- Analysts predict a significant rally in altcoin markets with APT/Ape showing quicker recovery than Bitcoin, hinting investor interest.

- Financial expert suggests Bitcoin price could approach $68,000 soon, nearing its all-time highs as market stability continues.

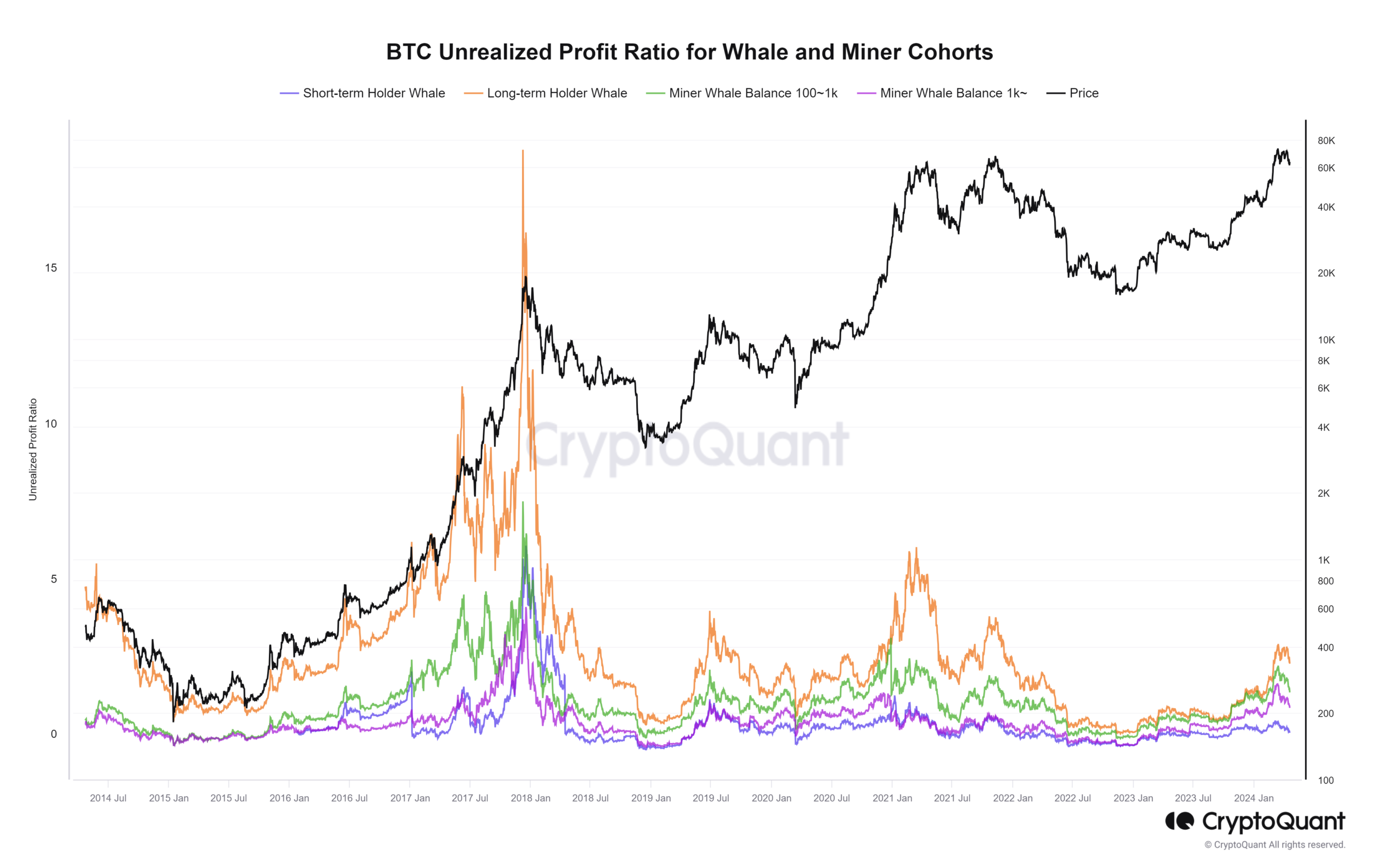

Recent trends in Bitcoin holdings show modest increases in unrealized profits among both short-term and long-term investors.

Specifically, short-term Bitcoin holders, defined as investors with at least 1,000 BTC held for up to 155 days, have reported an unrealized profit of 1.6%, according to data from CryptoQuant.

Differences in Profit Realization Among Bitcoin Holders

In stark contrast, long-term Bitcoin holders, who have retained their holdings for more than 155 days, have seen their unrealized profits surge to 223%. This data suggests varying strategies and outcomes between short-term and long-term Bitcoin investors.

Mining Sector Sales and Bitcoin Price Fluctuations

Regarding Bitcoin mining activities, smaller miners have realized profits of 131%, while large mining corporations have reported an 81% profit.

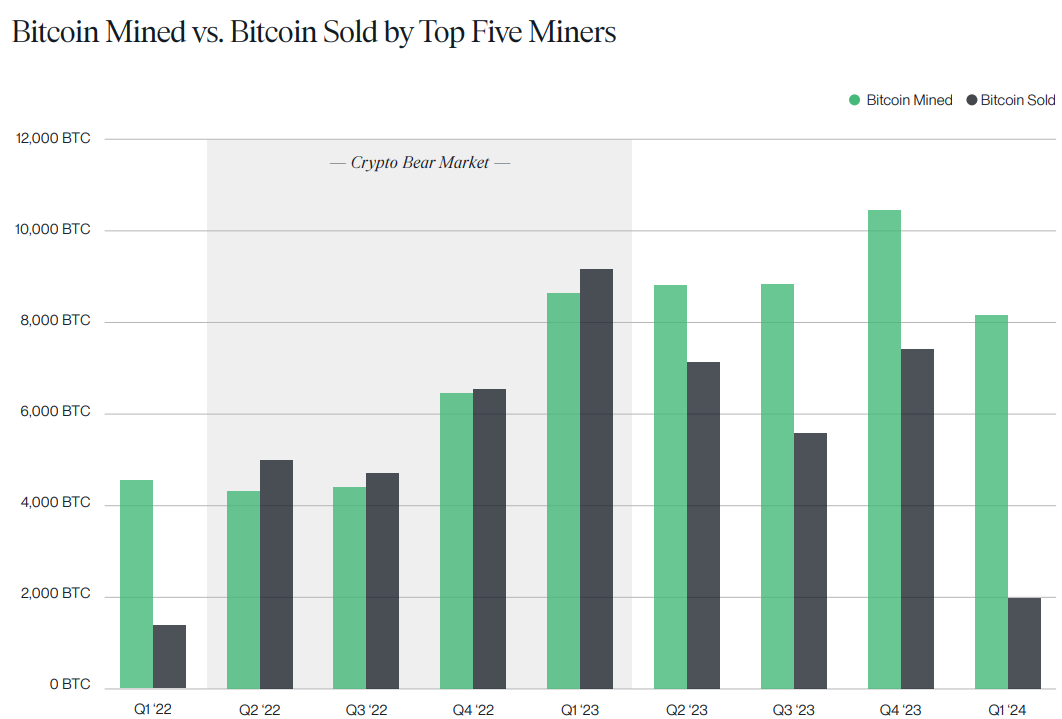

Despite these profitable margins, the largest mining entities have decreased their Bitcoin sales, reaching a two-year low with only about 2,000 BTC sold in the first quarter of 2024.

This reduction in sales corresponds with a recent drop in Bitcoin’s price below $60,000 on specific days in April, followed by a recovery towards $65,000.

Technical Analysis and Market Predictions

The technical analysis of Bitcoin’s price movements includes the Relative Strength Index (RSI), which recently adjusted from 76 (overbought) in March to 46, indicating a neutral market condition. This shift suggests that the market is stabilizing after recent volatility.

Arthur Cheong from DeFiance Capital posits that the dip below $60,000 could potentially mark a local bottom for Bitcoin, indicating a reversal point that could precede a price increase.

Furthermore, analysis from cryptocurrency trader Satoshi Flipper points to a breakout from a significant trading channel on the four-hour chart, suggesting that Bitcoin’s price might approach $72,000 soon.

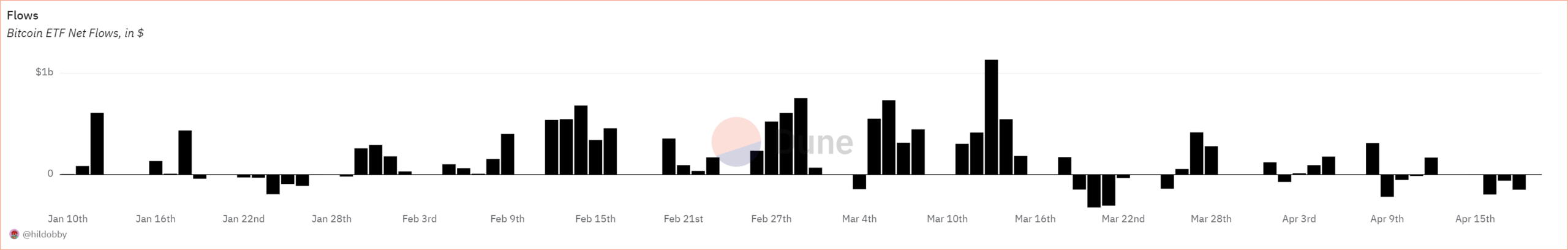

Denis Petrovcic, CEO of Blocksquare, anticipates that the combination of sustained institutional interest and reduced block rewards will likely support a stable or mildly bullish price trajectory for Bitcoin, countering the typical sell-off post-halving.

Bitcoin has completed its halving event at block 840,000, awarding a miner 40 BTC, which is currently valued at approximately $2.5 million.

Since the halving, Bitcoin has maintained a stable market presence, indicating its continued influence in the cryptocurrency sector.

Potential Surge in Altcoin Markets

Analysts predict a significant rally in altcoin markets, provided Bitcoin’s price remains stable. Crypto altcoins have shown quicker recoveries compared to Bitcoin, hinting at a growing investor interest in memecoins. This trend could potentially commence in May, aligning with market expectations.

Current and Projected Bitcoin Valuations

Bitcoin is presently priced at $64,536. Observations post-halving suggest that the market stability might attract buyers, potentially driving the price toward previous high points. One financial expert has projected that Bitcoin might soon approach $68,000, nearing its all-time high values.

Increased Focus on Altcoins

Investors are increasingly directing their attention towards altcoins, which have shown promising performances recently. This interest is driven by the potential for substantial returns as these cryptocurrencies’ prices are relatively low.

The shift in focus could lead to considerable growth in the altcoin sector, capitalizing on the current market after Bitcoin’s halving.