- Demand for Bitcoin from large investors is growing, but price rally hindered by slow stablecoin liquidity.

- Institutional investors and long-term holders are actively purchasing and accumulating Bitcoin.

The demand for Bitcoin (BTC) from large investors and long-term holders is on the rise. However, despite this increased interest, Bitcoin’s price has yet to see a significant rally. According to CryptoQuant’s recent report, the slowing growth in USDT’s market capitalization is a critical factor.

Stablecoin Liquidity and Market Impact

CryptoQuant highlighted that stablecoin liquidity has not recovered the growth trajectory needed to support a price rally.

The market capitalization of Tether’s USDT, a proxy for fresh liquidity in crypto markets, has decelerated, now growing at its slowest pace since February 11. This slowdown impacts Bitcoin’s price momentum.

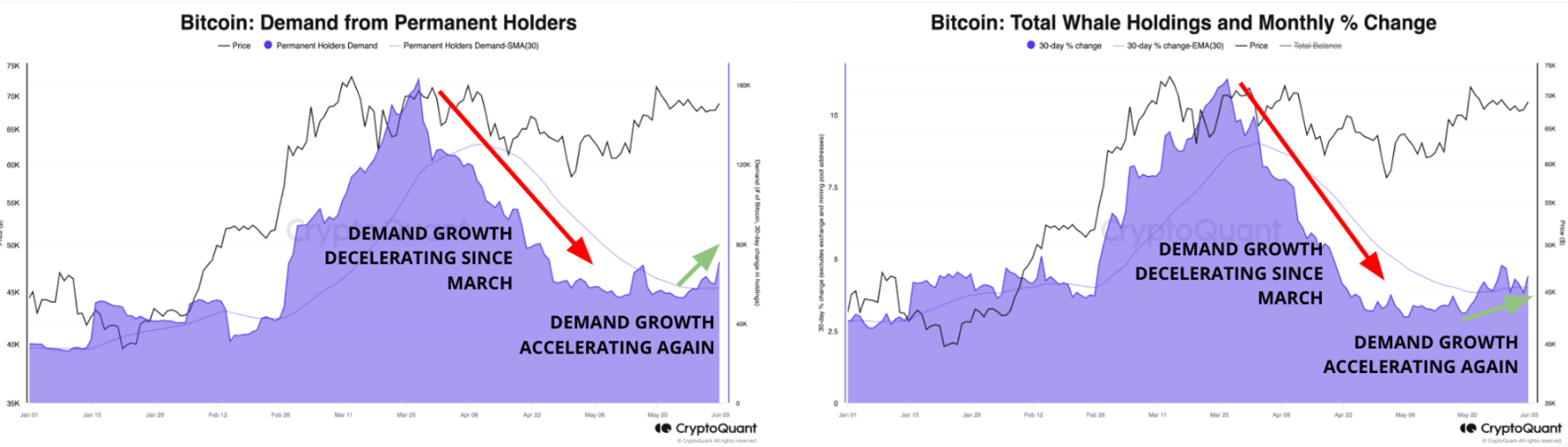

Demand for Bitcoin among large-scale investors (whales) and long-term holders is accelerating. The monthly growth rate for these groups is 4.4%, the fastest increase since April.

In the last 30 days, these holders have added 70,000 BTC to their holdings, the largest accumulation since April. This pattern mirrors the 2020 pre-rally phase, when large investors funneled about $1 billion into Bitcoin.

Robust On-Chain Activity

Despite Bitcoin’s low price volatility, on-chain activity remains robust. Data indicates that institutional investors are actively buying Bitcoin for custody wallets, and long-term holders have resumed accumulation.

The report also notes a decrease in selling pressure as traders have largely completed profit-taking. Unrealized profits are now at a low of 3%, down from 69% in early March, suggesting reduced selling pressure moving forward.

Bitcoin’s ETF Inflows and Price Movements

Bitcoin’s price has stagnated despite strong inflows into US spot Bitcoin ETFs. Holdings in these ETFs have increased from 819,000 to 859,000 between May 1 and June 6. On June 7, US spot Bitcoin funds recorded a net inflow of $131 million, marking 19 consecutive days of inflows.

Strong Bitcoin ETF inflows have historically coincided with price increases, but recent movements indicate that ETF flows are not the only factor influencing Bitcoin’s price.

CoinGecko data also noted that Bitcoin’s price fell from around $72,000 to $69,000 on Friday following the jobs report and unemployment data.

As of now, Bitcoin is trading around $69,190.37, having dropped 0.37% in the past 24 hours. Despite this, Bitcoin has shown a bullish trend over the past week, rising 2.15%.

Looking ahead, there are bullish predictions for Bitcoin. CEO of BitGo, Mike Belshe, has projected a substantial increase in BTC’s price, potentially reaching between $125,000 and $135,000 by the end of 2024, according to a prior ETHNews report.