- The U.S. spot Bitcoin ETF attracted $405 million on February 8, reflecting growing investor interest.

- Bitcoin tops $47,000, with the Futures Open Interest rising 5.51%, indicating confidence and optimism in its future value.

With Bitcoin reaching $48,000 it marks a special event ahead of the $405 million injection into the U.S. Bitcoin spot ETF, recorded on February 8 according to reports from BitMEX Research.

That deal, the most prominent of the week, has generated renewed interest and fueled a flurry of speculation among investors and crypto industry watchers.

The Attractiveness of the Bitcoin ETF for Investors

The attraction of significant funds to the Bitcoin spot ETF in the U.S. highlights confidence in VeChain’s blockchain solutions, evidencing a growing interest in the technology behind this digital currency .

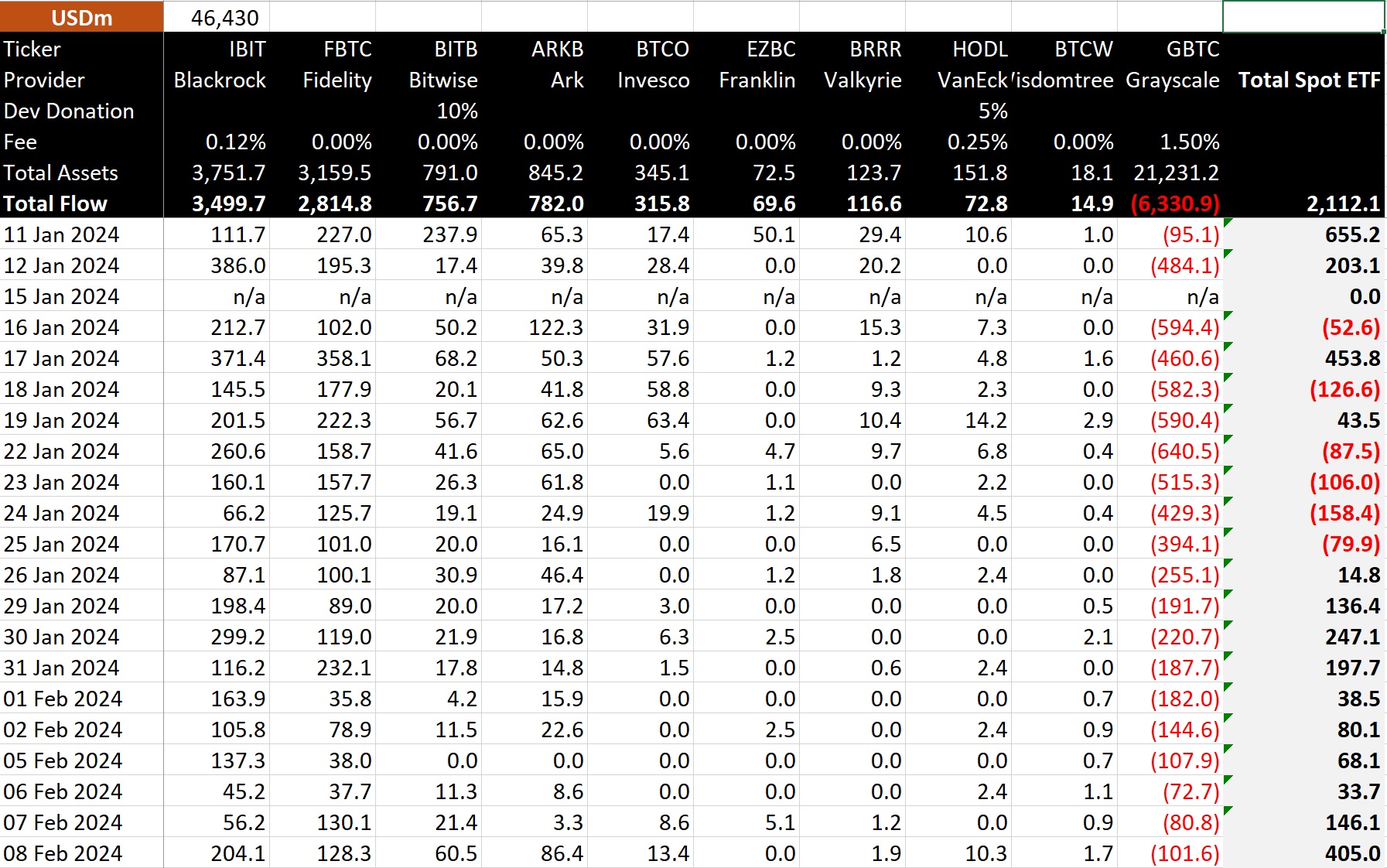

Despite initial challenges, this ETF has managed to raise a total sum of $2.11 billion in funds since its launch on January 11. In a single day, February 8, it saw an injection of $405 million, representing approximately 8,935 BTC.

Investment institutions such as BlackRock and Fidelity lead this phenomenon, with significant inflows into their respective ETFs.

However,it is important to note that the performance of Grayscale’s Bitcoin Trust has had an impact on overall market sentiment, evidencing total withdrawals of $6.33 billion since January 11. This is a reminder of the volatility and shifting nature of trust in the cryptocurrency market.

A New Breath with the Rise of Bitcoin

The rise in the price of Bitcoin has injected new dynamism into the market. In the last 24 hours, Bitcoin’s price has increased by more than 4%, raising expectations about its ability to break through the $48,000 mark again.

This period of growth has stoked conversation about the cryptocurrency’s future possibilities, especially in anticipation of significant market events.

The increase in the Open Interest (OI) in Bitcoin Futures reinforces this optimism, registering a 5.51% growth in the last day, reaching 444.81K BTC or $20.74 billion.

The Chicago Mercantile Exchange (CME) leads this increase with a 9.79% growth, followed by Binance with a 5.78% increase.

Bitcoin: Focusing Global Attention

At the time of writing, Bitcoin is trading at $47,467.77, reaching its highest point since January 11, with a 19% increase in its trading volume to $29.48 billion.

This rally underscores not only Bitcoin’s resilience to market fluctuations, but also its preeminent position in the crypto space.

With each new development, from record ETF inflows to strategic collaborations, Bitcoin continues to demonstrate its relevance beyond just being a digital currency, emerging as a global phenomenon that continually redefines notions of value and transaction in the digital age.