- Egorov faces $140 million in CRV liquidation, owing $95.7 million in stablecoins.

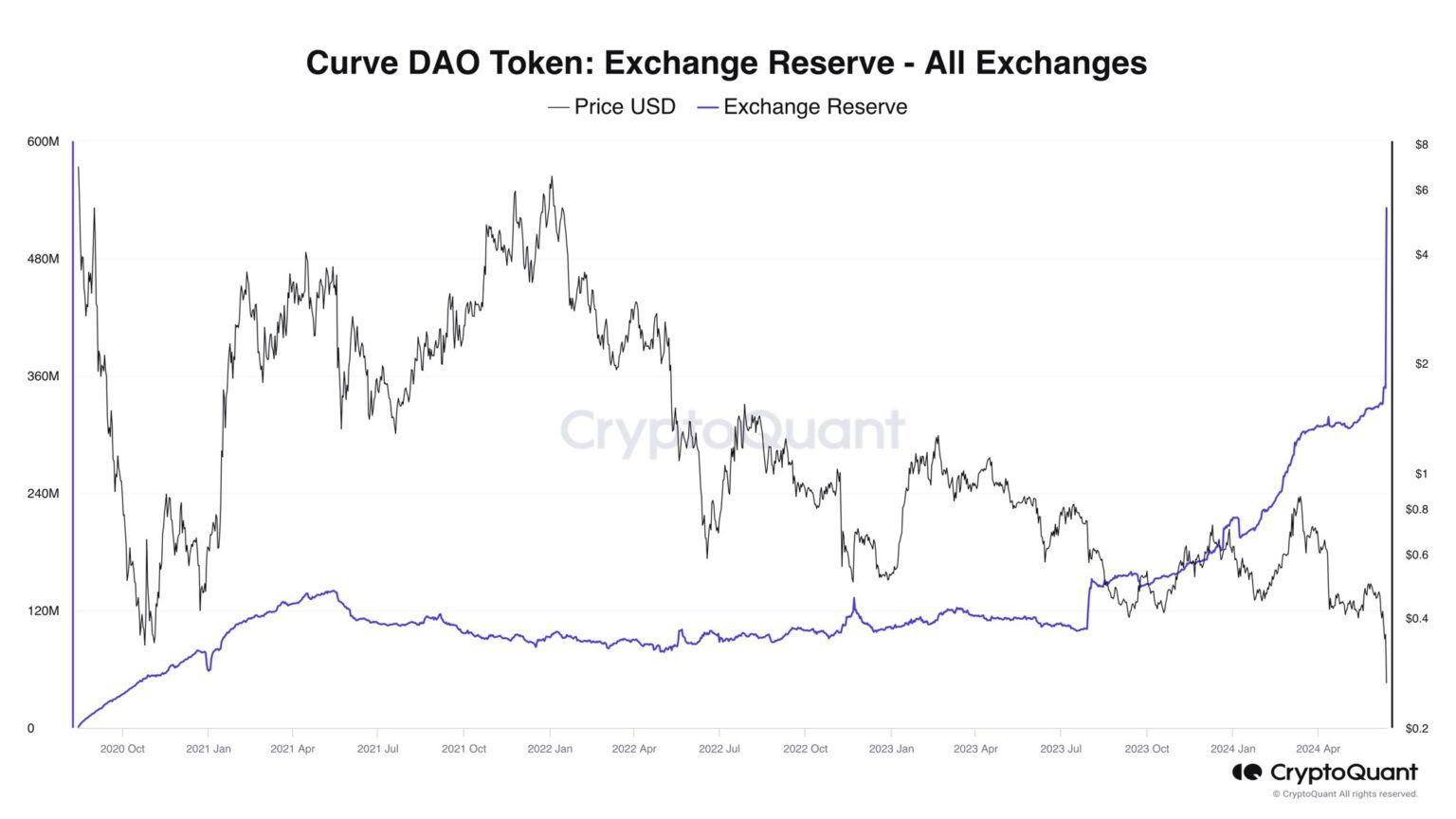

- CRV exchange balances surged by 57% in four hours amid market turmoil.

A few hours after word leaked out that Curve DAO (CRV) founder Michael Egorov may be facing insolvency, the price of the cryptocurrency fell by up to 35%. The decentralized finance (DeFi) industry is reeling from this sharp decline, which has rattled stakeholders’ and investors’ trust.

Egorov’s Precarious Position

A key player in the DeFi industry, Michael Egorov, is presently negotiating a volatile trade environment. On-chain analysis site Arkham reports that Egorov’s CRV is about to be liquidated for $140 million.

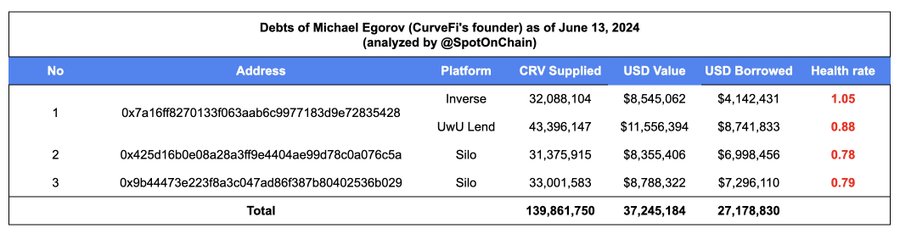

Against $141 million in CRV split over five accounts on different lending protocols, he has borrowed about $95.7 million in stablecoins, mostly crvUSD.

“Based on current rates, Egorov is paying $60 million annually to keep his positions open on Llamalend,” Arkham said, underscoring his financial difficulties.

High-Interest Borrowing

High interest rates on Egorov’s borrowings make his financial problems much worse. Using the DeFi platform Llamalend, he borrowed $50 million at an APY of about 120%.

$50M of Egorov's crvUSD borrows are on Llamalend, which currently costs him ~120% APY.

This is because there is almost no remaining crvUSD available for borrowing against CRV on Llamalend. 3 of Egorov’s accounts already make up over 90% of the borrowed crvUSD on the protocol.…

— Arkham (@ArkhamIntel) June 12, 2024

Most of the reason for this outrageous cost is that there is hardly any CRV available on Llamalend to borrow against CRV. Remarkably, over 90% of the crvUSD borrowed on this protocol comes from three of Egorov’s accounts.

Spot On Chain data on collateral and debt shows that Egorov now owes $27 million across three platforms and has 139 million CRV coins worth $37 million as collateral. The serious leverage emphasises how precarious his financial situation is.

The declining price of CRV has also had an impact on other significant market participants. A liquidation on Fraxlend, for example, forced crypto whale 0xF07 to send 29.62 million CRV, or almost $7.68 million, to Binance.

Exchange Balances Surge

founder of another on-chain monitoring site, Ki Young Ju, saw an unprecedented rise in the CRV balance on exchanges. In just four hours, it climbed 57%, suggesting a potential sell-off as investors fumble to reduce their risks.