- Despite regulatory obstacles, BNB network experienced notable revenue growth in the first quarter of 2024.

- Although the bulk of traders are bearish despite the positive performance, some analysts anticipate a possible bullish surge.

The Binance Smart Chain (BNB) network has shown impressive financial performance in the first quarter of 2024, despite regulatory obstacles. With revenues of $66.8 million, up a startling 70% from $39.2 million in the prior quarter, BNB is solidifying its place as a key participant in the blockchain ecosystem.

Growth Driven by DeFi and Stablecoin Trends

The substantial gain in the value of the BNB coin, which is presently trading at $593.42 despite a 2.48% decline in the last day, is primarily responsible for the rise in revenue, according to CoinMarketCap. In contrast to the previous week’s 6.01% growth, this current decline highlights the network’s solid position in a tumultuous market.

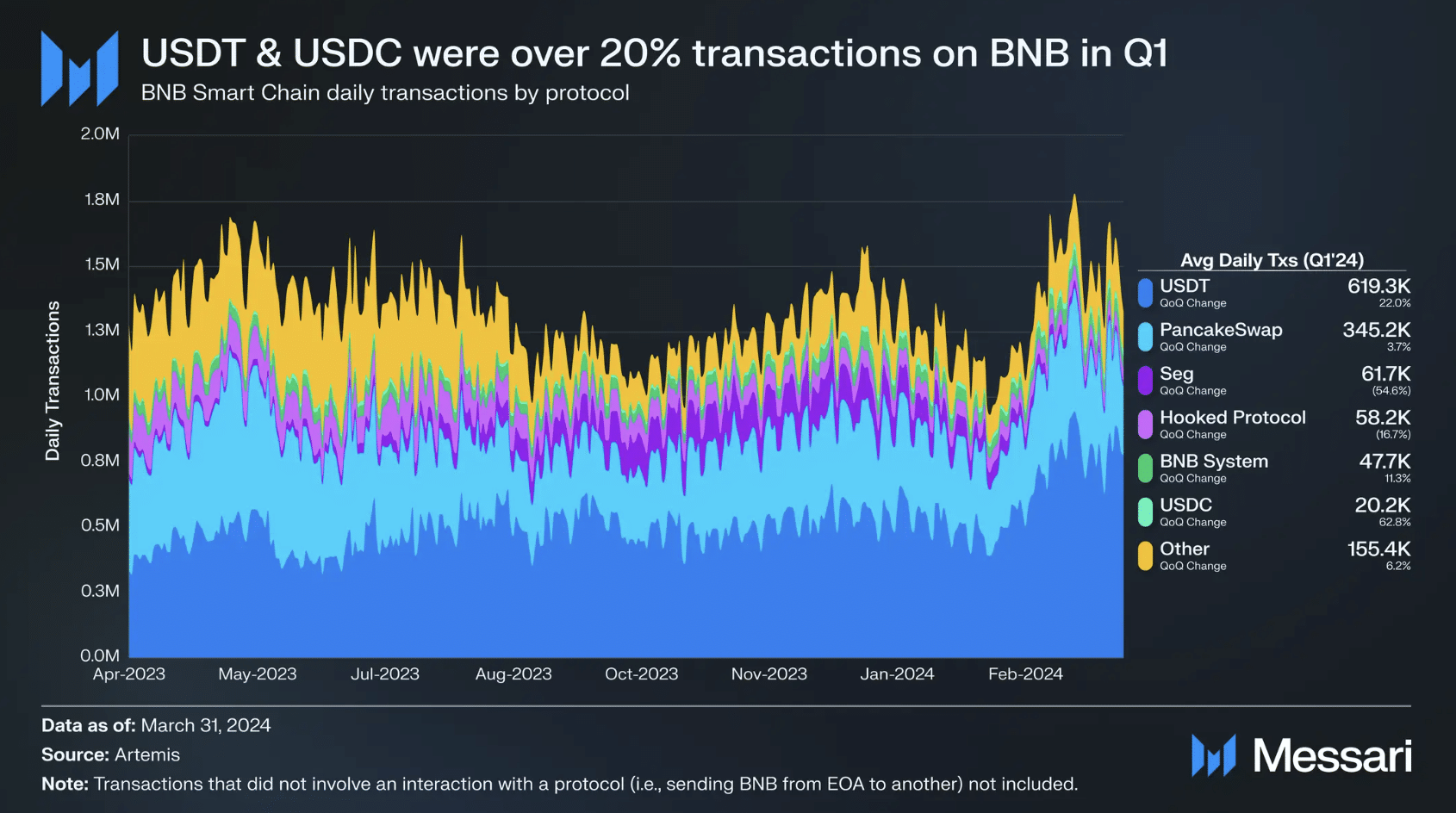

[mcrypto id=”51355″]Gas fees from DeFi transactions remained a primary revenue stream, totaling 76,200 BNB and marking a modest 1.7% increase from the previous quarter.

46% of total revenue came from DeFi transactions, with stablecoins—especially USDT—exhibiting the most quarter-over-quarter revenue growth (29%), in line with what ETHNews previously disclosed.

Not all market sectors performed well, though; there were noticeable drops in the gaming and infrastructure sectors. The network’s usefulness in stablecoin transactions is especially impressive in spite of these difficulties.

With a 22% growth from the previous quarter to 619,300 daily transactions, USDT is currently leading the field and surpassing rival protocols such as PancakeSwap, which had a 4% increase to 345,200 daily transactions.

BNB Future Outlook and Market Sentiments

Overall, the network’s effort has produced a range of outcomes. The average daily active addresses increased by 26% to 1.3 million, despite a 9% decline in average daily transactions from the previous quarter. This indicates that more users are interacting with the platform.

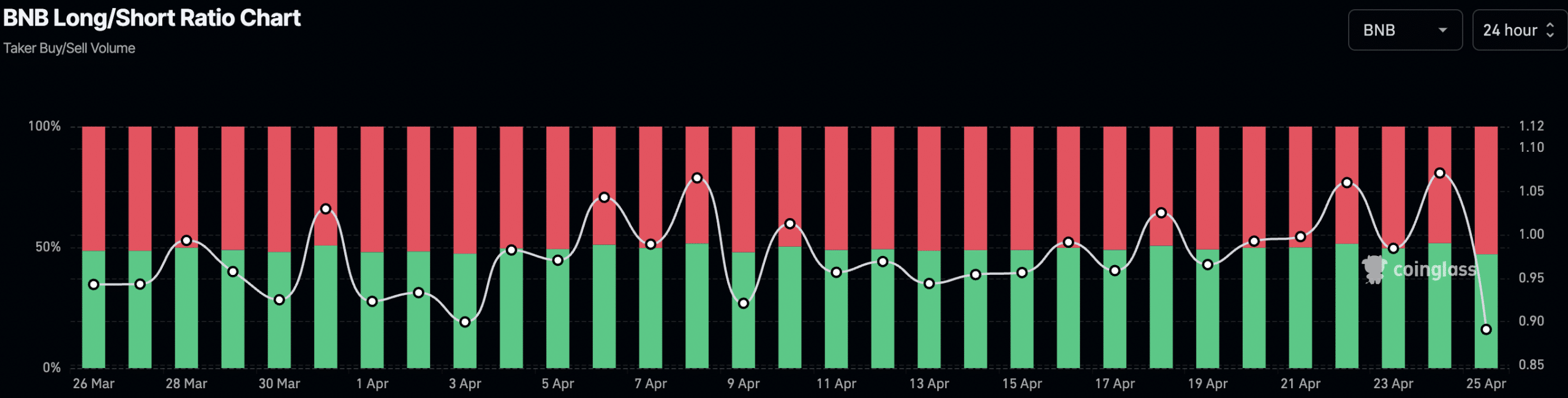

Despite this rise, 52% of traders have chosen to short BNB, reflecting the market’s cautiously negative emotions towards the coin.

However, popular crypto analyst Captain Faibik shares his bullish projection, predicting a short-term bullish jump of 40–45% for BNB should it break out of its symmetrical triangle pattern.

Keep an eye on $BNB 🧐

Looks Promising for the 40-45% Bullish Wave in the Short term..📈#Crypto #BNB #Binance pic.twitter.com/qYMLkI1MlJ

— Captain Faibik (@CryptoFaibik) April 25, 2024