- Ethereum’s growth is bolstered by a reduced liquid supply from staking and layer 2 solutions, enhancing its market stability.

- Technical analysts identify favorable patterns in Ethereum, predicting a strong market rebound, supported by historical data and DeFi engagement.

In its latest report, the prominent cryptocurrency exchange, Coinbase, has expressed considerable optimism about the price potential of Ethereum (ETH) in the coming months.

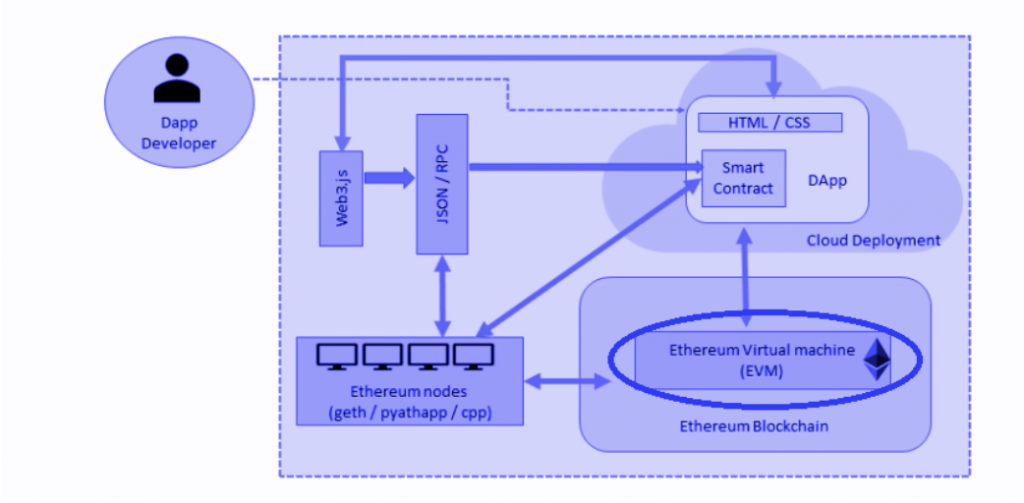

Despite underperforming in 2022, Ethereum remains a central pillar in the decentralized finance (DeFi) domain, largely due to the widespread adoption of the Ethereum Virtual Machine (EVM) and expansions in layer 2 solutions.

Coinbase is also hopeful about the approval of spot Ethereum ETFs in the United States, suggesting that even an initial rejection could be overturned in subsequent litigations.

“Ether may have the potential to surprise to the upside in the coming months”

Ethereum Buy Right Now

Though Ethereum trails behind Bitcoin in terms of annual performance, Coinbase analysts see considerable long-term potential in ETH. A recent report highlights Ethereum’s resilience and growth potential within the volatile digital asset market.

This year, Ethereum has seen a 29% increase in value, compared to Bitcoin’s impressive 50% surge, aligning with the overall 28% rise observed in the crypto market.

Key Drivers of Ethereum’s Growth

One of the most highlighted elements is the reduction in ETH’s liquid supply, driven primarily by staking and the development of layer 2 solutions.

These activities have solidified Ethereum’s role as an essential hub within the DeFi ecosystem, through ongoing adoption and enhancements to the EVM, which is crucial for running smart contracts and DeFi applications.

DeFi Dominance

Ethereum continues to be instrumental in the DeFi ecosystem due to its ability to facilitate the creation and execution of smart contracts. Technical analysts have identified positive patterns that suggest a favorable outlook for Ethereum in the near future.

Additionally, a recovery from the key support level at the 38.2% Fibonacci retracement around $2800, which historically has been a precursor to price rallies in bull markets, has been noted.

Understanding Market Sentiment

Ethereum’s previous spike above $4000 is seen as an turning point, marking the start of a new long-term uptrend.

Prominent cryptocurrency analysts, like CryptoYoddha, predict that Ethereum could surge past $10,000 by the end of 2024, supported by solid DeFi fundamentals and strong on-chain supply dynamics.

Is It Time to Buy Ethereum Ahead of the ETF Decision?

With a decision pending on the approval of spot Ethereum ETFs by May 23, the cryptocurrency community is speculating about the possibility of an ETH price rebound. Discussions revolve around the current context being similar to previous psychological lows, suggesting it might be an opportune moment to consider investments in Ethereum, especially if Bitcoin demonstrates a positive path in the short term.

Despite some recent apathy and a downward trend in the ETH/Bitcoin ratio, the expectation of a possible Ethereum ETF approval and the influx of new capital could provide a significant boost to Ethereum’s value and market position.

This context, coupled with a favorable technical outlook and ongoing interest in DeFi solutions, positions Ethereum as an investment option with appreciable potential in the coming months.