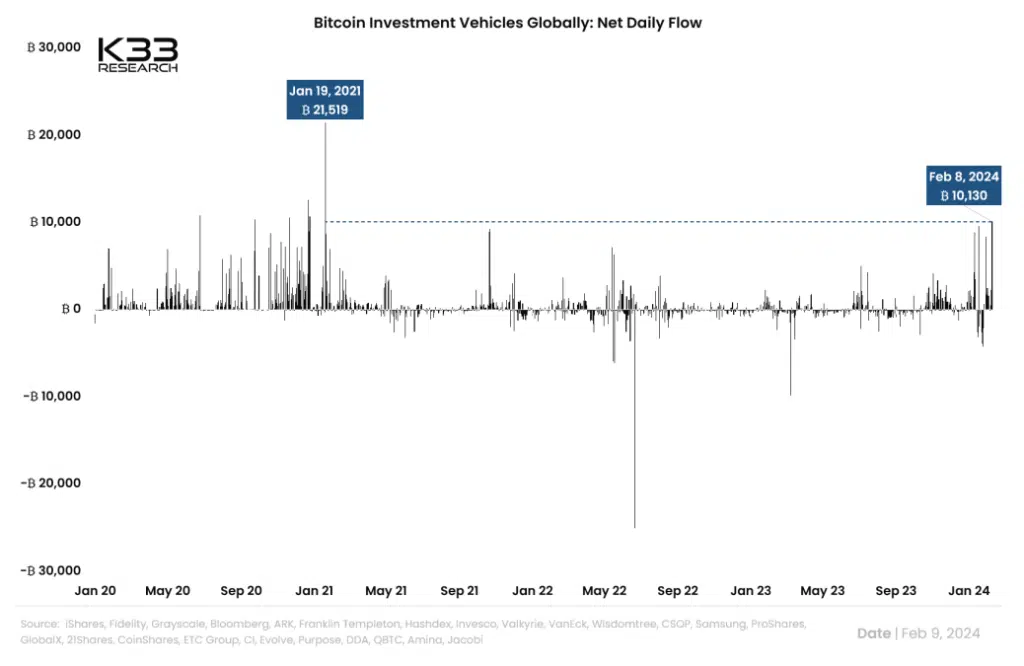

The fact that BlackRock’s IBIT ETF outperformed Grayscale’s fund in trading volume on Thursday, with $481.6 million versus GBTC’s $373.9 million, demonstrates a significant shift in where investors are placing their confidence and capital.

This strong day for inflows, with IBIT and FBTC adding $204.1 million and $128.3 million respectively, contrasts with $101.6 million in GBTC outflows, highlighting a shift in investor preference toward new Bitcoin investment vehicles.

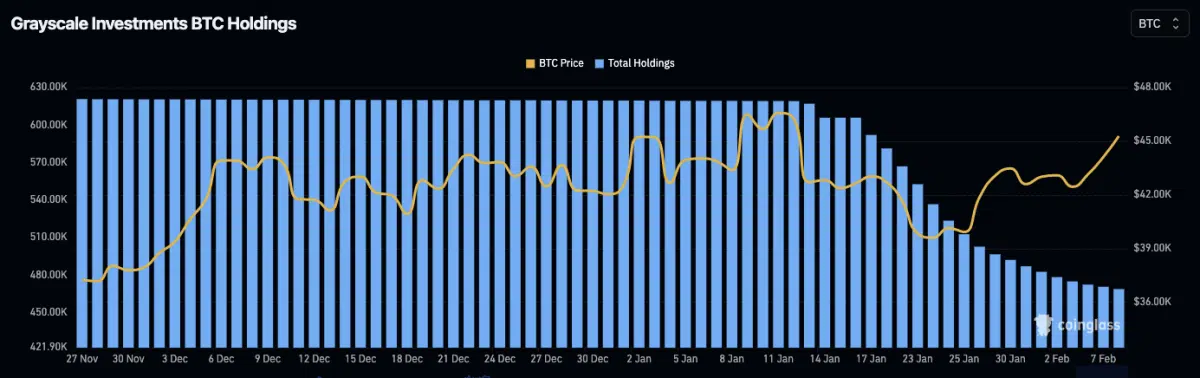

The drop in assets under management by the converted GBTC fund, from about 619,000 BTC to 469,000 BTC since Jan. 11, along with the decline in its market share in spot Bitcoin ETF trading volume , reflects a reconfiguration of the market and investors’ possible search for more robust and flexible alternatives.

Possible Implications for the Future of Bitcoin and ETFs

The addition of these spot Bitcoin ETFs and their rapid accumulation of assets not only demonstrates the strength of investor interest in Bitcoin but could also signal the beginning of a new era for cryptocurrency investing .

With 4.52% of the circulating supply of BTC currently managed by investment vehicles, and the Bitcoin price showing a 4.3% increase in the last 24 hours, 8% in the last week, and 10.7% since the start of the year, the outlook for Bitcoin looks promising.

This growth in spot Bitcoin ETFs, coupled with support from established financial institutions, not only strengthens Bitcoin’s position in the traditional financial market but could also pave the way for greater adoption and integration of cryptocurrencies into global financial systems.